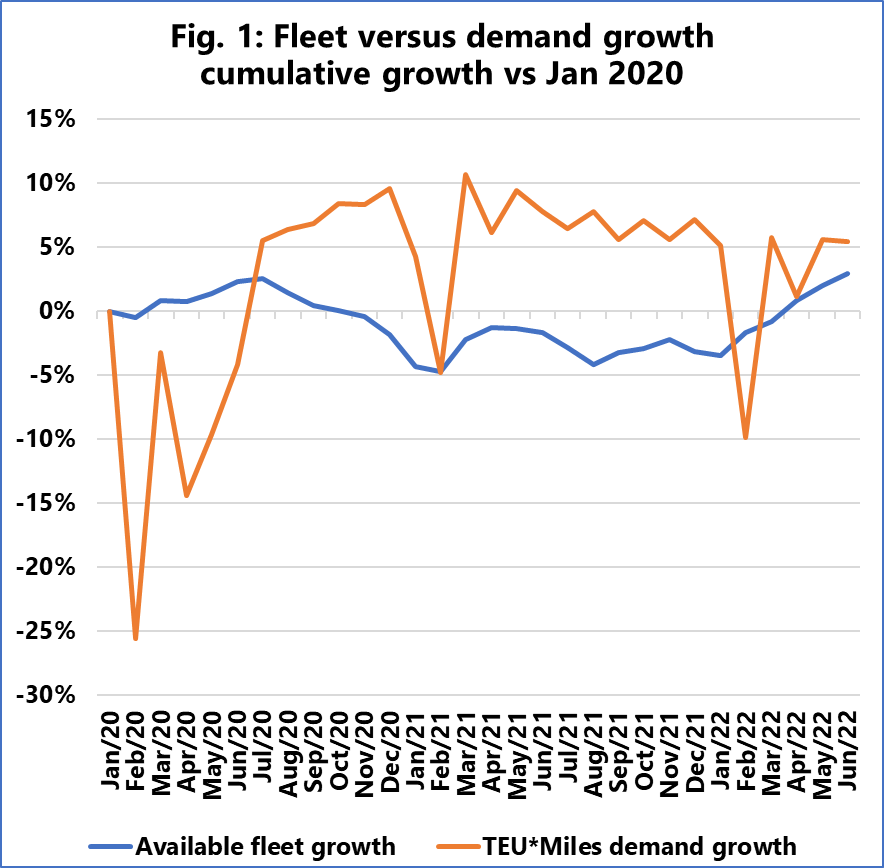

The extreme strength in favour of the carriers in 2021 according to Sea-Intelligence, was driven by a consistently higher cumulative demand growth than the available fleet.

The Danish maritime data analysis company said in a new report that this effect began in July 2020 and has only begun to taper off in recent months.

In fact, it added that demand was consistently 10% higher than capacity from November 2020 to January 2022. However, the gap has been narrowing and is now down to 2% versus the pre-pandemic levels.

As a starting point, Sea-Intelligence modelled the underlying structural fleet growth, also accounting for the unavailability of the global fleet due to vessel delays.

It noted that while the nominal fleet grew at a steady rate of roughly 4% Y/Y in 2020-2022, there was a substantial decline in the available fleet as delays started to become severe, with a sizable difference between the two.

Figure 1 shows the cumulative growth in available fleet size and demand in TEU*Miles versus January 2020.

The large spikes in demand in February 2021 and 2022 are purely a Chinese New Year effect and do not signal any underlying shifts, it added.