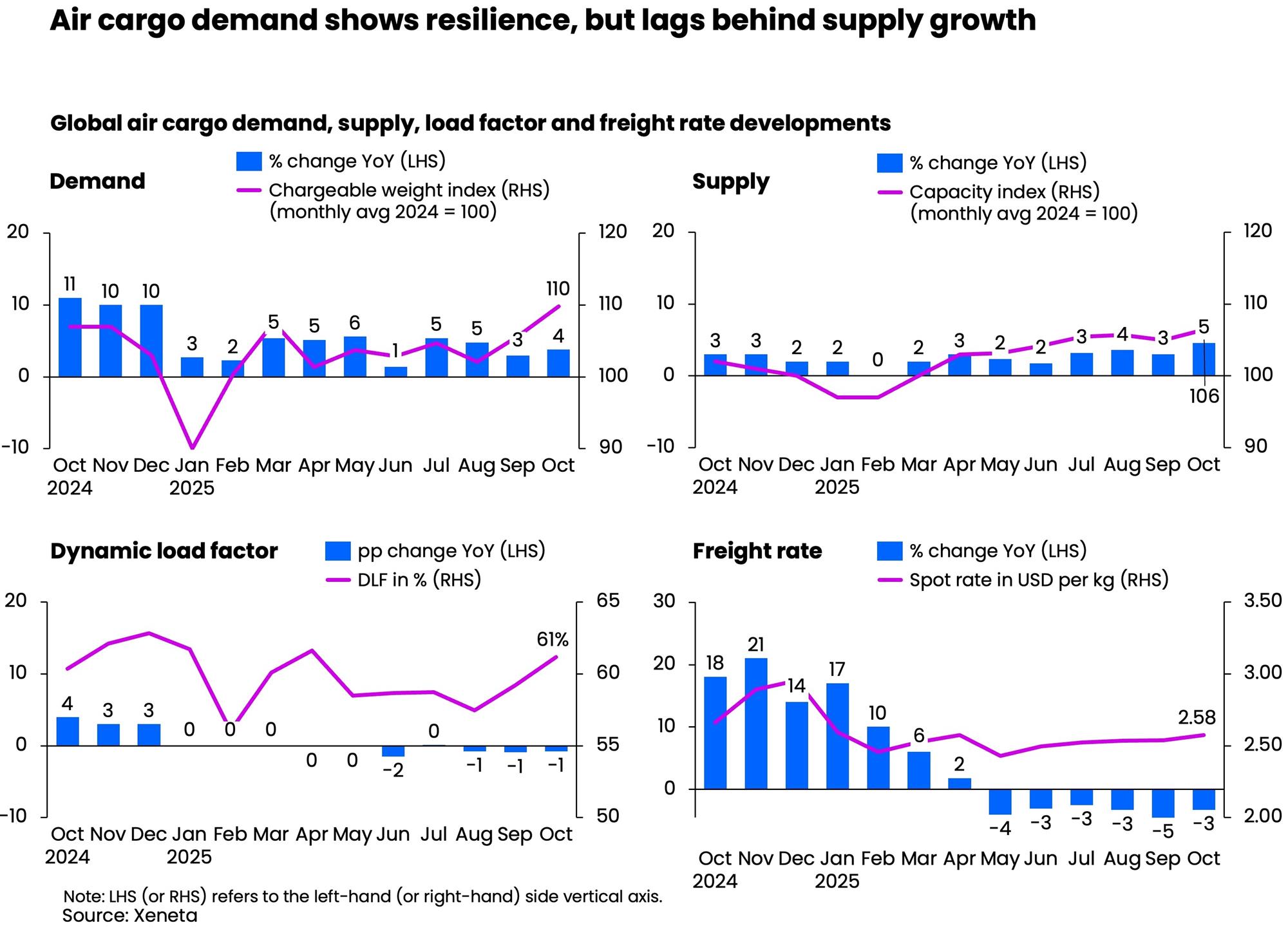

Global air cargo volume growth slowed in October but still recorded a stronger than expected 4% rise year-on-year, despite the easing of frontloading of imports by businesses countering the cost of tariffs and effects of the US de minimis ban, according to industry analysts Xeneta.

