Air cargo's strong seasonal fourth quarter (Q4) appears to have peaked, with tonnages and rates dropping slightly in the second full week of December, including from Asia Pacific origins, according to the latest figures and analysis by WorldACD Market Data.

Following several weeks of consecutive week-on-week (WoW) rises, average spot rates from Asia-Pacific origins dropped by around 4% in week 50 (December 9 to 15), compared with the previous week, to US$4.57 per kilo.

The air cargo market data provider said that the fall in prices from Asia-Pacific origins was offset by a 6% rise from North America and a 5% increase from the Middle East & South Asia (MESA) origins, together leading to a worldwide 1% WoW dip in spot rates overall.

Nevertheless, compared with last year, average global spot rates in week 50 this year were 16% higher, at US$3.20 per kilo, driven by a 60% year-on-year (YoY) rise from MESA, a 14% increase from Asia Pacific, 13% rise from Europe, and 8% rebound from North America origins, plus small increases from Africa and Central & South America (CSA).

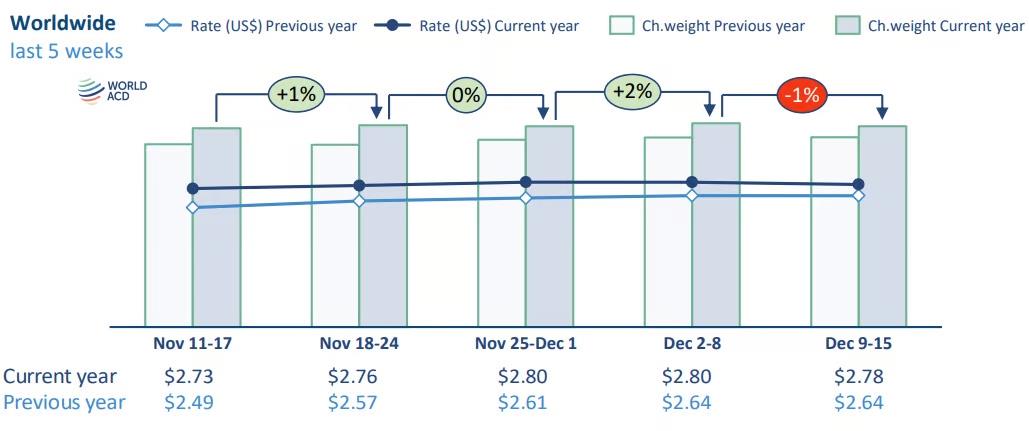

Average worldwide contract rates also recorded a small (1%) WoW decrease, to US$2.61 per kilo, generating a similar 1% drop in overall worldwide air cargo prices to US$2.78 per kilo, based on a full-market average of spot rates and contract rates – but around 6% higher, YoY.

Demand increase

"With worldwide air cargo capacity stable, WoW, in week 50, as a 1% drop in worldwide freighter capacity was balanced out by a 1% increase in passenger belly capacity, the changes in spot prices broadly reflected variations in demand," WorldACD said.

It added that overall worldwide tonnages fell by 1%, WoW, with a 2% drop in tonnages from Asia-Pacific origins and a 7% fall from MESA origins offset by a 4% tonnage increase from Africa and a 2% rise from CSA, boosted by rising seasonal shipments of perishables northbound from those southern hemisphere markets – for example, from Egypt to Europe.

[Source: WorldACD]

Asia individual markets

"Examining the WoW performance of various key Asia Pacific outbound markets in week 50, individual spot rates from Asia Pacific to the U.S., and from China to the USA specifically, edged up slightly higher, WoW, to US$6.94 and US$6.98 per kilo, respectively," the air cargo market data provider said.

"And compared with last year, Asia Pacific to U.S. spot rates in week 50 are slightly (4%) higher, YoY, although China to U.S. rates are down by 7%, YoY," it added.

Meanwhile, WorldACD noted that chargeable weight in week 50 from Asia Pacific and China to the U.S. was down, WoW, by 5% and 4%, respectively. But compared with last year, tonnages from Asia Pacific to the U.S. are 5% higher, while from China to the U.S. only slightly higher (1%).

From Asia Pacific to Europe, all of the big origin markets recorded significant WoW drops in tonnages in week 50, including WoW falls of 10% from Vietnam, 9% from Thailand, 8% from Hong Kong, 6% drops from both China and Japan and a 4% WoW drop from South Korea.

But WorldACD said that compared with last year, volumes from most of those markets are significantly elevated still in week 50 of this year, including a 26% YoY increase from Japan, 23% from China, 19% from Vietnam, and 15% from Hong Kong.