The International Air Transport Association (IATA) released data for May 2023 on global air cargo markets showing a continued, but slower, decline against the previous year's performance.

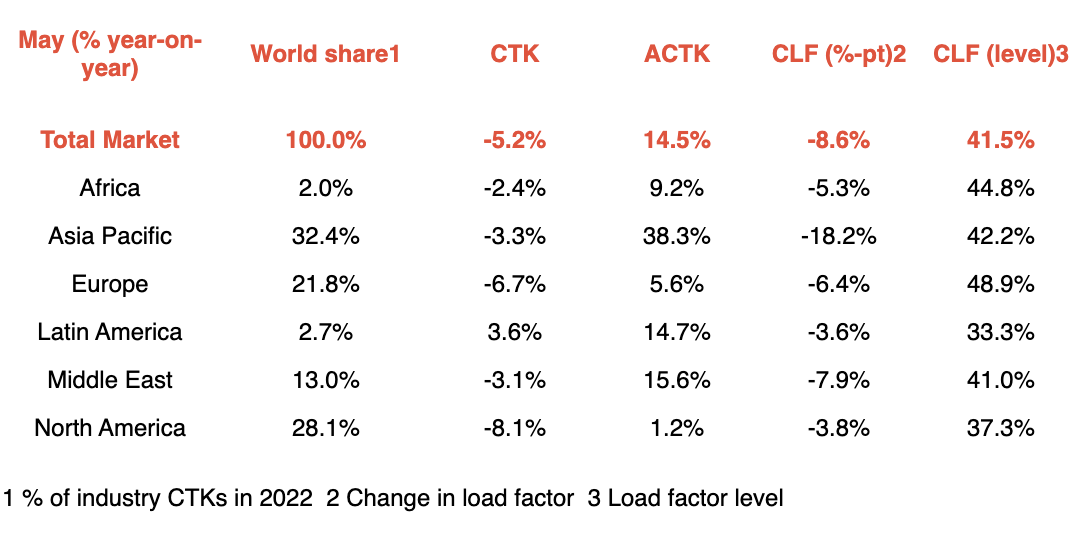

Global demand — measured in cargo tonne-kilometres (CTKs) — fell 5.2% compared to May 2022 (-6.0% for international operations).

The decline recorded for May was narrower than the 6.6% year-on-year drop recorded in April and also an improvement over March's 7.6% decline.

Capacity, as measured by available cargo tonne-kilometres (ACTKs), on the other hand, rose 14.5% compared to May 2022.

IATA said this is primarily driven by belly capacity, which increases as demand in the passenger business recovers.

Capacity is now 5.9% above May 2019 (pre-pandemic) levels.

Better second half of the year

"Trading conditions for air cargo continue to be challenging, with a 5.2% fall in demand and several economic indicators pointing towards weakness," said Willie Walsh, IATA's director-general.

"The second half of the year, however, should bring some improvements."

"As inflation moderates in many markets, it is widely expected that central bank rate hikes will taper. This should help stimulate economic activity with a positive impact on demand for air cargo," Walsh added.

[Photo: IATA]

May regional performance

IATA said this was a slight improvement in performance compared to April (-12.4%).

European carriers experienced a 6.7% year-on-year decrease in cargo volumes in May 2023. IATA noted that this was an improvement in performance compared to April (-7.7%), in part due to the smaller annual contraction in international CTKs on the Europe-Middle East trade lane, from -4.7% in April to -2.9% in May.

Middle Eastern carriers experienced a 3.1% year-on-year decrease in cargo volumes in May, although a slight improvement in performance compared to the previous month (-6.7%).

IATA said Latin American carriers had the only positive performance in May 2023, posting a 3.6% year-on-year increase in cargo volumes.

African airlines posted a 2.4% decrease in demand compared to May 2022, also representing a -0.9% decline compared to April.