Freight rates continued to stabilize across major trade routes from record-breaking highs seen in the past year or two.

The latest Freightos update said in particular that Asia-US West Coast rates dipped below the level seen in 2019 before the onset of the Covid-19 pandemic.

"As the US congress voted to block a major rail strike, the big unwind in ocean logistics continued last week unimpeded," Judah Levine, head of research, Freightos Group said.

He added that Transpacific ocean rates fell sharply again last week on easing demand and congestion.

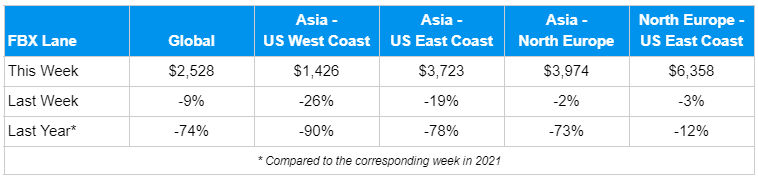

Source: Freightos

"As empty containers accumulate at Chinese ports, Asia - US West Coast rates fell by more than 25% last week to a level 5% lower than this time in 2019," Levine added.

The report also noted that Asia - US East Coast rates fell 19% but – with West Coast volumes and some congestion shifting east – are still 32% higher than three years ago.

Easing fuel prices are also removing some pressure on container rates, it said.

Air cargo peak season "did not materialize" this year

"Transatlantic prices dipped slightly last week and have decreased by nearly 25% since August – likely a result of carriers shifting now the excess capacity to this lane where demand has remained stable and rates are highest at more than US$6,000/FEU," the Freightos report said, adding that as congestion eases, some observers expect these rates to fall significantly as well.

"With inflation and inventory build-ups subduing demand for air imports too, air cargo peak season has now officially failed to materialize," the report said.

Freightos Air Index rates from China to North America and Europe of US$5.49/kg and US$4.64/kg, respectively, are down more than 40% compared to the end of November a year ago, the report said.

In its FBX Overview, Freightos said Asia-US West Coast prices (FBX01 Weekly) fell 26% to US$1,426/FEU. This rate is 90% lower than the same time last year.

Asia-US East Coast prices (FBX03 Weekly) also decreased 19% to US$3,723/FEU, and are 78% lower than rates for this week last year.

Meanwhile, Asia-North Europe prices (FBX11 Weekly) fell 2% to US$3,974/FEU, and are 73% lower than rates for this week last year.