The latest monthly data supports Xeneta's forecast in September of an overall a 3-4% growth in demand for 2025, but more worrying trends indicate challenging times ahead for airlines and freight forwarders as the market is "definitely starting to favour shippers more than it has for the past few years," said Niall van de Wouw, chief airfreight officer.

October saw a sixth consecutive monthly fall in global air cargo spot rates, with a 3% decline year-on-year to US$2.58 per kg.

Seasonal contract rates, valid for over a month, fell even faster than spot prices. Averaging US$2.31 per kg, they were down 8% year-on-year, reflecting a subdued outlook among freight forwarders and carriers.

A slowing market and 'a harsh signal'

van de Wouw warned falling volumes between Europe-North America — a market dominated by general air cargo and less exposed to the US de minimis ban — may be a "bellwether for the rest of global trade".

Xeneta said despite the 4% growth in the global market, Europe-North America demand fell 6% year-on-year in October, while spot rates on the corridor rose a meagre 4% year-on-year, a sharp deceleration from the 23% annual growth seen earlier in 2025.

"When we look at the global data for October, I would have expected the number to be closer to zero because of the busy Q4 for air cargo last year as well as the trade disruption still going on. But the numbers indicate it was stronger than anticipated," he said.

"The consensus, however, is of a market slowing down, just not as fast as expected – and a 6% drop-off in volumes on the Transatlantic market, a major trade lane, is a harsh signal," van de Wouw further said.

October data underscored a cooling market, with demand lagging behind the 5% rise in supply for the second month this year.

Across the top three global trade lanes, air cargo peak season growth momentum remained subdued in October.

The Xeneta report said adjusting for distortions from Super Typhoon Ragasa by averaging late-September and Golden Week volumes, Asia Pacific to Europe cargo demand rose 11% in October versus August — well below the 16% gain recorded in the same period last year.

Corresponding spot rates climbed 5%, but were well below the 9% rise seen a year earlier.

China-Europe ecommerce sales surge 62%

Meanwhile, ecommerce continued to propel Asia-Europe airfreight volumes as China's ecommerce behemoths accelerated their share of markets outside of the US.

The analysis said low-value and ecommerce sales to Europe surged 62% year-on-year in September, double the growth rate a year ago and far outpacing China's overall ecommerce expansion of 18%, citing China Customs data.

By contrast, it added that China-to-US ecommerce shipments fell for the fifth straight month, down 34% year-on-year in September, though the decline moderated from a trough of -49% in June.

As freighter capacity shifts from the Transpacific to the Asia-Europe corridor, spot rates from Northeast Asia to Europe also slipped, down 5% year-on-year, but still milder than the double-digit declines seen on Asia–North America routes.

Xeneta said compared with two months earlier, the Northeast Asia and Southeast Asia to Europe corridors proved more resilient, with spot rates rising 6% and 7% respectively, versus 3% and 1% changes on the Northeast and Southeast Asia–North America routes respectively.

Backhaul rates from North America to Northeast Asia showed a notable rebound, climbing 11% over the same period.

A fight for market share in 2026

"For many major forwarders, organic market growth is not expected to be enough to keep their investors happy. So, as we head into 2026, I expect them to be going for market share," van de Wouw said.

"You can't create more airfreight when the demand's not there, so you've got to win it from someone else, and that will create more downward pressure on rates."

He added that recent tariff-driven gains in airfreight may be short-lived as broader market realities set in.

"There's no question that the airfreight market has gained from the global economic disruption and fears caused by tariffs, in particular – and it would be foolish to think the tariff situation will be over any time soon. But, as the noise starts to subside, the industry is being reminded that there is only limited growth in the general freight market and that is causing lower expectations for 2026," van de Wouw said.