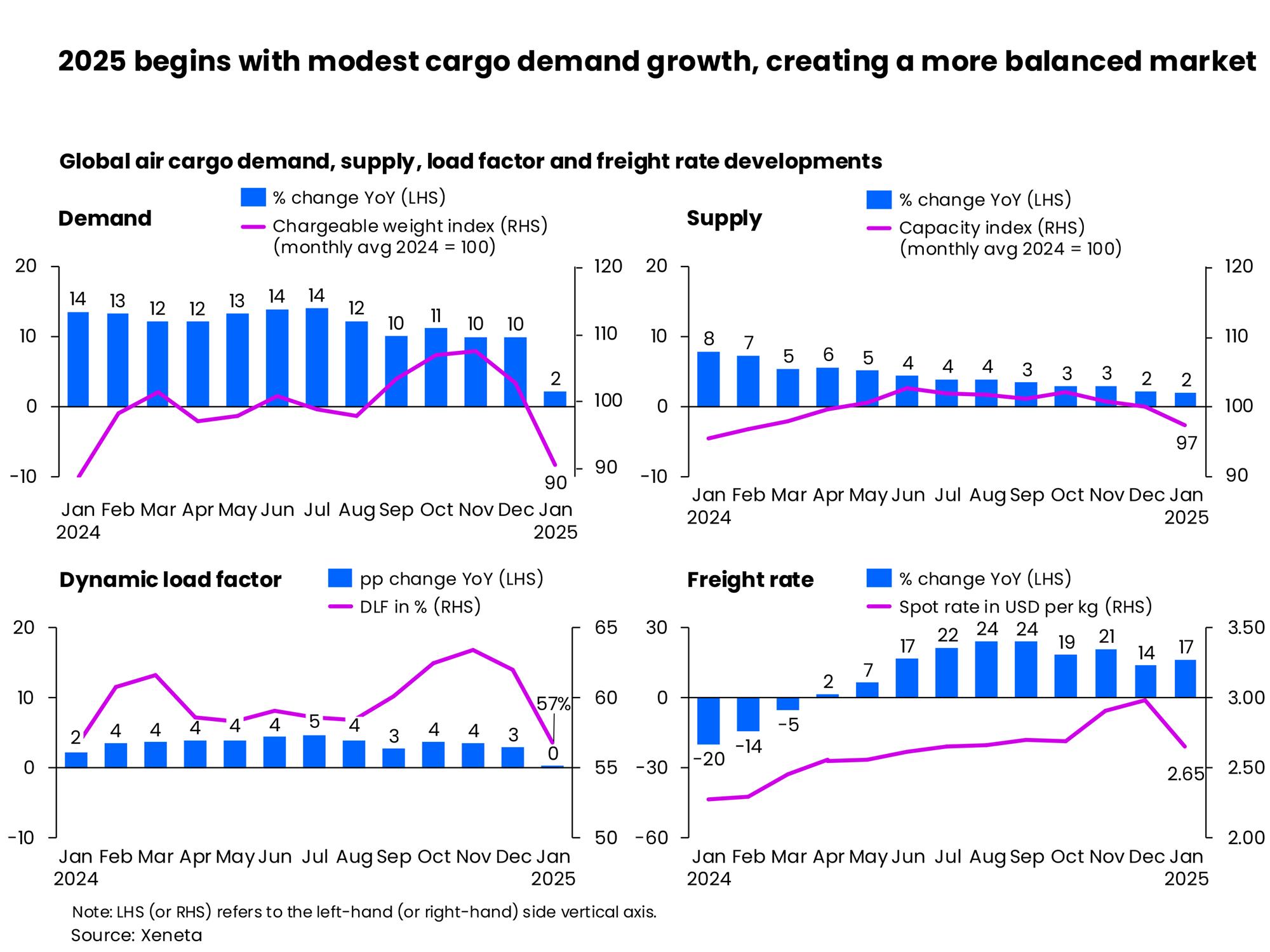

Global air cargo demand came lower than expected in January, posting a growth of only 2% year-on-year, according to a new Xeneta analysis, but brewing fears over recent tariff announcements affecting volumes and growth forecasts for the year may be premature.

The drop in demand for January was a "surprise," said Niall van de Wouw, chief airfreight officer at Xeneta, amid double-digit monthly growth throughout 2024. However, he pointed out that January's data was impacted by the earlier Lunar New Year reducing volumes out of China.

However, van de Wouw sees "no immediate reason" to change Xeneta's 4-6% growth forecast for global air cargo in 2025 despite the market's nervousness over new tariffs introduced by the United States – particularly on China -and their subsequent retaliation.

