Logistics article(s)

Rating

ASIA-PACIFIC LOGISTICS RENT CONTINUED TO RISE IN THE FIRST HALF OF 2023

August 14, 2023

The overall logistics rent in the Asia Pacific region maintained its upward trajectory in the first half of the year, according to Knight Frank, driven mainly by continuing growth in the e-commerce sector.

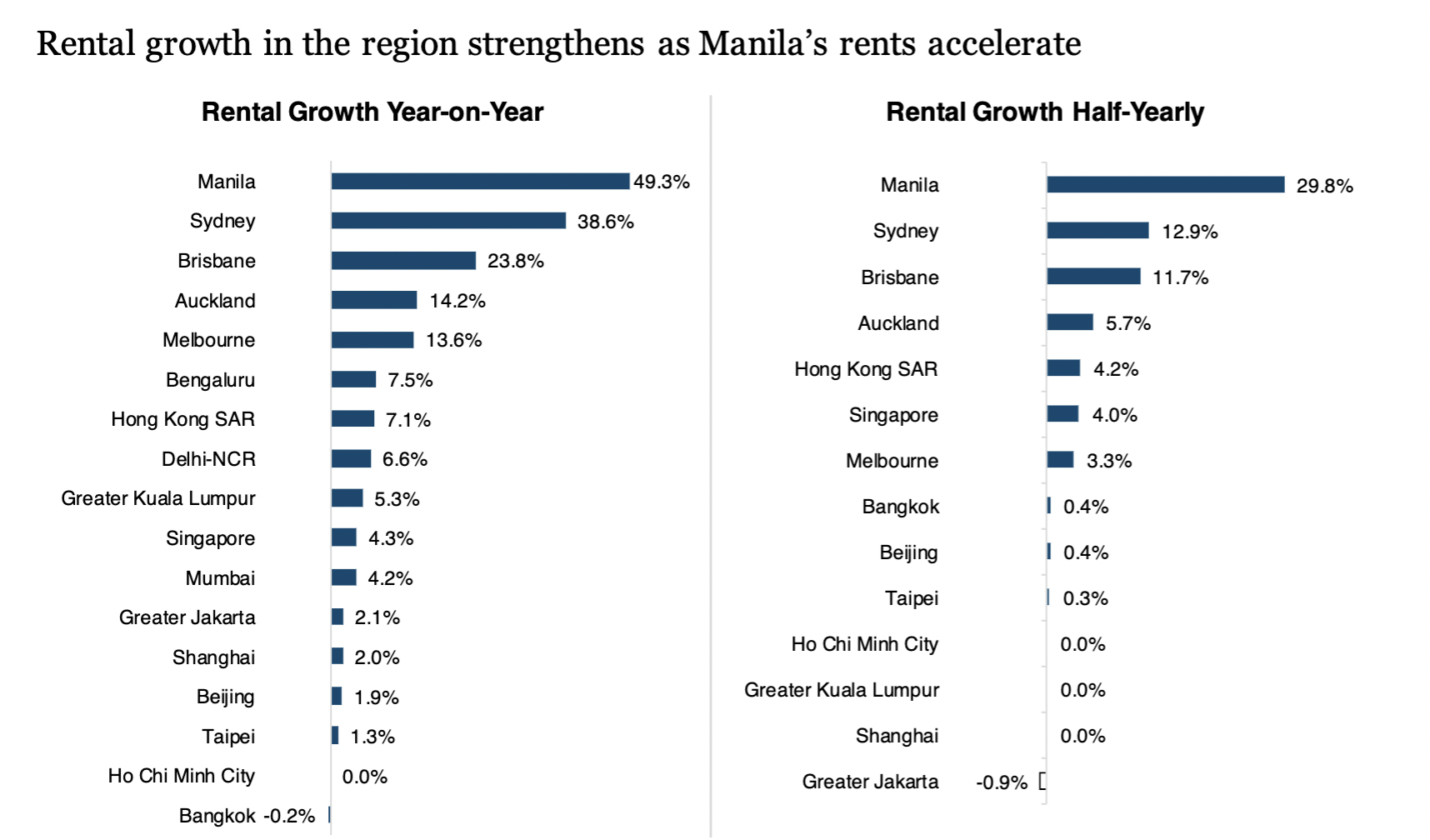

In its latest Asia-Pacific H1 2023 Logistics Highlights, the independent global property consultancy firm — which tracks prime logistics rents across 17 key cities — noted an average 10.4% rise year-on-year in the first half for the region, led by the acceleration of rental growth in Manila, the capital of the Philippines.

