The slowdown in global tonnage that began in the latter half of March accelerated last week, according to the latest weekly figures from WorldACD Market Data, with air freight demand from China and Hong Kong to the United States (U.S.) falling slightly and rates increasing amid tariff announcements.

In the week ending April 6 (week 14), demand from China and Hong Kong dropped 1% compared to the previous week, marking the first decline since the start of the year. However, volumes remained 3% higher than the same week last year.

Overall demand from the Asia-Pacific region decreased by approximately 7% week on week.

Pricing for air cargo originating from Asia Pacific increased by 4% week-on-week, with the average spot rate climbing 5% to US$3.94 per kg.

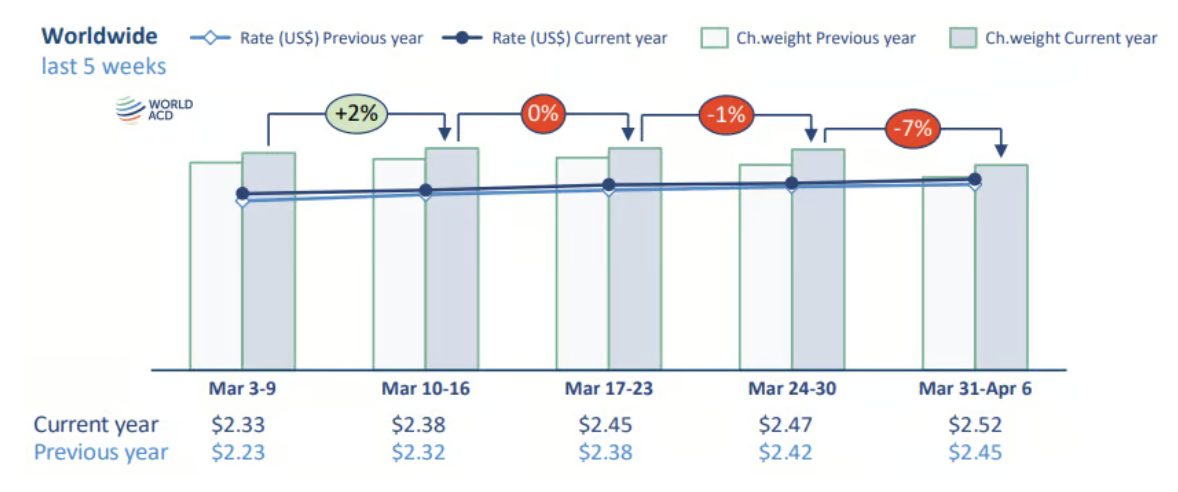

Worldwide air cargo demand weakened during week 14, with data from WorldACD showing a 7% decline compared to the previous week.

[Source: WorldACD]

The air cargo market data provider attributed the drop to the Eid holidays marking the end of Ramadan and growing uncertainty over a trade war fueled by new U.S. tariffs and the removal of "de minimis exemptions" for shipments from China and Hong Kong.

"About half of this was due to a seasonal drop in bookings during the Eid holidays at the end of Ramadan, while the other half reflects worldwide uncertainty over a trade war triggered by the latest wave of US tariffs and the removal of US de minimis exemptions for shipments from China and Hong Kong," WorldACD said.

Nonetheless, despite the recent decline, global demand remains 6% higher than the same period last year.

WorldACD said average air cargo rates increased across most regions last week, with the exception of Central and South America. Rates climbed 2% week-on-week to US$2.52 per kg, marking a 2.9% increase compared to the same period last year.

It cautioned, however, that the outlook could shift in the coming weeks as tensions escalate between China and the United States.

"While demand out of the [APAC] region has remained fairly robust during the first quarter of 2025, as highlighted in last week's report (up 3%, YoY), we might see a different trend going forward as global uncertainties seem to start impacting international trade flows," the report said.

"Most ominous there are the escalating tariffs between the US and China, but frequent changes in the US stance on tariffs elsewhere have prompted companies to postpone decisions while their inventory levels are high from front-loading until there is some clarity to plan their next moves," it added.

Washington plans to impose 145% tariffs on Chinese imports, while Beijing is set to respond with its own 125% tariff rate.

Meanwhile, the United States has temporarily put tariffs on hold for several countries for a 90-day period, reflecting what the U.S. called "trading partner retaliation and alignment."

"As the new US tariffs that have not been put on hold for 90 days came into effect on Wednesday, 9 April, the impact is expected to be more clearly visible on certain trade flows in next week's report," WorldACD said.