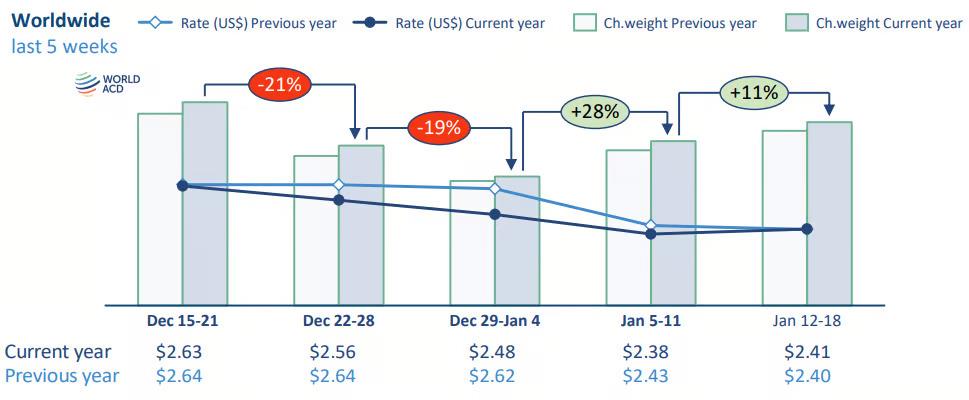

Worldwide air cargo volumes rose sharply for a second straight week in mid‑January, posting an 11% week‑on‑week increase that kept global tonnages about 5% above year‑ago levels, according to WorldACD Market Data. The latest rise, driven by gains across nearly all major origin regions, brings chargeable weight back close to pre‑holiday levels after a seasonal slump.

The 11% week‑on‑week rebound in global air cargo volumes in week 3 (12–18 January) was driven by rising tonnages across nearly all major origin regions, with only the Middle East & South Asia recording a slight dip.

The increase follows a strong 28% jump the previous week and brings worldwide chargeable weight back close to pre‑holiday levels, though still about 10% below mid‑December, according to WorldACD’s data.

Year on year, most regions continued to post higher tonnages, including MESA (+15%), Africa (+9%), Asia Pacific (+6%), Central & South America (+5%) and North America (+2%), with only Europe marginally lower. Patterns over the past five weeks broadly mirror last year, but at generally higher volume levels.

Rates picking up again

Global average rates appear to have bottomed out in week 2 and edged up 1% in week 3 to US$2.41 per kilo, supported by a 4% rise from Asia Pacific origins. Spot rates also gained 1% week on week.

WorldACD said both spot and full‑market averages are roughly in line with last year, despite capacity growing faster than chargeable weight. Notable YoY differences include higher spot rates ex‑Africa (+14%) and sharply lower levels ex‑MESA (‑19%).

Asia Pacific contrasts

Meanwhile, Asia Pacific exports to Europe are showing stronger early‑2026 growth than flows to the US.

Tonnages to Europe rose 19% YoY in week 3, with broad‑based gains led by Hong Kong (+30%), China (+17%), Taiwan, and Southeast Asia, including Thailand (+32%) and Malaysia (+26%).

Shipments from Asia Pacific to the US were up 6% YoY, but performance varied widely: volumes from China and Hong Kong fell 12%, while South Korea, Taiwan, Vietnam and Thailand continued to post strong double‑digit growth.

Spot rates trail last year

WorldACD noted that spot rates from Asia Pacific to Europe slipped 3% week on week and were 12% lower YoY, with only Taiwan and Singapore showing increases. Rates to the US rose 3% week on week but remained 11% below last year's levels.