The one-sided volatility in spot rates is currently evident on all trades, yet the difference in altitude is astonishing, according to a recent analysis by Xeneta.

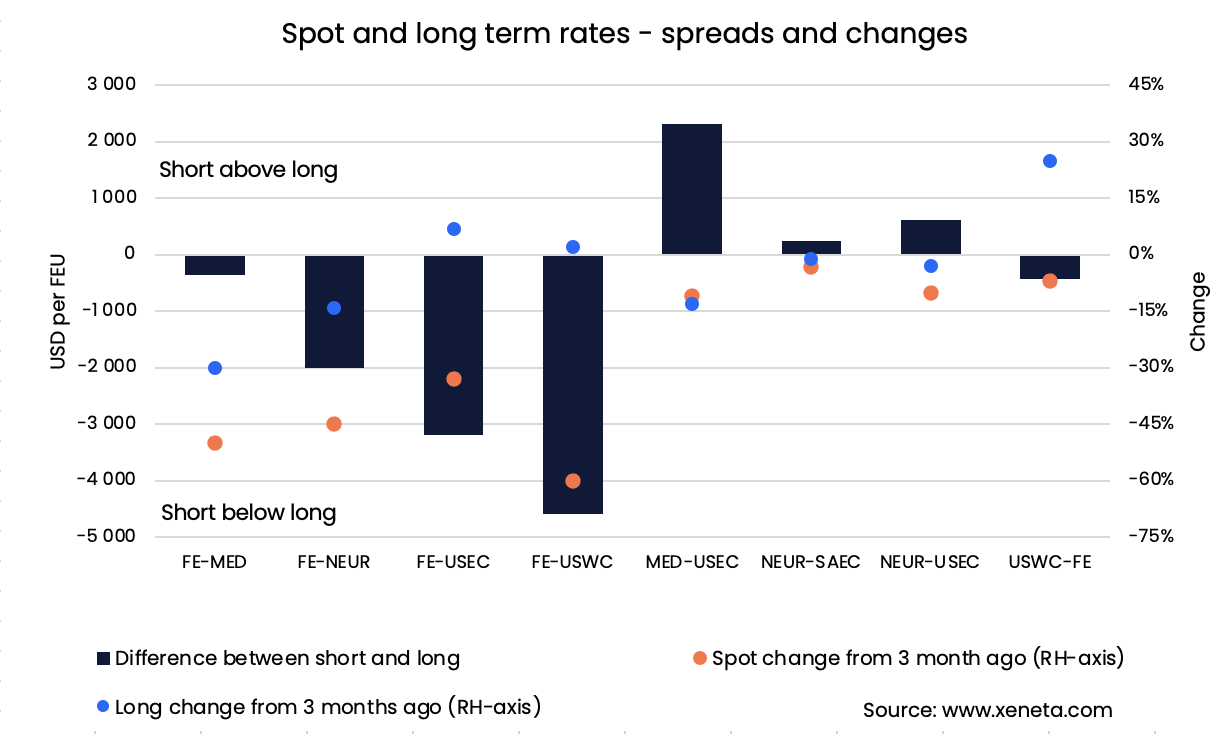

The ocean and air freight rate benchmarking and market analytics platform, said with only two trades falling by a single-digit percentage, other trades have experienced a 30% fall in spot rates from just three months ago, during the usual peak season month.

"There is a clear indication that the cost of shipping containerized goods out of the Far East have fallen the most," Peter Sand, chief analyst at Xeneta said.

"The buzz surrounding the deteriorating Transpacific head haul from the Far East to the US West Coast now seems well earned, as the spot rates have been sitting below US$3,000 per TEU since early October after falling by 60% from early July levels," he added.

While the drop in spot rates is substantial, Sand noted that the trend is less clear amongst the long-term contract rates on the same trades out of the Far East.

The Xeneta chief analyst noted that long-term rates have marginally increased on the trade lanes into the US since July, while the inbound trade lanes for the Mediterranean and North Europe have seen a decline of 14% and 30%, respectively.

Source: Xeneta

"The short and long-term rates from the Far East to the Mediterranean are close to one another as opposed to the three other trades out of Asia," Sand said, adding that the long-term rates into the US West Coast are right around where the spot market was three months ago, witnessing a spread of US$4,600 per FEU by October 11.

Opposite to the Transpacific trend, he noted that the trade lane from the Mediterranean to the congestion-marred US East Coast shows a spot market that still sits more than US$2,000 per FEU above the contract rates.

"As rates on the trade also lost altitude in October, its simultaneous nature has resulted in a roughly unchanged spread," Sand added.