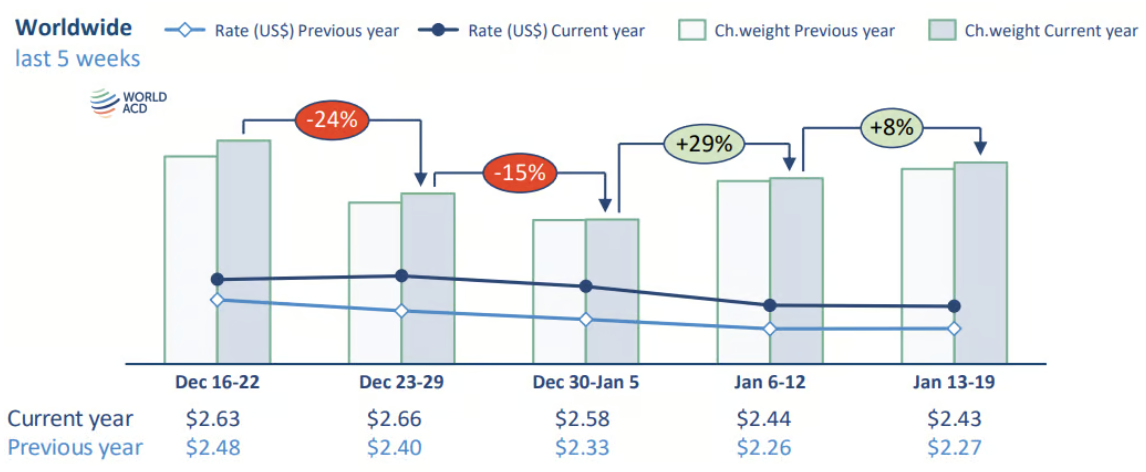

Air cargo tonnages worldwide began to recover in the third week of 2025, following a seasonal decline at the end of December and the beginning of the year, according to a recent analysis by WorldACD, though spot rates are still gradually decreasing.

The air cargo market data provider said worldwide air cargo tonnages regained 8% in week 3 (January 13 to 19) after rebounding 29% the previous week.

This follows a total drop of around 35% in the last week of December and the first week of 2025, taking worldwide tonnages in week 3 back up to around 90% of their levels in the last whole week before Christmas.

WorldACD said year on year (YoY), tonnages were up in week 3 by 3% globally (and 2% for weeks 2 and 3 combined).

Meanwhile, the report said average global rates remained more or less stable at US$2.43 per kilo in week 3, based on a full-market average of spot rates and contract rates, around 7% higher than in week 3 last year.

Average worldwide spot rates dropped by a further 3%, week on week (WoW).

But they stand 16% higher than in the same week last year, with spot prices from Middle East & South Asia (MESA) up by 54% YoY and rates from Asia Pacific origins 20% higher.

Asia Pacific demand drop

Tonnages from Asia Pacific origins regained another 5% in week 3, taking them 5% above their levels this time last year, although WorldACD said they remain around 10% below the peak levels reached in week 49.

[Source: WorldACD]

"Some air cargo industry executives have expressed concern this month about how steeply tonnages (mostly e-commerce) from Asia Pacific have dropped off since their peak in mid-December, especially to Europe," the report said.

Analysis by WorldACD indicates that the overall decline this winter is not so significantly greater than last winter.

WorldACD said that with both seasons experiencing extremely strong peak season volumes from Asia Pacific, volumes last winter dropped by around 30% from their peak levels to a low point in the first week of January, compared with around 33% this winter.

By week 3 in 2024, Asia Pacific tonnages had rebounded to around 95% of their weekly peak levels in December, compared with around 90% this year in week 3.

"Analysis by WorldACD indicates that the overall decline this winter is not so significantly greater than last winter," the report said.

With both seasons experiencing extremely strong peak season volumes from Asia Pacific, volumes last winter dropped by around 30% from their peak levels to a low point in the first week of January, compared with around 33% this winter.

By week 3 in 2024, Asia Pacific tonnages had rebounded to around 95% of their weekly peak levels in December, compared with around 90% this year in week 3. However, the recovery gap is more pronounced in Asia Pacific to Europe.

WorldACD said last winter, Asia Pacific to Europe (and China to Europe) tonnages in week 3 had already rebounded above their levels in weeks 48, 49, and 50. In contrast, this winter, in week 3, Asia Pacific to Europe volumes are still well below (-20%) the levels achieved in week 49, with China to Europe tonnages about -15% below their peak.

Spot rates remain high

Spot rates from Asia Pacific to Europe dipped by a further 4% in week 3 to an average of US$4.35 per kilo. That's down by around 15% compared with their level in week 49 (US$5.14 per kilo), but it's still up yearly by 31%.

Meanwhile, Asia Pacific to the US tonnages rebounded in week 3 by a further 7%, following an 11% recovery the previous week, taking them back to around 16% below their early December peak levels recorded in week 48.

WorldACD said Asia Pacific to US spot rates have dropped, WoW, for five consecutive weeks from their December peak of US$6.89 per kilo in week 50 to US$5.21 per kilo in week 3, although they are still up 29% compared with the equivalent week last year.