Global trade shifts are likely to continue in 2025 as businesses aim to prevent disruptions caused by existing and emerging risks.

Xeneta said in a new analysis that increasing trade capacity might appear to be an obvious benefit for shippers, but if it leads to congestion and delays—especially if larger ships are deployed, and port infrastructure is put under strain—then it presents supply chain risk.

Aside from ongoing strains caused by geopolitical tensions, the election of former US president Donald Trump also puts another test on the already fragile global supply chains amid renewed concerns about a possible trade war with China.

"With China seemingly looking to increase exports to regions such as South America, just as the US is set to increase import tariffs under a new Trump presidency, 2025 will see further shifts in global trade patterns, said Emily Staubøll, Xeneta senior shipping analyst wrote.

Record volumes for Far East-South America East Coast

Staubøll noted in the Xeneta analysis that massive shifts in global trading patterns occurred in 2024, making the task of managing and optimizing supply chains even more complex.

The report added that this is perfectly demonstrated in the trade from the Far East to South America's East Coast, where a record-breaking 1.6 million Twenty-foot Equivalent Units (TEU) were shipped in the first nine months of the year—driven by exports from China, which are up 14.8% compared to 2023.

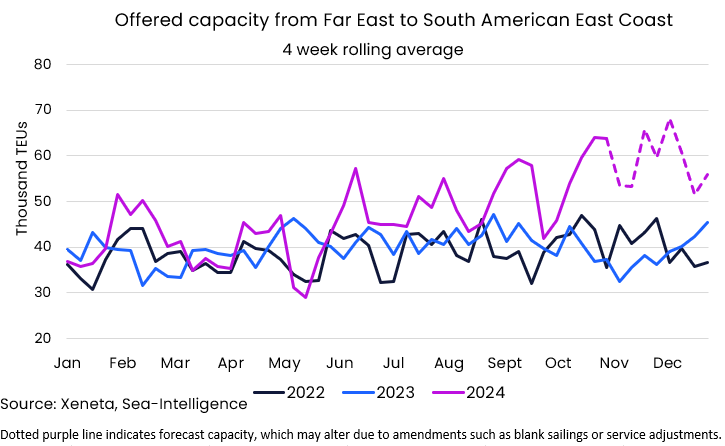

"Alongside the record-breaking volume on this trade is an all-time high in offered capacity, which averaged 63,900 TEU in the first four weeks of October (September 30 to October 27)," Xeneta's senior shipping analyst added.

Staubøll noted that this is an increase of 73% compared to the same period in 2023.

She added that prior to 2024, the four-week average of capacity on this trade had never been above 50,000 TEU, but that mark has now been passed 13 times.

Data in the Xeneta platform shows year-on-year increases in offered capacity on all services operating between the Far East and South America's East Coast in the four-week period ending on October 27.

The report added that the biggest increase came in the ESA/SA3/ASE1 service jointly operated by CMA CGM, COSCO, Evergreen and PIL.

Meanwhile, offered capacity more than doubled on this service from the same period in 2023, with four ships deployed compared to just one last year.

"The major East-West alliances don't operate between the Far East and South American East Coast. Instead, most services are operated jointly by several carriers outside of usual alliance partnerships," Staubøll said.

She noted that the standalone Carioca service operated by MSC is the only new service operating on this trade lane in 2024. In the four-week period ending in week 43, it saw a weekly average of 11,100 TEU deployed. The Carioca service connects South Korea and China to Southern Brazil, including stops in Singapore and Colombo.

This service almost doubles MSC's presence in the Far East-South America trade.

Xeneta noted that its other service, offered in partnership with Hapag-Lloyd and ONE, had an average weekly capacity of 11,500 TEU in the same four-week period.

Deteriorating transit times and schedule reliability

While shippers may be enjoying record-high capacity between the Far East and South America East Coast, data in the Xeneta platform shows the highest transit times on record for this trade and the lowest-ever recorded schedule reliability.

In the analysis, Xeneta noted that in the second half of 2024, carriers have promised an average journey of 38 days within a range of 34-42 days.

In Q3 this year, the actual journey time stood at 47 days. This is significantly up from the 42-day average in Q2 despite no announced change from carriers.

"This increase in actual transit times saw schedule reliability fall to an all-time low for this trade in September, when just 19.5% of ships arrived on time. This is a significant deterioration compared to the start of the year when just over half of ships (53%) arrived on time," Staubøll said.

