Reefer container freight rates are forecasted to accelerate through 2022, outpacing earlier estimates as well as expectations for dry container freight rates, as reefer traffic recovers from a flat 2020 and container vessel slots remain scarce amid tight supply and continuing supply chain disruption, according to Drewry’s recently published Reefer Shipping Forecaster.

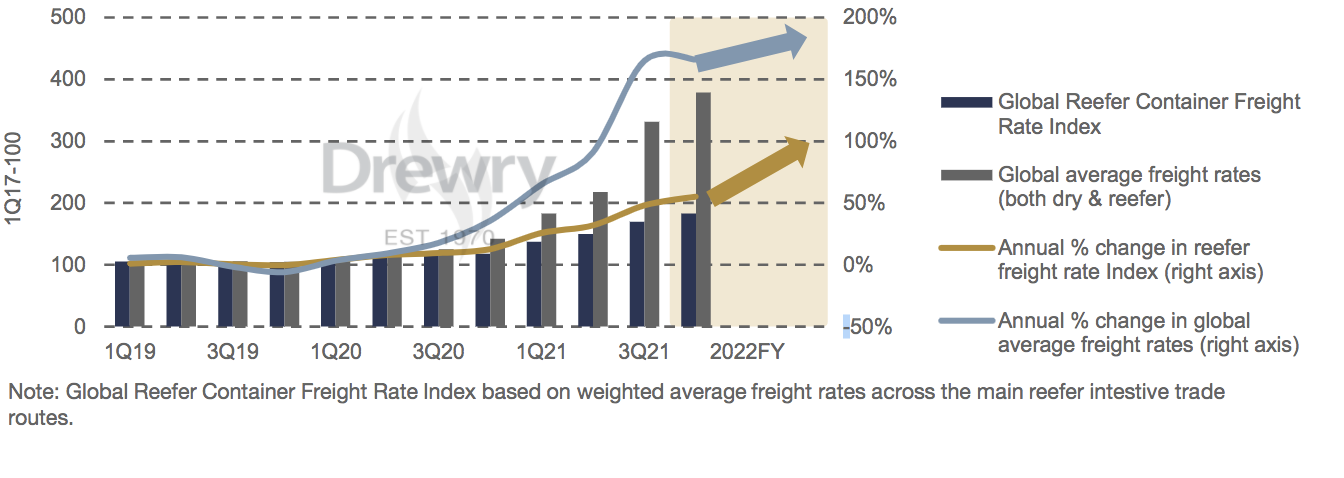

In a statement, it noted that according to its Global Reefer Container Freight Rate Index, a weighted average of rates across the top 15 reefer intensive deep-sea trade routes, it rose 48% over the year to 3Q21 and by the end of 4Q21 these gains are expected to reach as much as 55%.

Increasing reefer freights cited

These advances have been mirrored by spot time charter rates for specialised reefer ships, which have seen their best ‘off season’ in history with rates for smaller vessels exceeding 100 cents cft/30 days, it added.

"Booming reefer freight rates are following in the wake of the dry cargo sector, as operators realign risk/revenue expectations for refrigerated cargo in line with more inflated system costs and operational challenges, such as extended dwell times at transhipment ports and longer container equipment cycle times," Drewry added.

Drewry said shippers of lower value cargoes such as bananas, onions, citrus or frozen vegetables are now confronted with much higher shipping costs after enjoying years of relatively low freight rates which helped them develop markets far afield.

They must now work hard to ensure these higher costs are passed on to retailers and end consumers, the maritime research firm said.

"It was previously expected that ongoing supply chain disruption would eventually self-correct by mid-2022. But Drewry now believes that this situation will continue through next year and the stress on the system will not ease till 2023, supporting higher reefer freight rates," Drewry noted.

Seaborne reefer traffic is expected to grow 3.2% in 2021 to reach 136 million tons, a little lower than previous estimates. All commodities are showing growth in 2021, except bananas.

Meanwhile, it said trade in meat to Asia is slowing amid lower pork prices in China and the banana trade is expected to decline 5% in 2021, owing to ongoing disease of the Philippines crop and low banana prices in general.

Reefer container production is expected to reach a record high of 170,000 feu in 2021. But higher output has not necessarily resulted in improved equipment availability, as more carriers have deployed non-operating reefer containers to move higher paying dry cargo, which has prolonged reefer equipment cycles time and further constrained availability.

It said on the other hand, the specialised reefer vessel segment is fully employed, with both small and large vessels in short supply.

"As the southern hemisphere high season looms, operators are struggling to manage their fleet deployment to ensure commitment to long standing customers with rising space demands. At the same time more BCOs are turning to specialised vessel operators, seeking supply chain security for their short shelf life perishable products," it said.

Drewry said it expects tight market conditions to continue through 2022, supporting both specialised reefer vessel employment and reefer container freight rates, while challenging BCO logistics operations.