Not even zero growth in November and December can prevent the global air cargo market from landing a year of unexpected double-digit demand growth in 2024.

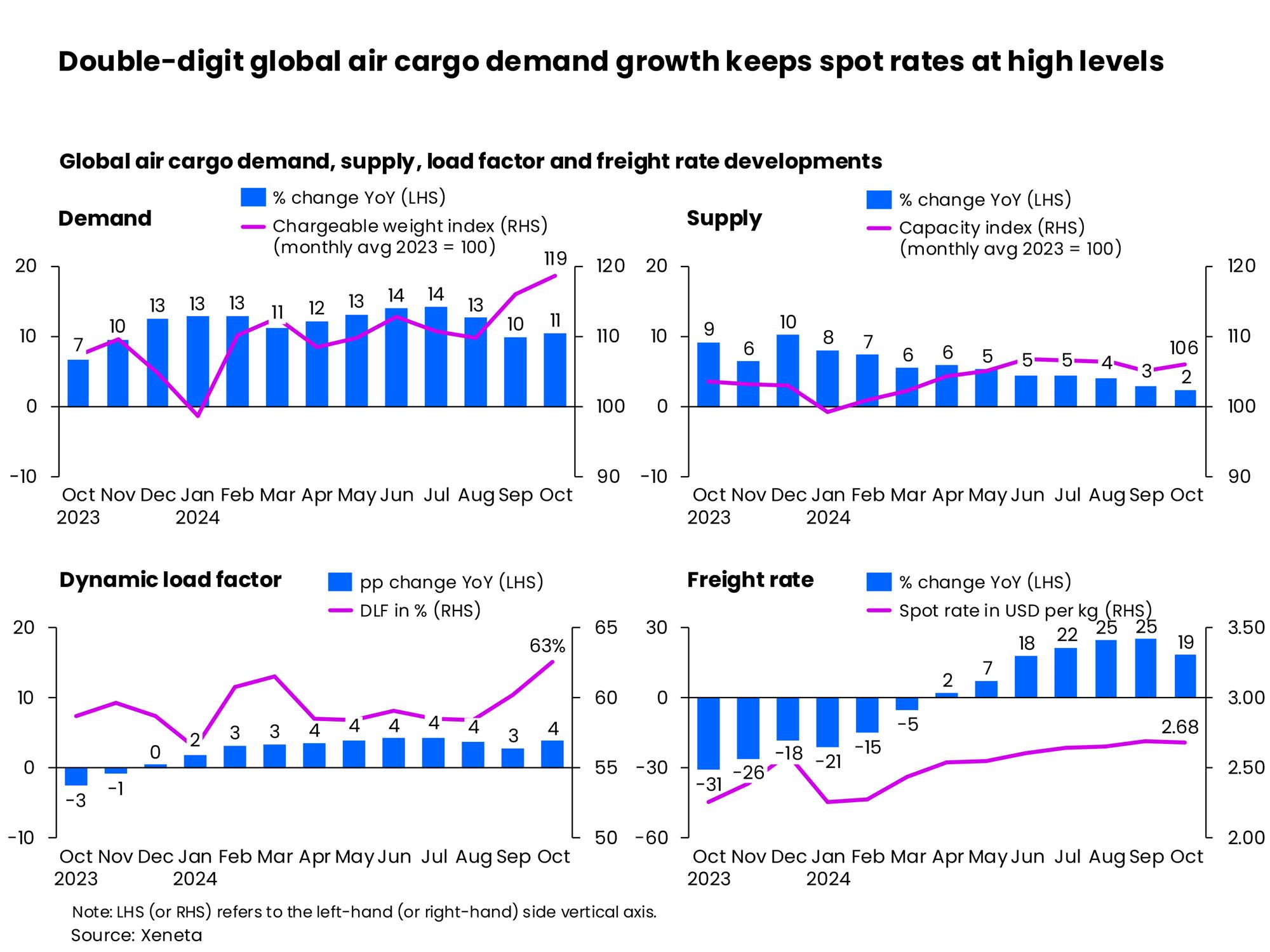

According to the latest market data by Xeneta, the healthy volumes of 11% in October and spot rates, which were up 19% year-on-year, reflect the growing maturity and balance among buyers and sellers of air cargo capacity.

"A year of constant, unexpected disruptions outside of the industry's control – which began with a growth forecast as of October 2023 of 1-2% for the full 2024 - is now firmly on course to end on a high in terms of demand," said Niall van de Wouw, Xeneta's chief airfreight officer.

"Such conditions traditionally result in winners and losers, but lessons learned and applied by shippers, freight forwarders, and airlines show the industry at its best," he added.

van de Wouw noted that the frequency and diversity of 'storms' coming the way of the air cargo industry in 2024 mean this year could have been quite messy, but the industry has found a way to navigate these challenges.

"This shows the prep work has paid off, as well as the flexibility shown in the industry. We see more emphasis on maintaining relationships than squeezing every last dime of revenue," he added.

While October's global air cargo spot rate continued to stay elevated — averaging US$2.68 per kg and just a few cents below 2023's peak season high — the growth momentum slowed down from 25% in September due mostly to a high comparison base in October 2023.

In terms of the month-on-month trend, van de Wouw said October's spot rate was relatively flat compared to September.

The elevated year-on-year growth spot rate was supported by continued double-digit growth (up 11%) in global demand, measured in chargeable weight. In comparison, global cargo capacity supply edged up only 2% year-on-year.

Zooming into the corridor level, Europe to North America saw the largest month-on-month volume increase of 11%. The return leg also saw a 10% month-on-month increase as shippers and forwarders took precautionary measures to lessen the impact of the 3-day strike by dockworkers at US East Coast and Gulf Coast ports.

Xeneta said capacity "traditionally shifts" to corridors generating higher revenues, which leads to a more balanced air cargo supply and demand.

Similarly, the Northeast Asia to Europe market stayed flat compared to a month ago.

Meanwhile, shifting capacity to Asia from the Americas market also triggered freight rate increases in secondary corridors. Spot rates ex-South America to Europe and its return leg rose by high single digits or double digits month-on-month.

The Middle East & Central Asia to Europe spot rates ticked down 3% month-on-month, driven by the easing of civil unrest in Bangladesh and subsiding weather disruptions.

"What we are seeing in the air cargo market is a compliment to the increasing ability of shippers, freight forwarders, and airlines to manage disruptions and process these kinds of volumes without as much drama around spiralling rates. Over the long-term, this is better for everybody," van de Wouw said.

"There is a maturity in the market which stems from airlines being better prepared this year as well as there being clearer rules in place between shippers and forwarders, and forwarders and airlines. This is good for relationships – and good for consumers."

He noted that rates are still elevated versus a year ago, but despite strong demand, rising load factor, and only a modest increase in supply, they are not going crazy.

"Lessons have been learned, and people are looking for healthy, reasonable rates on both sides," van de Wouw said.

"This puts air cargo demand safely on course to report double-digit growth in 2024, and not even zero growth in November or December is going to disrupt this," he added.