Worldwide air cargo tonnages rebounded in May with a 4% month-on-month (MoM) increase, according to the latest weekly figures and analysis from WorldACD Market Data, after falling 7%, MoM, in April following significant US tariff rises and Easter and other holidays.

The air cargo market data provider said the year-on-year growth for May also stood at 4%.

"May proved to be another highly volatile month for air cargo," WorldACD said, noting that alongside a number of national holidays in May, the ending on May 2 of 'de minimis' import tariff and reporting exemptions for low-value goods from China to the US, in addition to steep rises in US tariffs on China-origin goods, led to a slump in transpacific traffic in late April that continued in the first half of May.

"But the interim agreement on May 12 between the US and China – which included cancelling some tariffs altogether, suspending others for 90 days, and a partial softening of the de minimis changes – stimulated a strong rebound in traffic from China and Hong Kong to the US in the second half of May, taking tonnages on that market back up to their levels in early April," it added.

WorldACD said all of the world's main air cargo origin regions, except Central & South America (CSA), recorded MoM increases in flown chargeable weight, broadly reversing their MoM losses recorded in April.

Compared with last year, worldwide tonnages in May were also 4% higher, led by year-on-year increases in volumes from Asia Pacific (7%), Europe (4%) and CSA (3%), with small YoY growth from Africa (2%) and North America (1%), while traffic from Middle East & South Asia (MESA) was flat compared with its elevated levels in May 2024.

On the pricing side, average rates in May, based on a full-market average of spot rates and contract rates, were lower on both a MoM (4%) and YoY (3%) basis.

"That is the first full month since April 2024 in which average worldwide rates have been lower than last year, based on the more than 2 million monthly transactions covered by WorldACD's data," the report said.

[Source: WorldACD]

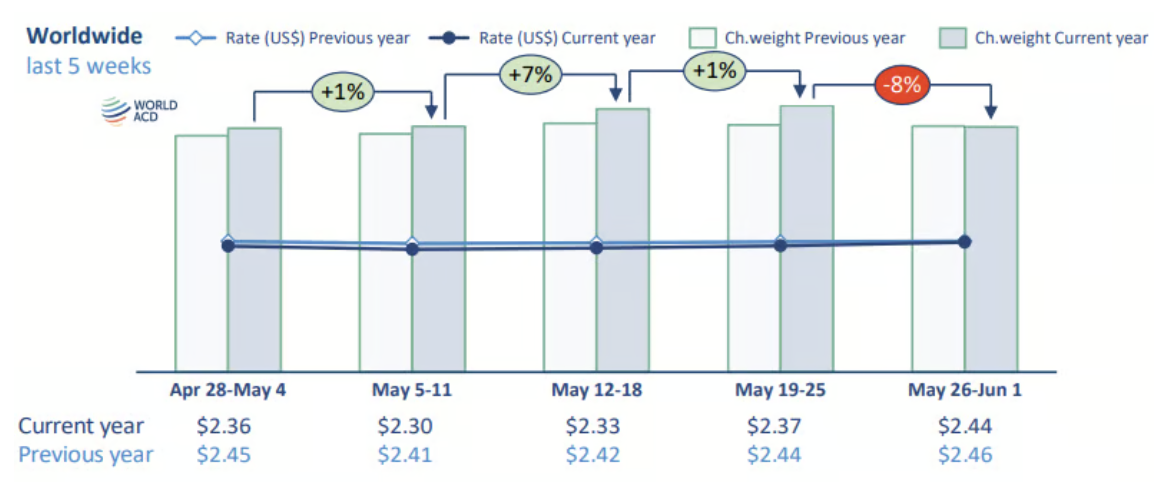

Looking specifically at the end of May, WorldACD said worldwide flown chargeable weight in week 22 (May 26 to June 1) was down 8% compared with the previous week, negatively impacted by national public holidays including 'Ascension Day' (May 29) in various countries and 'Memorial Day' in the US (May 26). The biggest WoW declines were from North America and Europe, which saw a drop of 13% and 11%, respectively.

On the pricing side, full-market average worldwide rates rose 3%, WoW, to US$2.44 per kilo, led by a 3% rise from Asia Pacific, although average rates were -1% lower than the equivalent week last year.

Volatile China to U.S. market

The air cargo market data provider noted that much worldwide attention has been on the highly volatile China to US market, where spot rates in week 22 edged up slightly higher (1%, WoW) to US$4.49 per kilo after gaining 15% the previous week — 6% above their average level so far this year of US$4.24 per kilo, but it remains 13% below their level this time last year.

WorldACD said Hong Kong to US spot rates strengthened for a second consecutive week, gaining a further 9%, WoW, to US$4.76 per kilo — also slightly (3%) above their average level so far this year of US$4.60 per kilo and just 4% below last year's level in week 22.

On the demand side, combined volumes from China and Hong Kong to the US dropped slightly (3%, WoW) in week 22, and are still 8% lower than the equivalent week last year.

In comparison, China to Europe and Hong Kong to Europe spot prices recorded a second consecutive week of small WoW rises, regaining 3% and 2%, respectively, to US$3.95 and US$4.54 per kilo.