National holidays in Japan and several European countries contributed to a sizeable mid-August dip in air cargo tonnages – similar to one experienced in the equivalent period last year, according to the latest figures and analysis from WorldACD Market Data.

Air cargo tonnages in week 33 (August 11-17) dipped sharply, by 7% compared with the previous week, dropping especially steeply from Europe (11%) and Asia Pacific (8%) origins, although there were week-on-week (WoW) declines in chargeable weight from all the main world regions – including Middle East & South Asia (MESA, 4%), North America (3%), and Africa (3%).

Tonnages from Japan to the US plummeted by 53%, week-over-week (WoW), in week 33 and by 44% to Europe, primarily due to temporary business closures resulting from Japan's three-day Obon festival.

[Source: WorldACD]

Similarly, much of the 11% decline ex-Europe can most likely be explained by a fall in tonnages from countries where an August 15 holiday was widely celebrated.

The air cargo market data provider noted that tonnages from Asia Pacific to the US dropped 9%, WoW, in week 33, with the much-reduced volumes from Japan responsible for around half of that decline.

"But there were falls also from most other major Asia Pacific air cargo origin markets to the US, as shippers continue to adjust and adapt to the evolving US import tariff environment," WorldACD said.

After two weeks of consecutive WoW declines of at least 10%, tonnages from South Korea to the US partially rebounded with a 6% WoW gain. But there were WoW falls from China (6%) and Hong Kong (3%), along with the third consecutive week of falling tonnages from Thailand (12%) and Singapore (19%).

Meanwhile, the analysis said a strike at Air Canada of nearly four days led to many of their flights being cancelled, contributing to downward pressure on volumes to and from North America.

"As with volumes from Japan to the US, the decline in tonnage from Japan was responsible for around half of an overall 4% WoW drop in chargeable weight from Asia Pacific to Europe in week 33," the analysis said.

It added that tonnages from South Korea to Europe recorded their third consecutive WoW decline (7%, WoW) to around 25% below their average weekly level in July.

Spot pricing relatively stable

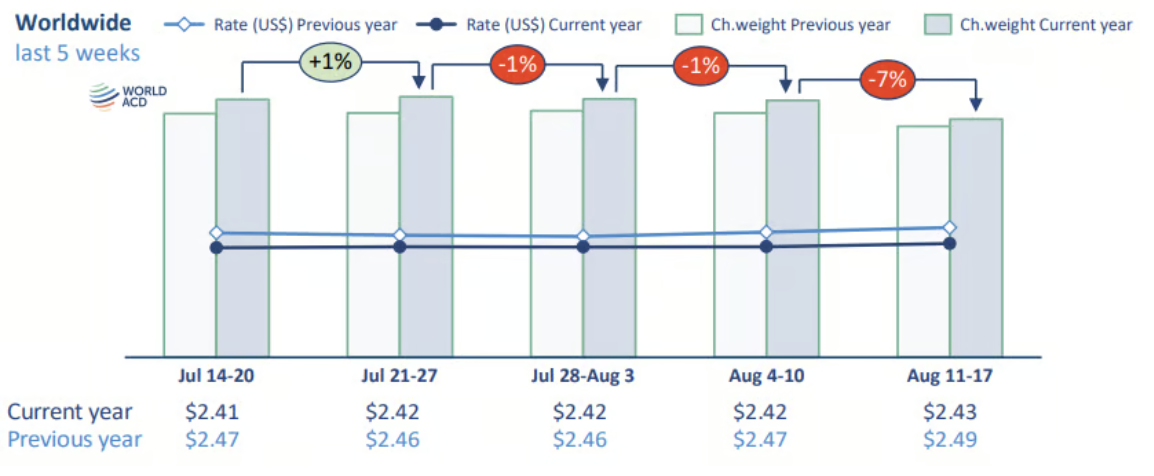

On the pricing side, average worldwide spot rates in week 33 were flat, WoW, at US$2.64 per kilo – around 3% down compared with the equivalent period last year. Spot prices are slightly higher, year on year (YoY), from most regions, apart from Asia Pacific (decline of 8%) and MESA (decline of 25%).

Average spot rates from Asia Pacific to the US dropped back slightly (3%, WoW) in week 33 to US$4.89 per kilo, although they have been relatively stable for the last three months despite the fast-changing tariff environment.

"And with US import tariff levels becoming clearer for some of the US's key trading partners, albeit at a higher tariff level than at the start of this year, there are some anecdotal indications of air cargo charter capacity beginning to return on transpacific lanes to the US," WorldACD said.

Average spot rates from Asia Pacific origins to Europe were stable at US$3.76 per kilo in week 33, despite a 10% drop from Japan origins and a 3% reduction from China, balanced out by WoW increases from South Korea (5%), Vietnam (4%), and Malaysia (9%).