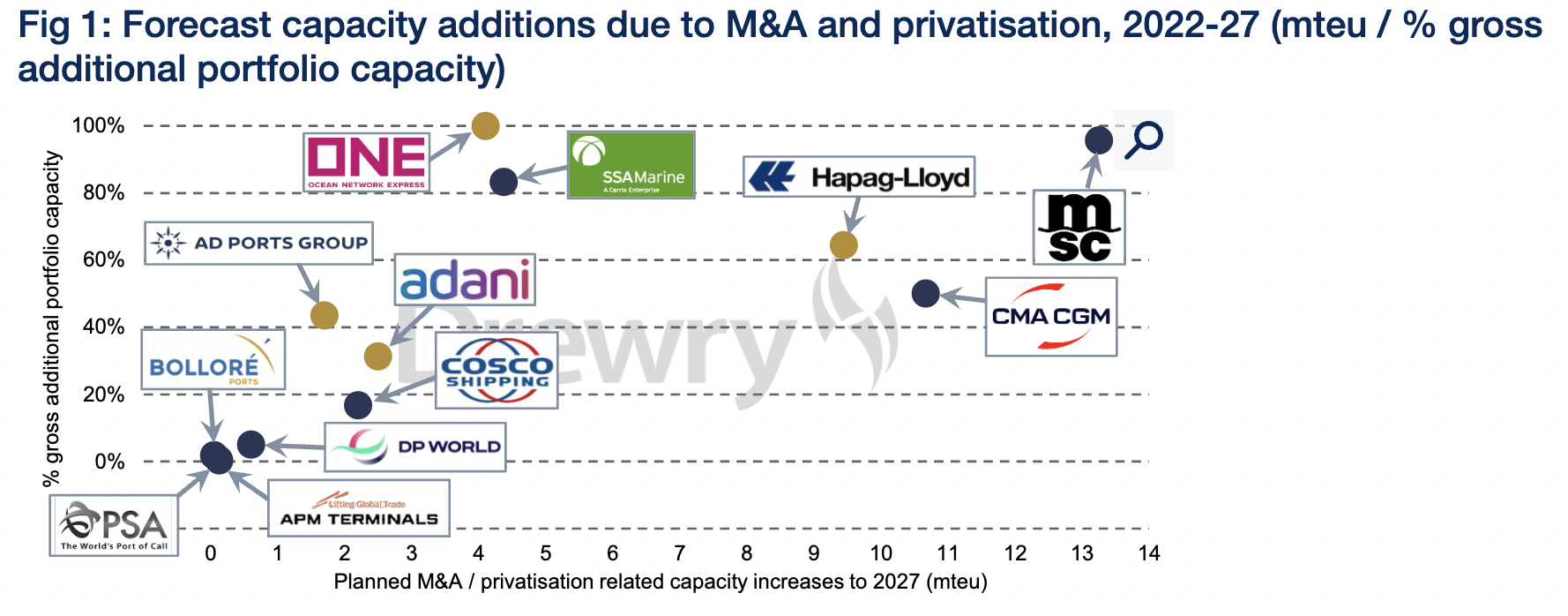

M&A-led growth strategies will propel leading regional terminal operators and container shipping lines into the global terminal operator rankings next year, according to Drewry's latest Global Container Terminal Operators Annual Review and Forecast report.

The maritime research consultancy firm noted that while the position of the largest global terminal operators (GTOs) at the top of the rankings looks secure, the number of companies seeking to invest in the global ports market has increased in recent years.

However, it added that with global container port volumes increasing by just 0.5% in 2022, M&A has emerged as the quickest route to build market share.

"Increased M&A and privatisation activity will see the number of GTOs increase — Hapag Lloyd, ONE, Adani and Abu Dhabi Ports Group are all set to feature in next year's league tables," said Eleanor Hadland, author of the report and Drewry’s senior analyst for ports and terminals.

