WorldACD said air cargo demand continued to bounce back in February but various regions showed different trends.

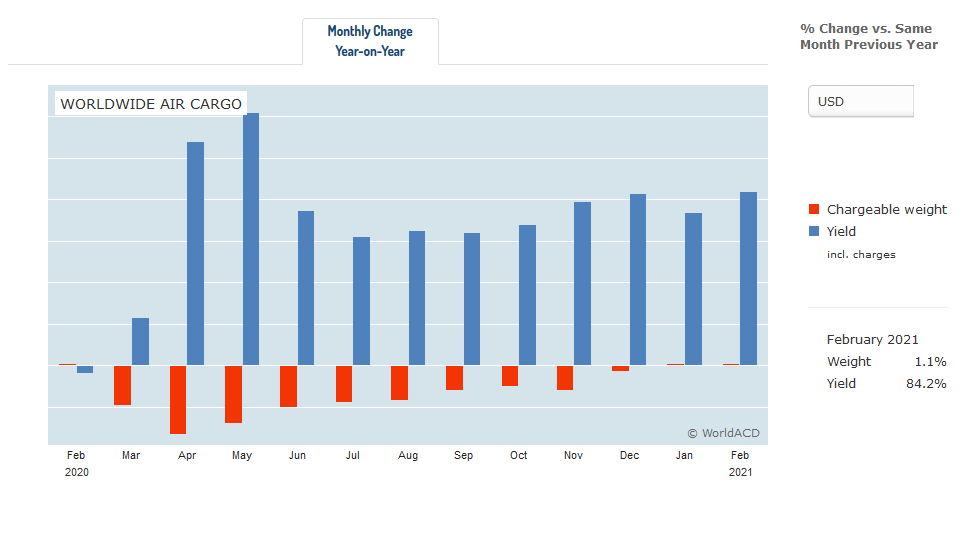

The air cargo data provider reported that February showed a worldwide year-on-year (YoY) weight increase of 1.1%. Rates for the month of February were up by 84% compared with a year ago, while over the first two months yields are up 79%.

After a strong volume drop in the middle of the month, the end of February also showed a strong recovery, WorldACD said.

It added that within the two months’ period, yields/rates increased by 4% month-on-month and the load factors went up by 3.2 percentage points, also month over month.

While this shows positive signs for the industry, WorldACD warned that “worldwide, the trend may be positive, but in many markets, the reality is different.”

"As always, worldwide averages need to be broken down in order to get the real state-of-affairs. Volumes are the best indicator of where things stand over a longer period," WorldACD said.

APAC trade growth cited

In its monthly round-up report, the air cargo data provider said “Asia Pacific, one of the six main regions charted by WorldACD, is in a class of its own, emphasising the increasing importance of the region in world trade.”

WorldACD reported that except from the sub-region Australasia & the Pacific (-26% YoY), air cargo exports kept growing, particularly from the sub-regions China and North-East Asia, showing YoY growth figures of 46% and 24% respectively.

“The entire region’s air cargo output grew by 19% YoY, by 14% vs 2019, and by 6% vs the bumper year 2018. In imports, Asia Pacific was 7% above 2020, 2% above 2019, but 4% below 2018. It is noteworthy that the business intra-Asia Pacific grows much less than the exports to other regions,” it added.

However, WorldACD said that for the other 19 sub-regions, the picture is “drastically different”.

“Apart from 3 small sub-regions (Central Africa, Mexico and Central Asia), all sub-regions showed a decrease in outgoing business in 2021 compared to each of the three foregoing years,” it noted.

The report went on to say that the hardest hit is South Asia, with a decrease of around 24% vs each of the three earlier years, North Africa (-23% YoY), Southern Africa (-20% YoY), the Gulf Area (-17% YoY) and Canada (-16% YoY).

“Of the larger 15 city-to-city markets growing by more than 100% YoY in Jan/Feb, only two had Shanghai as their origin, and one Hong Kong. The 12 other markets had diverse origin cities, including Paris, Liege, Nairobi, Beirut, Los Angeles and New York. The highest MoM growth was recorded in the market from Japan to US Midwest, in kilograms, but also in yields/rates,” it said.

Higher growth in general cargo

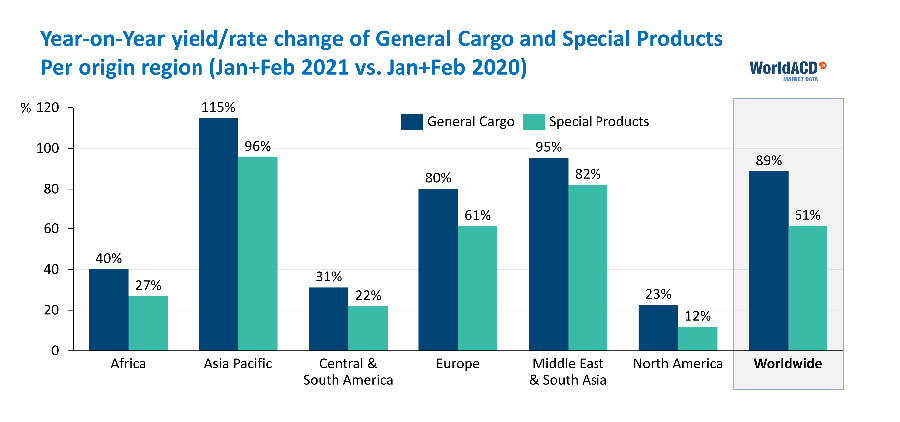

Looking at cargo types, WorldACD noted that general cargo continued to outperform special cargo in terms of yield growth in percentage terms against a year ago.

All six regions — Africa, Asia Pacific, Central & South America, Europe, MESA and North America — behave in the same way when it comes to increases in yields/rates: in all regions the yield/rate growth YoY continues to be stronger in general cargo than in special cargo, it added.

WorldACD said when it comes to volume growth, vulnerable and high tech demand outpaced the market. Pharma/temperature controlled volumes decreased compared with a year ago.

“The highest rates in air cargo at the moment are paid for business originating in South Korea, both eastbound and westbound: demand for COVID-19 diagnostic kits and a sea/air transfer play an important role here,” it added.

Looking ahead, the air cargo data provider noted that the outcome could come differently from expectations once again.

“What will March bring us? Worldwide volumes at the beginning of the month were slightly higher than at the end of February: an early sign that the month will be positive? Many individual markets will no doubt experience a different reality once again,” WorldACD said.