Global air cargo demand bounced back into growth in April after a -3% dip in March, with high load factors keeping the international airfreight system under significant strain as the traditional surge in summer capacity has so far failed to materialize for a second consecutive year, according to industry analysts CLIVE Data Services and TAC Index.

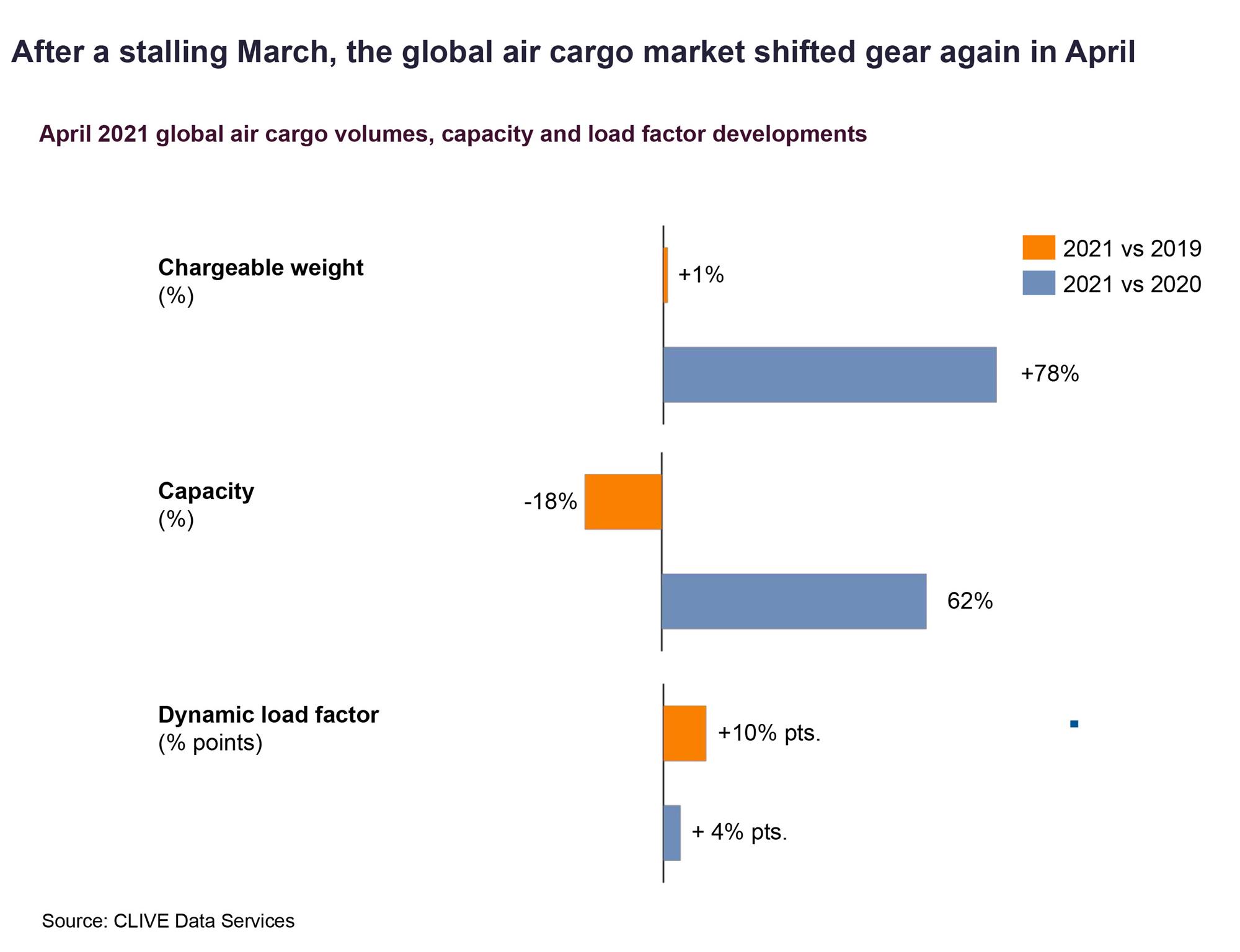

In a statement, CLIVE said based on its first-to-market weekly and monthly air cargo market data shows volumes in April up 1% over April 2019 and +78% compared to the same month of 2020, continuing the positive trend seen in the opening two months of this year.

The second half of April 2021 showed particularly strong year-over-year growth, up 6%.

"Despite the similar volumes as in April 2019, the pressure on available airline cargo capacity is much higher. Overall capacity was down 18% versus 2019 as the increase in belly capacity seen then and in previous years, as airlines increased from winter to summer schedules, remained grounded due to continuing Covid restrictions on international passenger movements," the industry analyst added.

Consequently, CLIVE noted that its 'dynamic load factor for April of 71% — based on the volume and weight perspectives of cargo flown and capacity available — was 10% pts higher than in 2019 and 4% pts above the level of a year ago.

"The air cargo market shifted gear again in April. The month-over-month change from -3% to +1% is quite a jump, but a dynamic loadfactor of 71% represents a tremendous strain on the air cargo system," said Niall van de Wouw, Managing Director of CLIVE Data Services.

He noted that this lack of bandwidth capacity-wise is being exacerbated by the fact there is no summer schedule based on passenger demand, which is contributing to the high rates being reported in the market.

"Airlines operating ‘preighter’ services need these rates in order to operate cargo-only operations because the margins on these services are very thin," van de Wouw added.

China to Europe volumes was 18% higher in April 2021 than in 2019, with load factors ex-China at 95% or ‘completely full’, he said.

Mixed, volatile rates across the region

Despite a 10% drop in volumes from Europe to North America compared to 2019, CLIVE noted that based on its latest data, the fall in capacity of around 40% on this lane, resulted in a dynamic loadfactor at 87%, 21% pts higher than in 2019.

It said the decline in North America to Europe volumes is less pronounced at -4% versus 2019, producing a load factor of 69% or 19% points higher than in 2019.

"TAC Index data for April shows the impact of the volume vs. capacity conundrum on airfreight rates," the industry analyst added.

Meanwhile, commenting on the data, Gareth Sinclair of TAC Index said: "There has been a big bounce back from the slowdown we saw in March with prices strengthening, driven by demand outstripping capacity in several markets, with some lanes recording higher pricing levels versus the highs seen in 2020."

He noted that the BAI (Baltic Air Freight Indices) increased by almost 17% in April over March largely driven by China (HKG & PVG) with growth around 30% but London Heathrow also saw an improvement on 3 out of 4 indices although at more modest levels (~3%) building on similar growth levels in March.

Meanwhile, Frankfurt, Chicago and Singapore origins all saw declines over March levels.

"There continues to be a dynamic market environment with operational crewing and permits continuing to impact some carrier operations," van de Wouw said.

TAC Index says the differences by market can be seen in the performance of the China and Hong Kong markets, which continued to lead the way in terms of price strength, while the US and Europe saw a more volatile and mixed picture in April.

"In summary, the airfreight market continues to be strong, particularly CN/HK to US, and may continue, at least in the short term, with demand strengthening as countries relax lockdowns and subdued passenger travel continues to impact capacity," Sinclair said.

"With the easing of Hong Kong quarantine rules for crew, Cathay Pacific, for example, are looking to restore their full market presence as soon as possible, which may dampen pricing," he added.