Ocean carriers have the ability to manage capacity, even in the face of a large supply/demand discrepancy, according to a new analysis by Sea-Intelligence, and it is up to them which direction the rates are headed in the second half of 2023.

The Danish maritime data analysis firm noted that the market has certainly been in many situations in the past, a "cyclical nature of shipping", which makes it inevitable that capacity injection, at times, will exceed demand growth.

"But it is not a law of nature that this should necessarily tank the market," Sea-Intelligence said.

"The carriers have the ability to manage capacity, even in the face of a large supply/demand discrepancy. The developments in spring 2020 clearly showed this," it added.

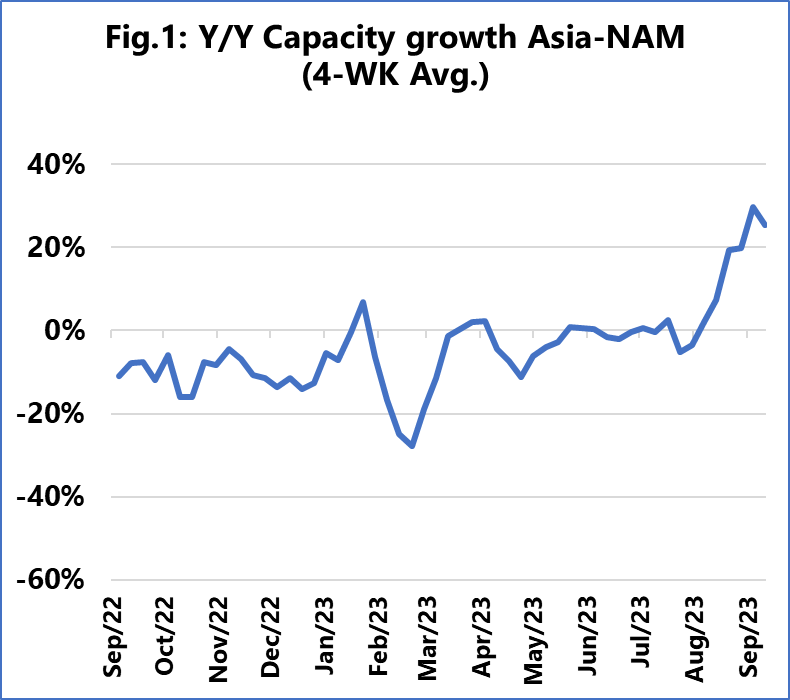

[Photo: Sea-Intelligence]

Capacity issue "very much in the carriers' court"

Alan Murphy, CEO, Sea-Intelligence, pointed out that carriers would be able to influence which way the market is headed with their response to current developments.

"The ball is right now very much in the carriers' court," Murphy said.

"Their current planning will certainly result in a sharply worsening market balance and likely continuing declines in freight rates — something which could lead to loss-making territory in 2nd half of 2023," the chief of Sea Intelligence added.

"But this can be avoided by the tactical use of blank sailings," he further said. "Some of the idle capacity might then be sent to yards to get retrofitted for (even more) slow steaming in preparation for the tightening environmental regulations."