"The lower growth in air cargo demand in January was not down to President Trump, nor, entirely, the earlier Lunar New Year. It also compares to an unusually high comparison in January 2024," van de Wouw said.

"Nonetheless, the air cargo market in entering a period of uncertainty, which makes planning extremely challenging."

van de Wouw noted that the implementation of tariffs by the U.S. — announced earlier this month — and the responses of China, Canada, and Mexico are just the start of a negotiation.

"It's all transactional. We could end up in a global trade war, but in the case of President Trump, we have someone who's ready to negotiate everything, and the rest of the world can influence the outcome, as we have already seen. The consistency here is he's looking for a deal," he added.

"We don't know what will happen, but we do understand that uncertainty is not good for trade confidence, and it doesn't help investment. People like to see some kind of stability before they put their money down," he added.

van de Wouw then cautioned shippers from "rushing to make too many plans or take any drastic measures."

"I'd have my team ready to do things differently, but I'd wait to see what actually happens because, right now, there's a lot of sabre rattling and noise but little clarity," he said.

Impact of "de-minimis" exemption cancellation

Xeneta noted that cross-border e-commerce demand has been one of the main pillars fuelling global growth in air cargo volumes since the third quarter of 2023, and the suspension of the de minimis exemption could have a "profound impact" on air freight capacity between China and the US by prohibiting these import shipments from de minimis entry, increasing costs, and adding time-consuming entry filing requirements and potential customs delays.

In 2024, China's cross-border e-commerce shipments to the US accounted for 25% of its total global sales – and filled over 50% of cargo capacity from China to the US.

"E-commerce volumes out of China grew 20-30% last year, following similar growth in 2023, so it's going to take a sledgehammer to crack that level of consumer demand, and I'm not sure blocking de minimis alone is enough. China e-commerce was not set up to take advantage of de minimis loopholes - it has taken advantage of consumer demand for cheap, fast goods," van de Wouw said.

"E-commerce products may be slightly more expensive if de minimis is removed, but they will still be cheaper than buying through retailers in the US – but delays in receiving the goods due to operational disruptions could have a bigger impact than price because it takes away the attractiveness for consumers," he added.

The Xeneta chief airfreight officer noted, however, that China's e-commerce giants also knew this day would come and will not allow a business model on this scale to collapse due to de minimis cancellation.

"Even if de minimis is being blocked, the e-commerce retailers will still keep selling and shipping the goods. There may not be a significant impact on air freight rates in the short term in this scenario, even if it causes chaos at the receiving airport in the US," van de Wouw said.

In the longer term, however, he said that demand for e-commerce — and therefore freight rates — will only be impacted if the consumer feels the cheap price is not worth it if they face a longer wait to receive their goods.

"In this scenario, we'd expect to see a major downward impact on freight rates at a global level – but to predict this now would be to 'cry wolf'. Let's wait and see. Maybe nothing changes," the Xeneta chief airfreight officer added.

Impact on general freight market

van de Wouw said the winners of any muted growth in e-commerce volumes will be general freight shippers globally as capacity is deployed elsewhere, placing downward pressure on rates in these new markets.

But, general air freight demand has recorded no real growth in recent years, and there's little expectation of any significant upturn in its fortunes in 2025, he cautioned.

For January, global air cargo chargeable weight in the first month of the year grew just 2% year-on-year, also influenced by the diminishing impact of ocean shipping disruptions.

Xeneta noted that, as anticipated, global air cargo capacity showed similarly modest growth of 2% in January, lowering the dynamic load factor to 57% in January, on par with a year ago.

Nevertheless, global air cargo spot rates in January remained 17% higher than a year ago, reaching US$2.65 per kg and 56% above pre-pandemic 2019 levels.

"These elevated rates can be attributed to the e-commerce boom, limited air cargo capacity from slow aircraft production, flight rerouting due to Russian airspace closures, and the delayed adjustment of freight rates to supply-demand changes," the Xeneta analysis said.

Month-on-month, January's global air cargo spot rate fell 11%, a slower decline compared to the same period a year ago (a decline of 13%).

