Shipping alliances have preferential services for blank sailings contrary to the traditional use of the tactical tool to manage supply to bring it down in line with demand, according to a recent report by Sea-Intelligence.

The maritime analyst said over the course of the pandemic, as demand plummeted, carriers resorted to blank sailings once again to ensure that vessels were not deployed empty. However, this was not the case across every alliance service.

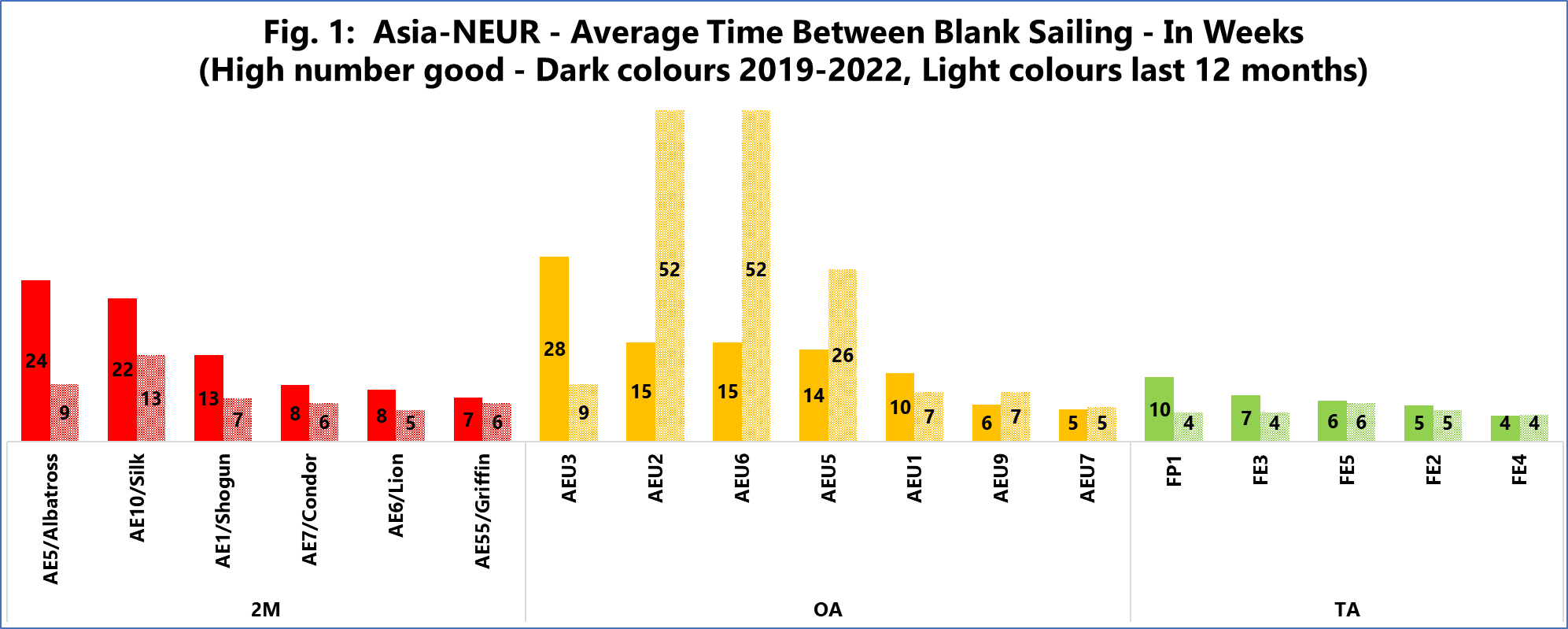

To see how susceptible a service is to blank sailings, Sea-Intel noted that it introduced a measure called ATBBS (average time between blank sailings) which is basically the average number of weeks between a blank sailing on each respective service.

Photo: Sea-Intelligence

"As we can see in figure 1, not every service received the same treatment when it came to blank sailings on Asia-North Europe. Looking at 2M, for example, AE5/Albatross and AE10/Silk were blanked once every 22-24 weeks (9-13 weeks in the last 12 months), whereas the AE55/Griffin and AE6/Lion were blanked every 7-8 weeks (5-6 weeks in the last 12 months)," Sea-Intel said.

It added that the same goes for Ocean Alliance, where AEU2 and AEU6 were hardly blanked in the last 12 months, while AEU7, AEU9, and AEU1 were blanked every 5-7 weeks in the same time period.

It added that there was also "very little to choose" from across THE Alliance services, as they were all blanked quite frequently.

Sea-Intel noted that this is a similar pattern across Asia-Mediterranean as well.

"While the general understanding might be that blank sailings are made across the board, the reality is that carriers favour certain services, either by virtue of choice and the value of cargo on board certain routes, by virtue of the ports that they call, or any other external factor," said Alan Murphy, CEO, Sea-Intelligence.