February 1st marked the start of a new competitive landscape in the pivotal deep-sea container trades from Asia to North America and Europe. As a result, Sea-Intelligence analyzed the changes in market share among shipping line alliances compared to the previous year.

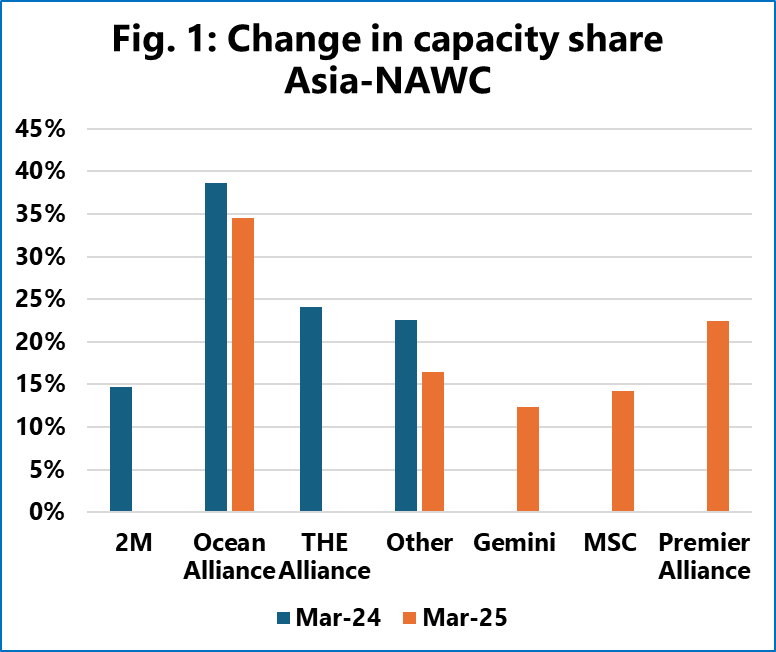

Sea-Intelligence said Figure 1 (below) shows the Asia-North America West Coast market share for both March 2024 and March 2025 for the shipping line alliances in operation in the two different timelines.

The 'other' refers to the capacity across all non-alliance services, from both non-alliance carriers and alliance carriers operating independent services outside of the alliance cooperation.

[Source: Sea-Intelligence]

"Here, we find a slight loss of market share for Ocean Alliance. It is not because they are reducing their capacity, but simply because the other carriers are injecting capacity at a higher pace than Ocean Alliance itself," Alan Murphy, CEO of Sea-Intelligence, said.

"They do, however, clearly remain the largest alliance, operating 35% of the planned capacity," he added.

Meanwhile, the Danish maritime data analysis firm noted that the Premier Alliance — formed by Ocean Network Express (ONE), Hyundai Merchant Marine and Yang Ming Marine — is the "interesting one" to watch.

"Despite seeing Hapag-Lloyd leave the alliance, Premier Alliance essentially maintains the same market share as THE Alliance had," Murphy said.

He added that Gemini Cooperation is clearly the smallest player in the Transpacific trade into the NAWC.

"We find a similar pattern on the Asia-North America East Coast as well, where Ocean Alliance continues to hold the largest market share, with Premier Alliance maintaining a similar market share as the outgoing THE Alliance, while Gemini Corporation has the smallest market share," the Sea-Intelligence chief said.

He noted that the difference between Premier Alliance and Gemini Cooperation, however, is a "very marginal 0.2 percentage points" in favour of Premier Alliance.

"The changes in the competitive landscape between the carrier alliances are likely to create significant competitive pressure as the carriers adjust to the new situation," Murphy said. "For shippers, this is likely to manifest itself as a downward pressure on freight rates."

2M Alliance has been operated by MSC and Maersk since 2015, but after nearly eight years, it will be reorganised in February 2025. Maersk and Hapag-Lloyd will form Gemini Cooperation, and MSC will opt to operate independently but with new strategic partnerships on certain trade lanes.