The Transatlantic air cargo market has seen skyrocketing rates during peak season which puts it back in the spotlight with shippers facing a dilemma over new contract negotiations.

Xeneta said in a new analysis that the Transatlantic air cargo market has been overlooked by many during 2024 due to the dramatic developments in ex-Asia corridors.

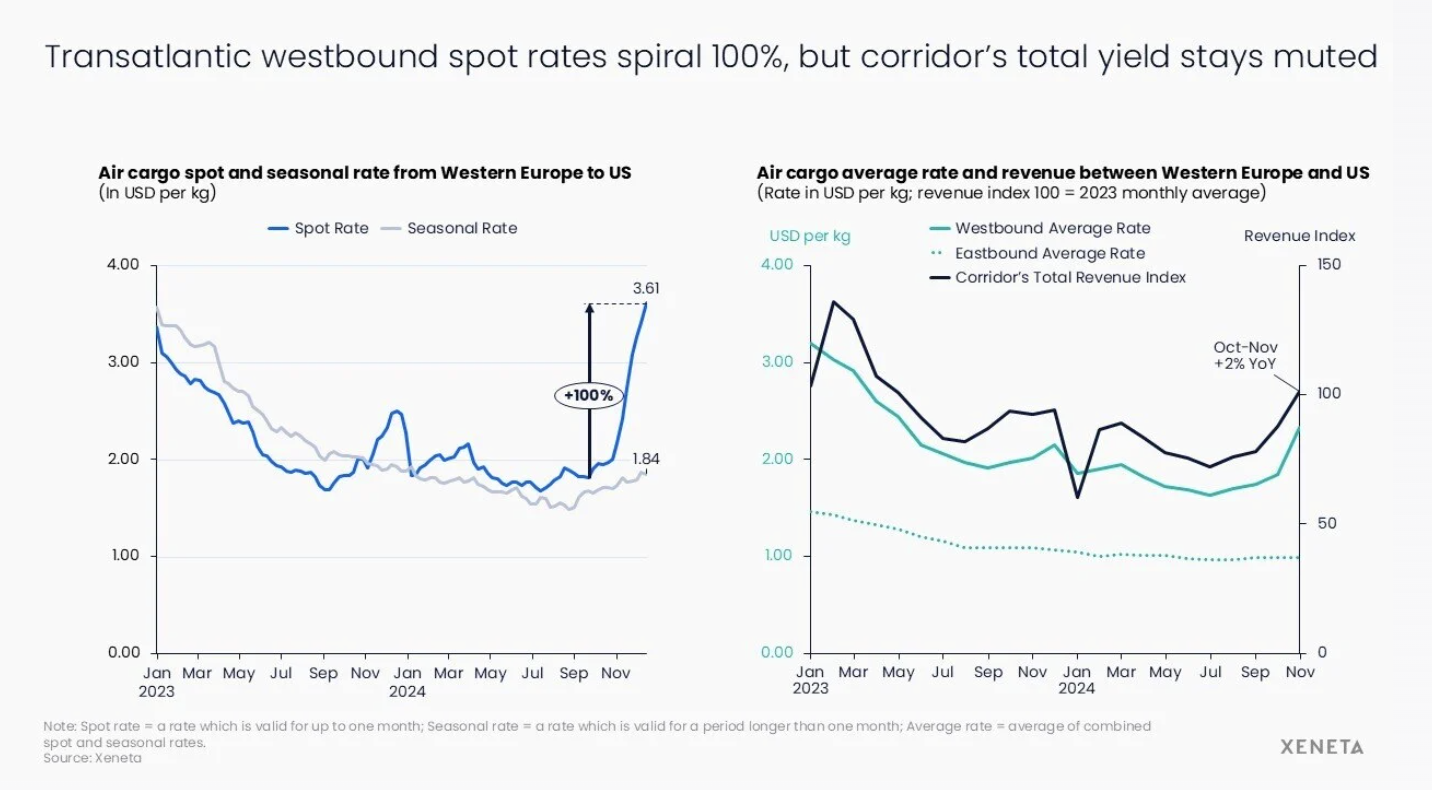

In the week ending December 15, the average air cargo spot rate from Western Europe to the US (valid for up to one month) surged to US$3.61 per kg.

"This marks a 100% increase compared to the start of this year's peak in late September and represents the highest rate recorded in over two and a half years," the ocean and air freight rate analytics platform said.

It noted that around 50% of the volume on this corridor is sold on the spot market.

Xeneta added that developments on the spot market are in "stark contrast" to the westbound seasonal rate (valid for over one month), which only showed a modest increase of 10% since the start of peak season and dropped 4% from a year ago.

Air cargo demand has been muted on this corridor, so the spot rate spike can be attributed more to factors relating to supply.

"These factors include airlines' winter schedules seeing reduced passenger belly capacity and slight capacity dip during Thanksgiving holidays in the US.

There is also the impact of airlines moving capacity off traditional established air cargo trades such as the Transatlantic to meet the increasing demand on ex-Asia corridors where e-commerce is booming," Xeneta said.

Consequently, air cargo capacity from Western Europe to the US fell 5% in mid-December compared to the same period in 2023 and down 15% from pre-winter schedule levels two months ago.

Xeneta noted that spot rate increases on the Transatlantic westbound market may stem from a trade imbalance on the backhaul from the US to Western Europe, where cargo average rates dropped 4% year-on-year.

"In the first two months of Q4, the overall cargo revenue growth for both westbound and eastbound trades combined was just 2% year-on-year. This means it becomes even more important for airlines to increase revenue on the fronthaul," it added.

The dynamic load factor from Western Europe to the US stood at 80% in the first half of December, way above the weight load factor of 55%, a traditional load factor measurement.

"As the year draws to a close, Western Europe to US spot rates are expected to decline in the coming weeks, following air freight's cyclical patterns.

However, market sentiment has shifted considerably from a year ago and shippers must consider more than seasonal and regional patterns, especially given the gravitational pull e-commerce out of China seems to have on available air cargo capacity," Xeneta said.

It added that shippers who secured contracts before the recent rate surge may feel temporarily insulated from the escalating market, but they will likely face pressure during the upcoming tender season.

Meanwhile, freight forwarders – currently under intense pressure to maintain operations for volumes without block space agreements – will likely pass at least some of their increased costs on to customers.

"On top of this, the implementation of the ReFuelEU sustainable aviation fuel (SAF) mandate on January 1, 2025 (requiring fuel suppliers at EU airports to include a minimum of 2% SAF) will increase costs for airlines.'

Xeneta added that the potential second round of US East and Gulf Coast port strikes from January 15 will also surely drive up air freight rates further in this corridor (if it happens).