Shipping article(s)

Rating

FREIGHTOS: SOME RETAILERS SKEPTICAL OF H2 REBOUND AS INVENTORIES REMAIN HIGH

March 29, 2023

Hopes for a rebound in ocean demand in time for peak season may have dampened a bit this week, according to Freightos, as major retailers like Nike and Adidas reported that they are still coping with inventory surpluses built up over H1 of last year, with other importers taking drastic inventory-reduction measures in response.

In a new report, the market intelligence company noted that the longer inventories remain high, the longer new orders, ocean volumes and freight rates will remain deflated.

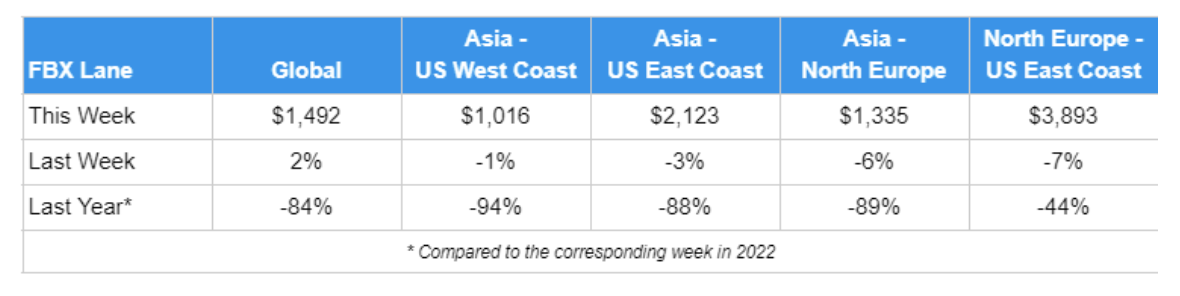

It said that Transpacific ocean rates dipped slightly last week.

West Coast prices of just over US$1,000/FEU are the lowest rates recorded since the FBX launched in 2016 — which are 21% lower than in 2019.

It noted that rates on the East Coast are 14% lower than 2019 levels, and Asia-North Europe rates fell 6% to US$1,335/FEU, just 4% higher than in 2019, though reports that some ships are sailing at capacity may indicate that carriers are close to aligning supply with demand levels, which could stabilize rates.

Freightos said Transatlantic prices of US$3,893/FEU are more than double 2019 levels, though rates fell 7% last week and are 21% lower than a month ago

"Prices have fallen about 50% since a year ago and have decreased fairly steadily since the fall as carriers have added capacity to this still-lucrative lane and as volumes have declined – though they remain well above 2019 levels," commented Judah Levine, head of research, Freightos Group.

In labour developments, Levine noted that widespread logistics worker strikes in Germany disrupted operations early this week, while in the US, shipper groups are calling for the White House to intervene in stalled West Coast port labour union negotiations.

Freightos Air Index data show ex-Asia air cargo rates to Europe and the US are more than 20% lower than a month ago as weak demand persists.

Prices to the US of US$3.28/kg are more than 70% lower than a year ago, and, at US$3.53/kg, rates to Europe are 46% lower than this time last year, the report added.