Rent in logistics warehouses across Asia-Pacific is expected to remain elevated throughout the rest of the year amid continued strong demand from manufacturers and third-party logistics players.

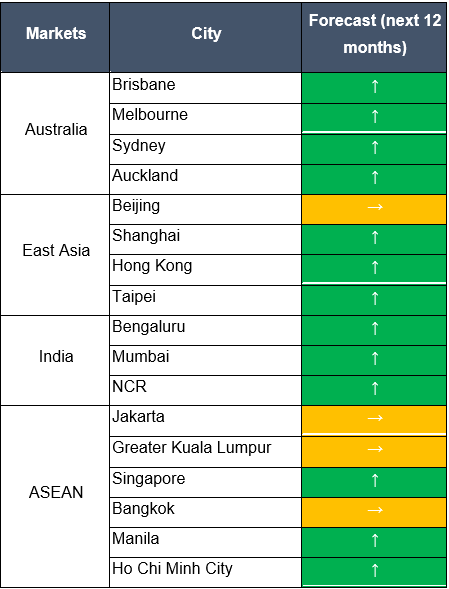

Independent global property consultancy firm, Knight Frank, said in its latest Asia-Pacific Logistics Highlights for H1 2022 that all 17 cities tracked recorded "stable or increasing rents" in the first half of 2022, compared to 13 cities in the second half of 2021.

Australia, New Zealand, India, Singapore

The report tracked prime logistics rents across 17 key cities, registering an average rise of 3% year-on-year, propelled by Australia, New Zealand, India and Singapore.

"Knight Frank foresees that rents will remain elevated for the rest of the year as much of the supply pipeline is expected only from 2023, and companies continue to seek out additional inventory space to buffer against supply chain volatility," the global property consultancy firm said.

Australian cities led the rental growth in the region, with Sydney, Melbourne, and Brisbane in the top nine positions for both annual and half-yearly growth.

For the first six months of 2022, Singapore led the region in rental expansion with a 10.9% growth

For Ho Chi Minh City, which was covered from H1 2022, Knight Frank noted that rent grew 2.5% half-yearly and stayed flat on a yearly basis.

"There has been evidence of upward pressure on prime logistics rents across the Asia region and the momentum could persist for the remainder of 2022, as long as high oil prices and supply chain disruptions are here to stay," said Tim Armstrong, head of occupier strategy and solutions, Asia-Pacific at Knight Frank.

He noted, nevertheless, that higher borrowing costs coupled with looming recession fears due to the aggressive interest rate hikes could result in a more cost-conscious business environment in the near term.

"[This] could moderate rental growth trajectory in the next 6-12 months," Armstrong added.

Photo: Knight Frank

Christine Li, head of research, Asia-Pacific at Knight Frank, noted the strong demand that continues to drive the higher rent in logistics warehouses.

Moving forward, Knight Frank's head of research (APAC) also anticipates that demand would outpace supply in many cities.

"Continued strong occupier demand from manufacturers and third-party logistics players have underpinned the rental growth in the 1H of 2022, with all 17 markets recording stable or increasing rents. Other than active pre-commitments, there is also a tendency for occupiers to seek more inventory space to avoid shortages due to supply chain volatility, and thus we see demand outpacing supply in many cities," Li said.

Rental uptrend to continue in the medium term

Li explained that logistics real estate in the APAC region is a relatively new asset class that has yet to approach the levels of maturity seen in Europe or the US and for a long time, development opportunities in the region had been held back by high land costs as well as the tight control of industrial land supply by governments.

"Consequently, there is a structural undersupply of modern logistics facilities across the region," she added.

"While the explosive surge in demand for logistics spaces is likely to stabilise as the pandemic recedes, requirements for a variety of logistics assets across the supply chain to support its rapidly industrialising economies and urbanisation rates will continue to sustain the region’s rental uptrend in the medium term," Li further said.

Early this year, Knight Frank said rent in logistics warehouses across Asia-Pacific is expected to rise 3%-5% in 2022 amid continued strong demand boosted by a recovery in global trade flows.