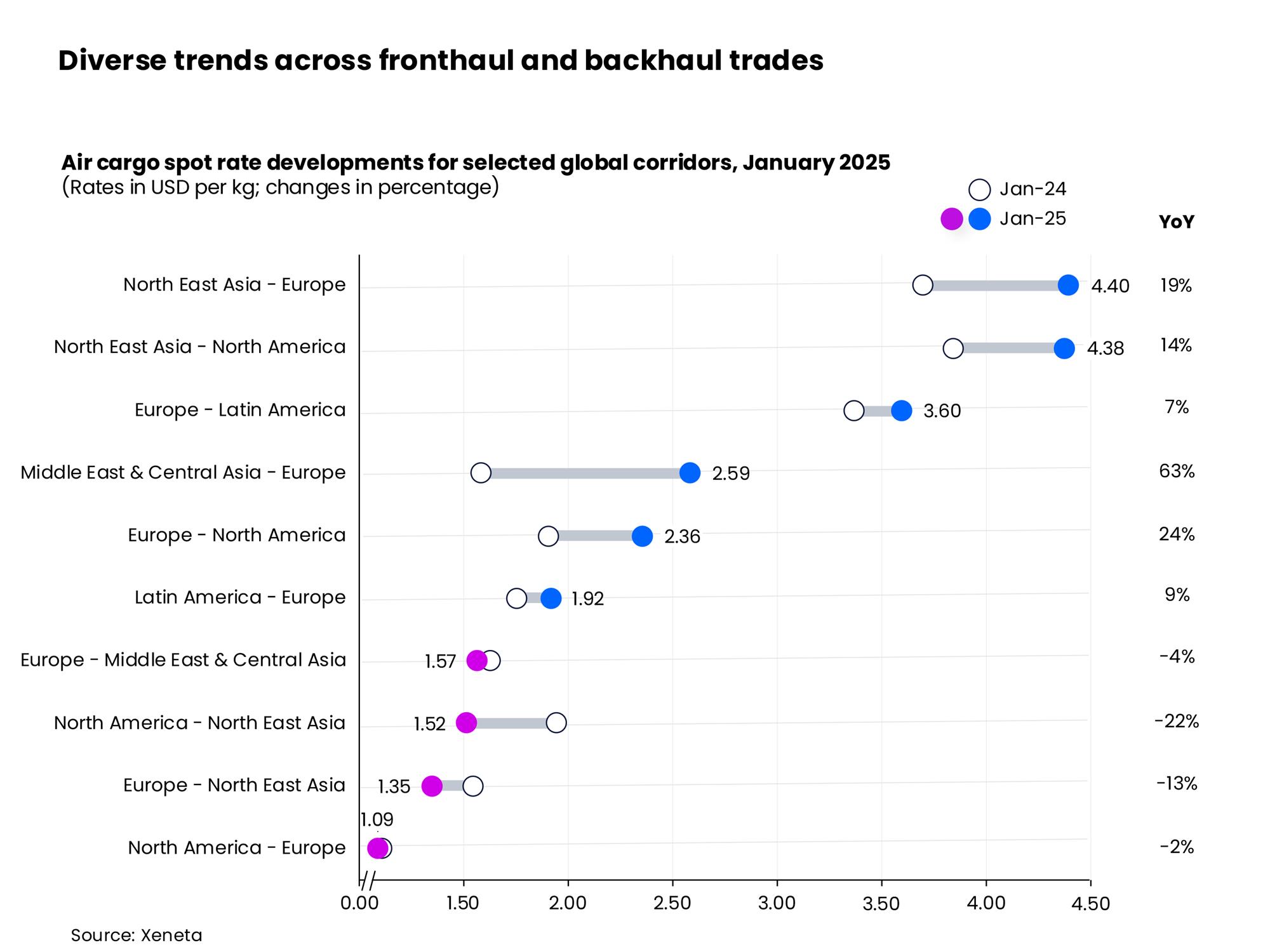

In terms of corridor trends, fronthaul trades on major global corridors continued to rise year-on-year in January. The most significant increase was seen in trade from the Middle East and Central Asia to Europe, with the air cargo spot rate up 63% year-on-year to US$2.59 per kg, driven by ongoing Red Sea issues, followed by the Europe to North America trade lane, where the spot rate grew 24% to US$2.36 per kg.

A strategic shift in freighter capacity towards Asia-related trades has led to a moderate rate of growth originating from North East Asia.

According to Xeneta, spot rates from North East Asia to Europe increased by 19%, reaching US$4.40 per kg, while rates to North America rose by 14%, hitting US$4.38 per kg.

In contrast, the Xeneta analysis noted that backhaul trades on these routes experienced a decline in spot rates due to growing trade imbalances. This decline ranged from 22% on the North America to North East Asia corridor to 2% on the North America to Europe corridor.

The only corridor where air cargo spot rates increased in both directions was between Europe and Latin America, which saw high single-digit year-over-year growth.