Shipping lines are slashing capacity on Transpacific trade routes as the ongoing trade war disrupts supply chains, leading to a surge in blank sailings between Asia and North America.

According to Sea-Intelligence, blanked capacity now accounts for 19% of total planned capacity on Asia-North America West Coast routes and 17% on East Coast routes for April and May.

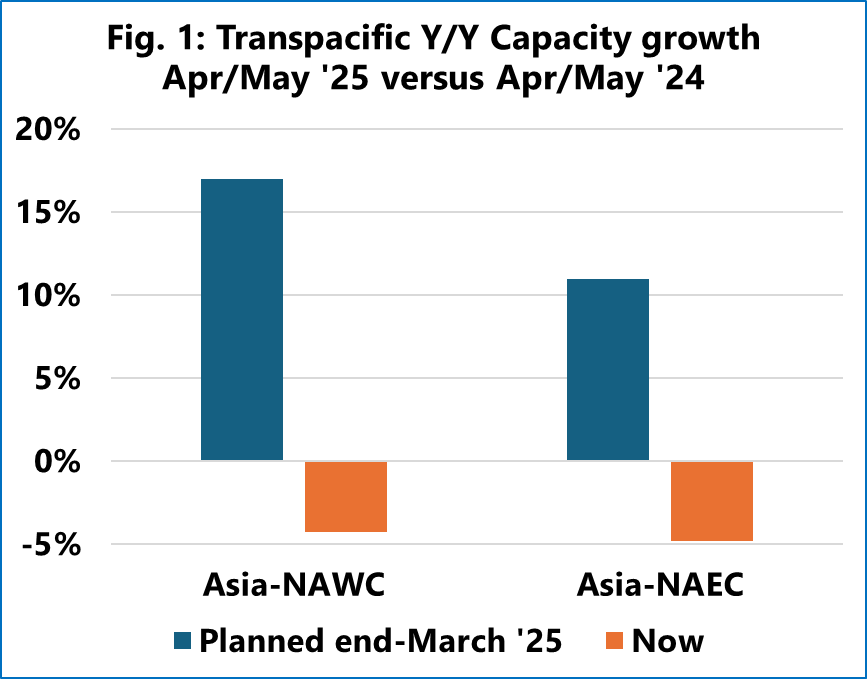

However, the high number of blank sailings does not necessarily translate to a drastic year-over-year capacity reduction, as initial deployment plans had anticipated a significant increase before the latest round of tariffs took effect.

"At the end of March—just before the trade war escalated—shipping lines were planning to increase capacity on the Asia-North America West Coast trade by 17% year-over-year," said Alan Murphy, CEO of Sea-Intelligence, adding that now, instead of an increase, the industry is seeing a 4.3% decline.

On Asia-NAEC, prior to the trade war, the lines planned to increase trade capacity by 10.9% Y/Y, but this has now been changed to a Y/Y capacity reduction of 4.9%.

"This explains the seemingly counterintuitive situation, where blanked capacity is 17%-19% of the total planned capacity on the two Transpacific trade lanes, while Y/Y capacity reduction is 'only' 4%-5%," Murphy said.

[Source: Sea-Intelligence]

Murphy explained that the shift reflects broader uncertainty in the market.

"At the end of March, the shipping lines had planned a significant capacity injection into the trade, but the blanked capacity, and the deployment of smaller vessels, has switched the Y/Y capacity injection to a capacity reduction," he said.

The container volume data for Asian exports in April won't be available until early June, but early indications suggest a 30% to 50% drop in Chinese export bookings — far greater than the 4-5% reduction in overall capacity.

Sea-Intelligence noted that while other Asian markets may offset some of the losses, it's unlikely they will fully compensate for the decline in Chinese shipments.

"While the Chinese volume drop will be partially offset by uptake elsewhere in Asia, it does not seem likely that gains in the rest of Asia can offset the loss from China," Murphy said.

The spike in blank sailings has also raised concerns about spot rate volatility.

"If demand continues to fall, we could see a significant drop in spot rates in the coming weeks," Murphy said.

"This could result in even more blank sailings in the coming weeks, and possible lead to a significant drop in spot rates," he added.

Industry analysts warn that further reductions in trade capacity could exacerbate supply chain disruptions, particularly for businesses reliant on stable shipping schedules.

With tariffs still in flux, many shippers are adopting a wait-and-see approach before making long-term adjustments to their logistics networks.

For now, the Sea-Intelligence analysis noted that the Transpacific trade remains in a state of flux, with carriers adjusting their strategies in response to shifting economic and political conditions.