Major shipping lines continued to post high incomes in 2022, with larger ocean carriers posting larger income margins than the smaller ones.

The shipping lines continued where they left off in 2021 and reported a "very strong financial result for 2022", according to the latest report by Danish maritime data analysis company Sea-Intelligence.

It said that at the initial time of writing, 12 of the largest shipping lines had published their financial results — minus CMA CGM (did not publish EBIT), COSCO, ONE, and PIL (had not published their FY accounts at the initial time of writing), and MSC (privately held so does not publish accounts).

"The combined EBIT figure for these 12 lines in 2022-FY was US$ 95 billion; adding in these remaining carriers increases it to an estimated US$ 208 billion," Sea-Intelligence added.

"However, there is a weakness in the market that is highlighted by a sharp contraction in transported volumes, while the freight rates, though higher Y/Y, also seem to have slowed down," it added.

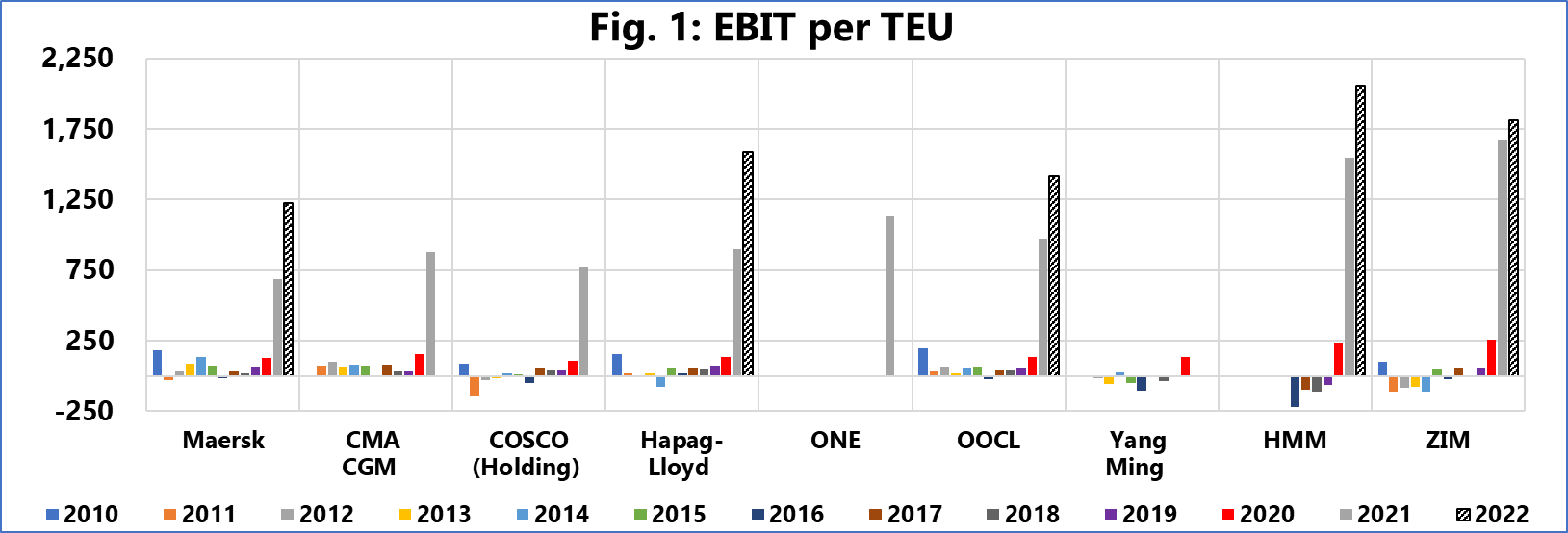

Sea-Intelligence noted that the scale of the current profitability of the carriers could be seen in figure 1, which shows the EBIT/TEU of the lines that report on these figures.

Source: Sea-Intelligence

"While the larger shipping lines have close to doubled their EBIT/TEU, the smaller ones were only able to increase it by a relatively smaller margin," commented Alan Murphy, CEO, Sea-Intelligence.

"Even then, the EBIT/TEU across the board continues to dwarf that of the previous years," he added.

The Sea-Intelligence chief further explained that HMM (2,055 EBIT/TEU) reported the largest EBIT/TEU and was the only shipping line so far to record over 2,000 EBIT/TEU in 2022‑FY, followed by ZIM with 1,815 EBIT/TEU.

The remaining shipping lines were within a range of 1,200‑1,600 EBIT/TEU.