[Source: Drewry]

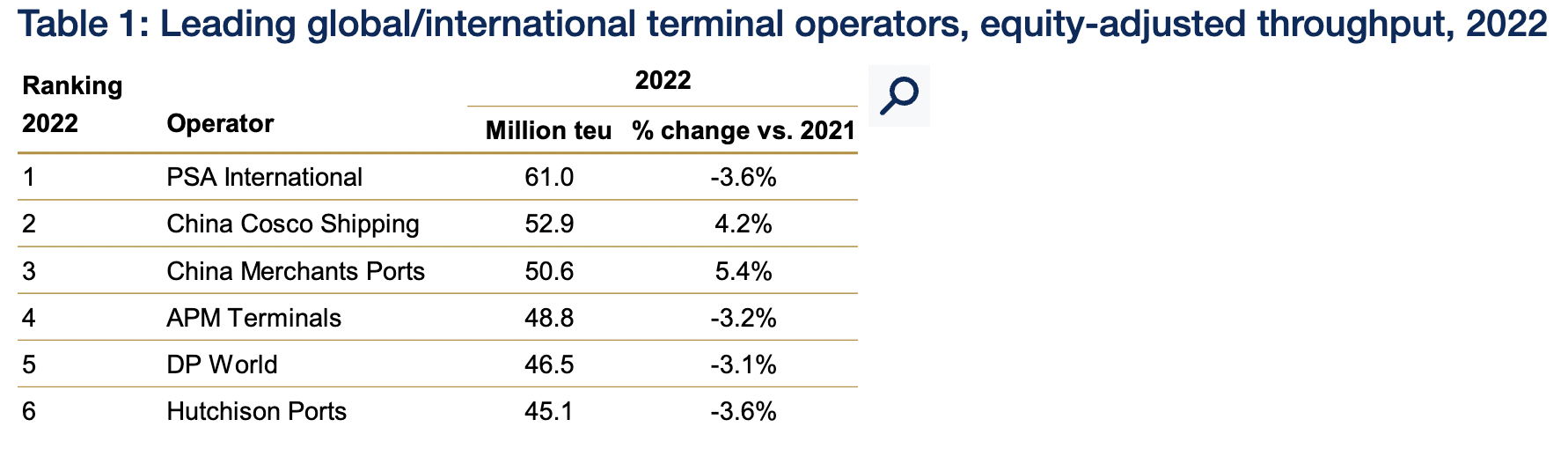

Drewry said in its latest analysis that in 2022, there was a net increase in the number of companies that qualified as GTOs from 20 to 21.

It added that while HHLA dropped out of the rankings due to the closure of its terminal in Odesa after the Russian invasion of Ukraine, MSC and Wan Hai entered the rankings in 7th and 19th position, respectively.

Annual growth in equity-adjusted throughput for the 21 GTOs was 0.6%, which is slightly above the 0.5% increase in global port handling recorded in 2022.

Meanwhile, it said that the leading operators handled over 48% of the global port volumes on an equity-adjusted basis, stable on a like-for-like basis vs. 2021.

Drewry pointed out that China Cosco Shipping gained ground on the back of its increased stake in Tianjin Container Terminal, while China Merchant's equity-throughput gains follow from the uplift in shareholding in Shanghai International Ports Group and Ningbo Zhoushan Port Co.

"In contrast, APMT slipped down the rankings due to the full-year impact of the sale of Rotterdam Maasvlakte in 2021 and the sale of a minority stake in Wilhelmshaven in 2022," the report said.

"Similarly, DP World's monetisation strategy, which has reduced its equity stake in its flagship Jebel Ali terminal to less than 68%, underpinned the 3.1% drop in equity throughput in 2022," it added.

[Source: Drewry]

Downtrend to halt in the second half of 2023

The Global Container Terminal Operators Annual Review and Forecast report further revealed that the revenue of terminal operators rose in 2022, despite a slowdown in volume growth.

However, it noted that by 2H22, the widespread easing of congestion saw storage revenues plunge as dwell times quickly returned to pre-pandemic levels.

The report said in 2022, the Drewry Global Container Terminal Earnings Index dipped 16.3% year-on-year, led by falling revenue and rising cost per unit. However, the pace of decline slowed in 1Q23 due to a reduction in operating costs per TEU.

"We expect this downtrend to recede as the impact from reduced storage revenues weakens in 2H23," Hadland said.