Average worldwide air cargo rates increased by 4% during the third full week of March, returning to levels seen in mid-January and last summer as markets in Asia Pacific continue to recover after the Lunar New Year (LNY).

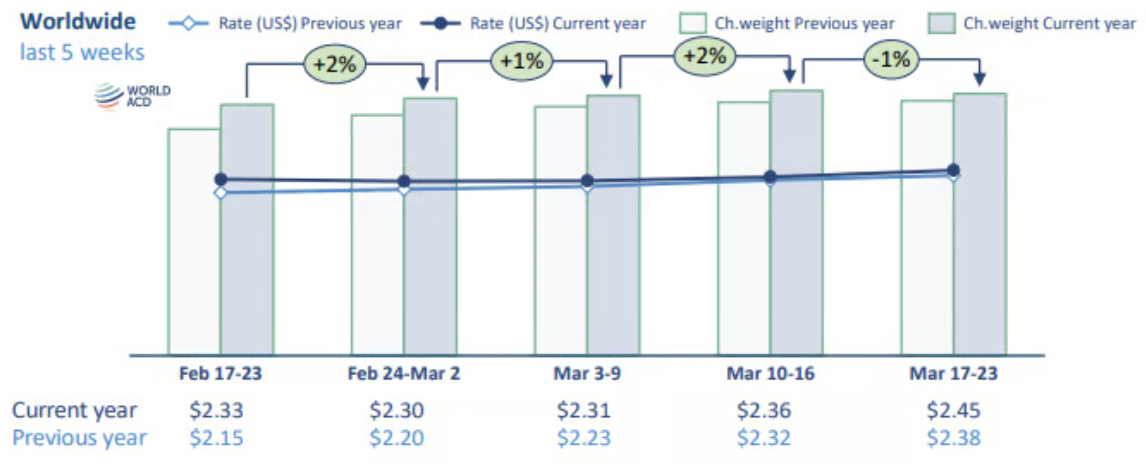

According to WorldACD Market Data, global spot rates gained 5% in week 12 (March 17-23), reaching US$2.69 per kilogram, while contract rates rose 3% to US$2.40 per kilogram, bringing the combined market average to US$2.45 per kilogram — 3% higher than the same week last year.

Despite a 1% week-on-week (WoW) drop in global flown chargeable weight, year-on-year (YoY) weight remains 3% higher, with Asia Pacific and Africa leading tonnage growth at 1% WoW.

Chargeable weight from Asia Pacific origins rose 10% year over year, a surge likely influenced by the earlier LNY timing in 2025.

[Source: WorldACD]

Regional Trends

WorldACD said in its report that most major origin regions reported WoW increases in market rates and spot rates. Central & South America (CSA) saw a 13% rise in spot rates, while Asia Pacific origins recorded a 5% gain to US$3.71 per kilogram.

In the Middle East and South Asia (MESA) region, spot rates rose by 3% WoW to US$2.81 per kilogram, although this is 17% lower than the elevated levels last year during disruptions in container shipping in the Red Sea.

China to U.S. rates rise

Meanwhile, WorldACD said air cargo tonnages from Asia Pacific to the U.S. increased for the sixth consecutive week since LNY, with rates driven by growth from South Korea (+13%), Vietnam (+6%), Hong Kong (+5%), and China (+2%).

Spot prices from Asia Pacific to the U.S. climbed 5% WoW to US$5.16 per kilogram. China to U.S. prices recorded a second straight week of double-digit growth (+12%) to reach US$4.53 per kilogram — the second-highest level of the year.

Asia Pacific to Europe

Tonnages from Asia Pacific to Europe also saw a sixth successive weekly increase, albeit at a smaller 2% gain. Growth was led by Thailand (+6%), South Korea (+5%), and China (+3%), while tonnages ex-Japan dropped 8% WoW.

Spot prices from Asia Pacific to Europe rose 2%, recovering from four weeks of declines, with China leading the increase at 6%.

The MESA to Europe market showed signs of stabilization, with slight increases in tonnages and spot rates. Dubai (+6%) and India (+4%) led rate increases, offsetting declines from Colombo (-3%). Compared to last year’s elevated demand, MESA to Europe spot rates in week 12 were down 23% YoY.

The report noted that spot rates from Bangladesh to Europe held steady at US$2.86 per kilogram for five weeks, a return to normal levels after inflation-driven highs of over US$5 per kilogram during political upheavals in 2024.