"This growth defies the significant economic challenges that prevailed during the same period," Knight Frank said, adding that this also highlights the sustained growth of logistics real estate in the region.

Sustained e-commerce growth

"The overall rise is largely fuelled by resilient demand from e-commerce, third-party logistics (3PL) entities and manufacturers, despite flagging GDP growth in the Chinese mainland and an uncertain global economic forecast," the global property consultancy firm noted.

Knight Frank said most Southeast Asia cities tracked recorded stable or improved rents, with Manila recording the highest rental growth year-on-year in Asia-Pacific, fuelled by sustained demand from e-commerce.

Source: Knight Frank

Meanwhile, with the huge volume of supply expected in the Chinese mainland, it added that rents in Beijing and Shanghai are expected to soften in tandem with rising vacancy rates for the rest of 2023.

"Jakarta is the only market to defy the broader regional trend with falling rents. However, near-term momentum indicated a slight slowdown," Knight Frank said, adding that half-yearly rental growth decreased by 4.8%, compared with 5.3% six months ago, highlighting a nuanced shift in Jakarta's rental market dynamics.

The global property consultancy firm said as e-commerce demand normalises, the focus on optimising the sector's logistics footprint has driven demand for modern facilities.

It added that preference for institutional-grade facilities in core areas and last-mile locations continues to fuel leasing activity in the region.

Tempered rate of growth in H2

Looking ahead to the second half of the year, the report foresees that while the persistent shortage of quality spaces is expected to drive rent increases in the region, the cautious approach of occupiers is likely to temper the rate of growth.

"Even as the Asia-Pacific logistics sector continues to be characterised by resilient demand, underpinned by the long-term appeal for quality spaces, we see the pace remaining restrained by a cautious occupier base," said Tim Armstrong, global head of occupier strategy and solutions, Asia-Pacific at Knight Frank.

He added that in the medium term, rising interest rates and slowing growth remain key concerns for the region, impacting consumer spending and consumption.

He added that in the medium term, rising interest rates and slowing growth remain key concerns for the region, impacting consumer spending and consumption.

"Consequently, businesses are expected to maintain reduced inventory levels and streamline their supply chains, leading to a moderation in sector demand and creating prospects for sub-leasing," Armstrong added.

The Knight Frank report showed that the 12-month rental outlook in Beijing and Shanghai would decrease, while rental is expected to remain unchanged in six cities: Greater Kuala Lumpur, Greater Jakarta, Ho Chi Minh City, Hong Kong SAR, and Bangkok.

Logistics rent is forecasted to rise in the 10 other cities: Aukland, Brisbane, Sydney, Melbourne, Bengaluru, Mumbai, Delhi NCR, Singapore, Taipei and Manila.

Christine Li, head of research, Asia-Pacific at Knight Frank, said conditions within the Chinese mainland market are "displaying a divergence from the rest of the region as its economy continues to underperform."

"However, this is counterbalanced by more positive sentiment in other areas, where the growth in demand outpaces the supply of new units," Li said, adding that long-term structural fundamentals also continue to underpin demand in emerging Southeast Asia markets, alongside India, which is progressively gaining significance within the global manufacturing supply chain.

"Overall, the region's logistics sector remains in adjustment mode as e-commerce demand continues to adapt to a new cycle in the post-pandemic environment, which will persist into the second half of 2023," the head of research, Asia-Pacific at Knight Frank, said.

"We expect supply-side induced rental increases to moderate as occupiers adopt a more selective approach and prioritise future-proofing their logistics footprints," Li added.