She noted that schedule reliability on this trade had not fallen below 33% prior to 2024, which highlights the scale of the challenge shippers are facing, especially considering this trade is not directly affected by the major disruption of 2024—the conflict in the Red Sea.

Staubøll went on to say that even the best-performing carrier on this metric, ZIM, only achieved schedule reliability of 30.4% in September. HMM had the lowest schedule reliability, with only 10.3% of its ships arriving on time.

Extra capacity helps spot rates soften

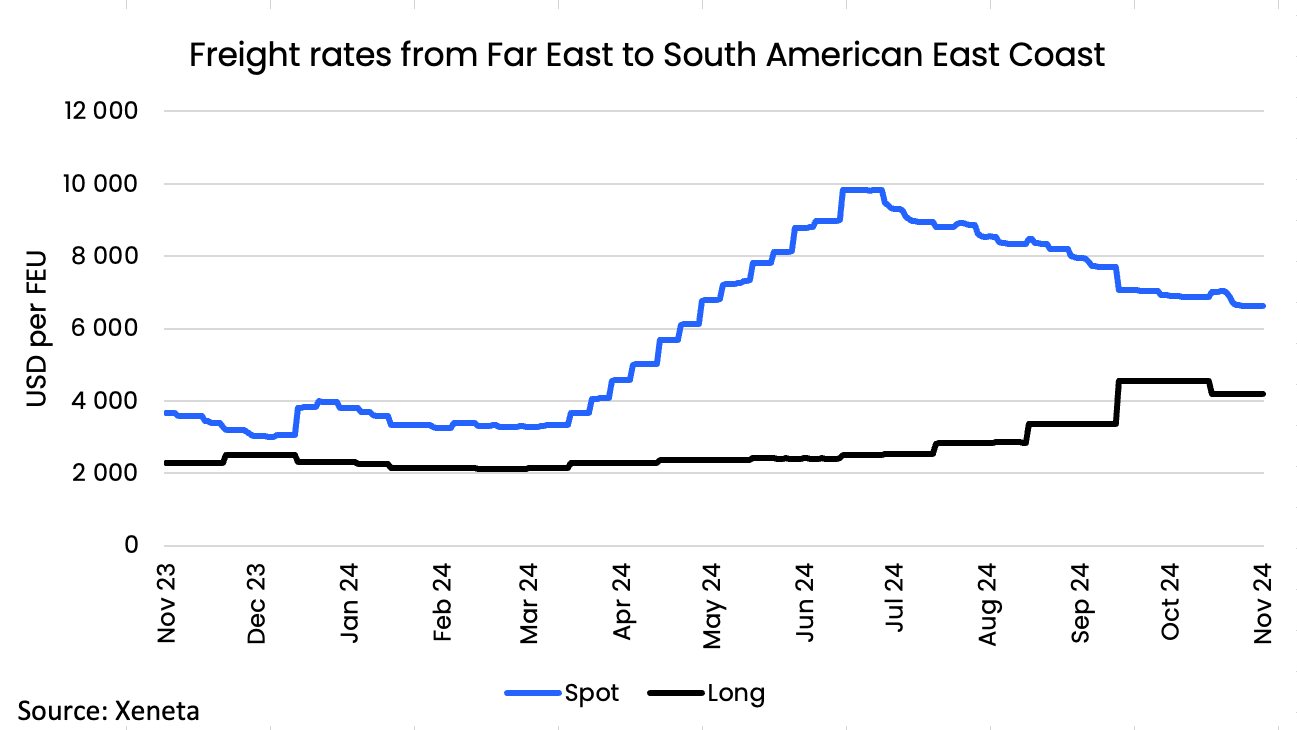

Despite deteriorating transit times and reliability, the report said record high capacity offered between the Far East and South America East Coast has contributed to a softening of the spot market since July.

The average spot rate fell to US$6,610 per FEU on November 18, down 33.8% from the market peak of US$9,840 per FEU in July.

Despite the recent drops, the report noted that spot rates are still 80.7% higher than they were at this time last year.

Xeneta said the average long-term rate is also substantially up from last year, with an 84.6% increase, leaving it at US$4,200 per FEU.

"This uptick has only come in the second half of 2024, with November being the first month long-term rates dropped slightly, down a couple of hundred dollars from the end of October," it added.

The report said many shippers are currently tendering on this trade, and the weakening spot market must be balanced against the still significant US$2,500 per FEU spread between spot and long-term rates.