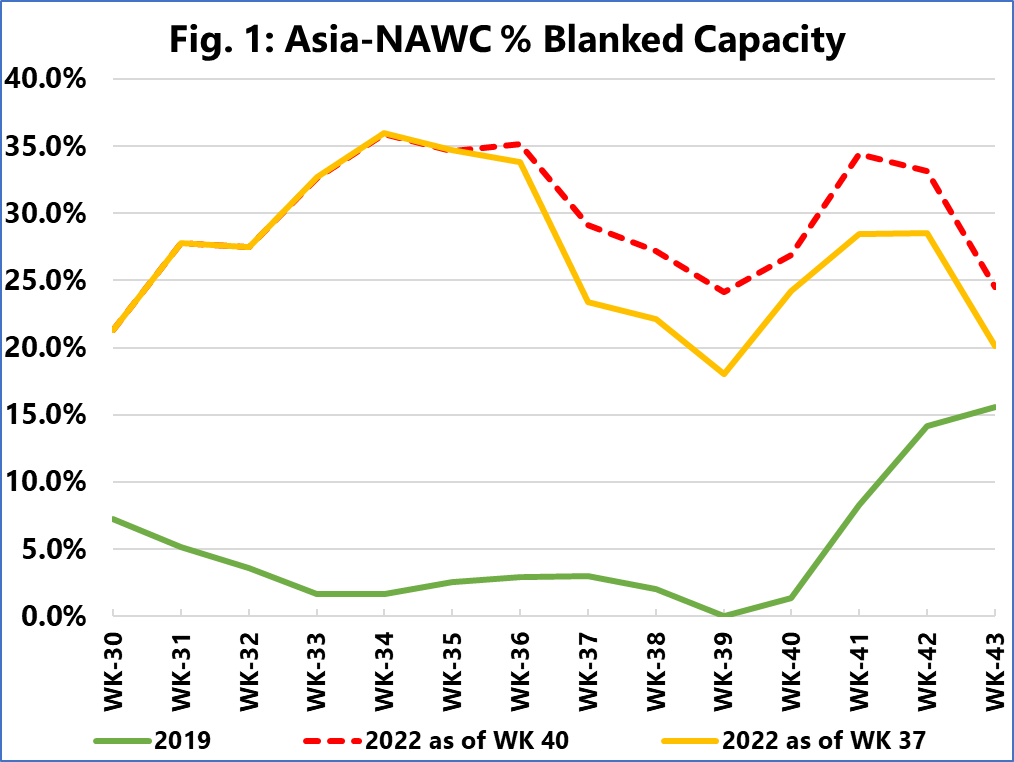

In the weeks following Golden Week, carriers are taking out significant levels of capacity per week, according to a new report by Sea Intelligence.

The maritime analyst said this level of blanked capacity is not only higher than in 2019 but has also increased from what was scheduled 3 weeks ago.

"However, even with an average 26%-31% capacity reduction on the Transpacific and 19%-27% capacity reduction on Asia-Europe, freight rates on these trades continue to fall considerably," commented Alan Murphy, CEO, Sea-Intelligence. "The question is why?"

Murphy added that the simple answer is because carriers added so much capacity during last year, that even with these levels of capacity reductions, the underlying capacity has still only been brought in line with 2019.

Source: Sea-Intelligence

"For weeks 41-43 in 2022, Asia-North America West Coast is scheduled to see capacity grow by 1.9% when annualised over 2019, while Asia-North America East Coast and Asia-North Europe are slated to see even larger capacity increases, of 3.1% and 5.1%, respectively. Only Asia-Mediterranean is contracting, by -1.3%," the Sea-Intelligence report added.

It noted that with this said, a more pertinent question then becomes whether carriers can really blank more capacity to try and control the freight rate drop.

The peak reductions during the initial Covid impact were 35%-53%, but that lasted for only 1-2 weeks, before capacity reductions dropped to 10%-30% for a few more weeks.

"Carriers are already within the latter range now, and a 50% reduction in deployed capacity, will not only create significantly more supply chain problems, but will also likely have the cargo owners up in arms," Murphy said.

"There is a very delicate balancing act for the carriers to follow from here on," he added.