Major shipping lines recorded a combined EBIT (Earnings Before Interest and Tax) of US$41.6 billion in the second quarter which passed their past Q2 earnings in the past 11 years.

Sea-Intelligence (Sea-Intel) said in a report that this record, however, discounts CMA CGM which has only issued a press release so far, which does not list their EBIT.

"Most profitable quarter" in a decade

"This is not only higher than the combined Q2 EBIT of the past 11 years but is also right at the top with the 2021-Q4 and 2022-Q1 EBIT," commented Alan Murphy, CEO, Sea-Intelligence.

"Once CMA CGM's EBIT is included in the list, 2022-Q2 would likely become the most profitable quarter in the last decade."

"We should stress that we do not mean this as a value judgement on whether shipping lines making money is a good or a bad thing, and we note it has generally been an unprofitable business for the past decade or so; we are merely pointing out the unprecedented nature of the current market dynamics," Murphy further said.

Photo: Sea-Intelligence

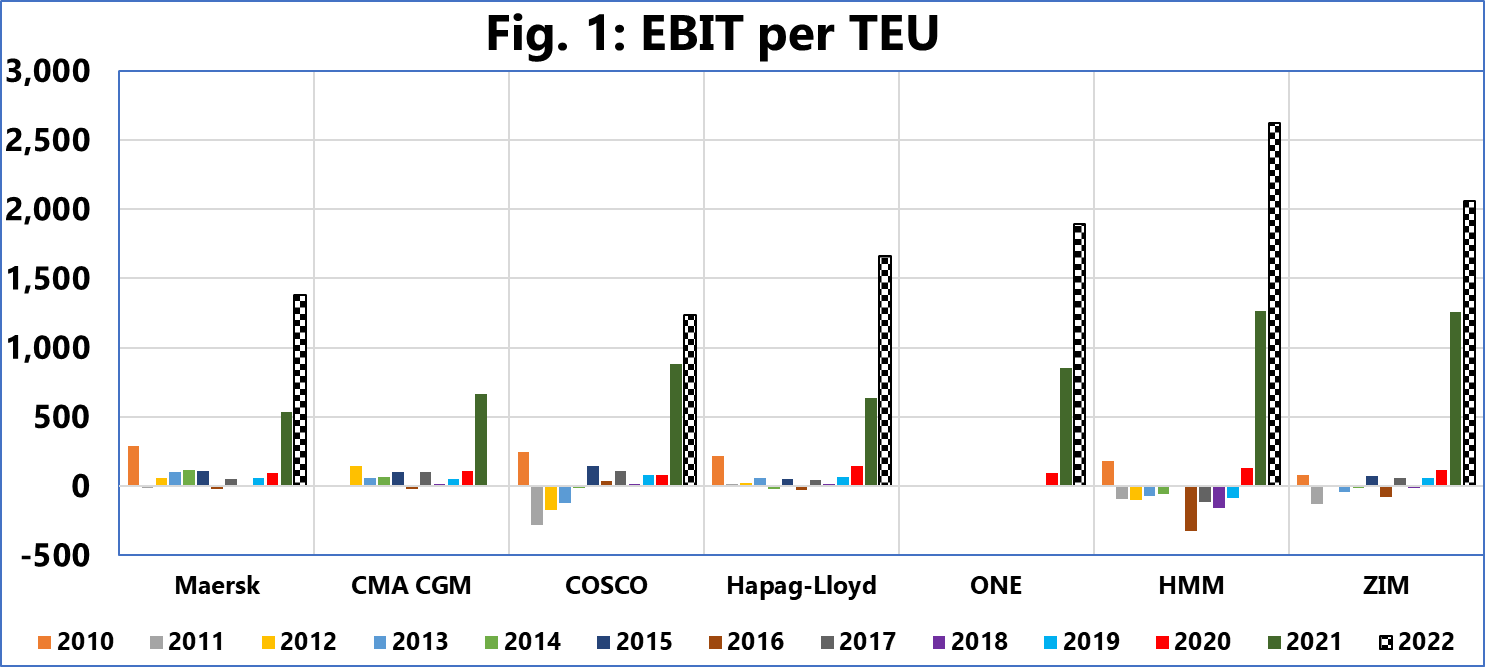

Sea-Intelligence pointed out that to see just how "unprecedented these profits are," figure 1 shows the EBIT/TEU for the carriers that publish both their EBIT and their global volumes — also still missing CMA CGM for 2022-Q2.

"The 2022-Q2 EBIT/TEU figure of each of these shipping lines dwarfs each of the previous years, with the latter hardly relevant in the context of the outsized EBIT/TEU numbers that we are seeing right now," the maritime analyst said, adding that these figures are backed by a year-on-year increase in freight rates in Q2 2022.

"This level of profitability, however, might not continue into Q3, due to the fast-falling freight rates, and the slowdown in global demand," Sea-Intelligence further said.