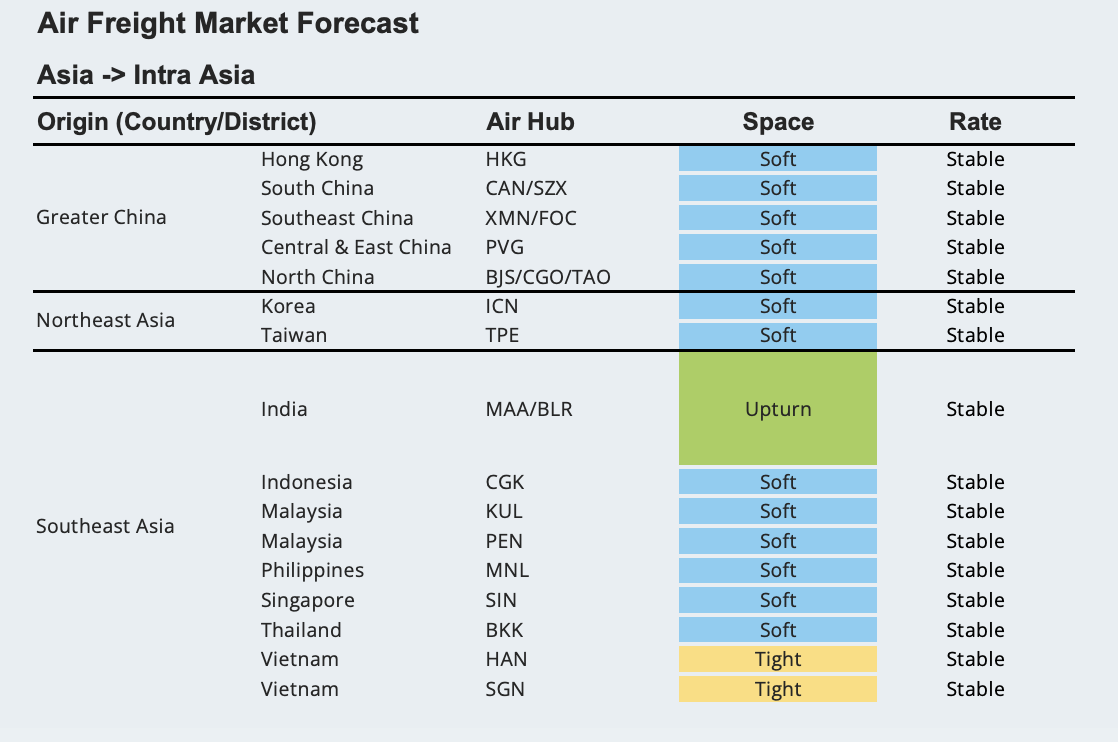

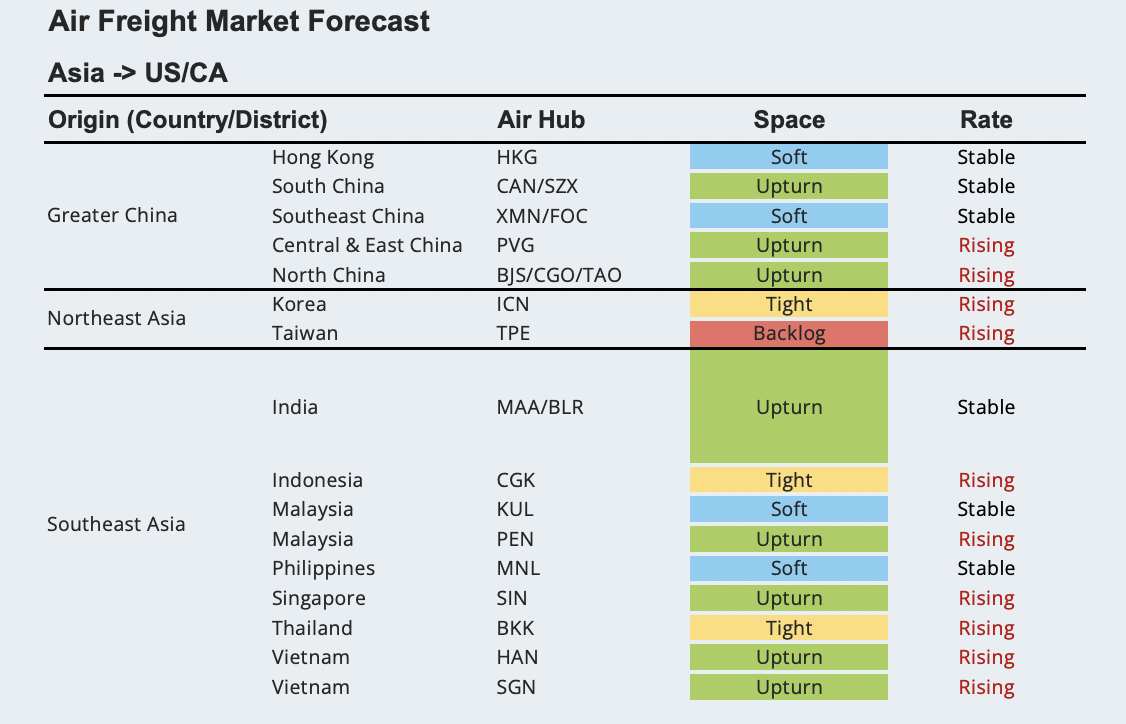

The air freight market is expected to remain subdued in September with stable rates and soft capacity, particularly for Asia-Europe and Intra-Asia lanes, while an upturn in space and rising rates is forecasted for most of Asia-North America trades.

In its August-September freight update, global 3PL Dimerco said the demand for e-commerce remains high, continually supporting the volume of air freight from Asia to the US and Europe.

The long holiday in China from September 29 to October 6, combined with the quarter-end demand in September, is also seen to result in rate increases and capacity shortages for air freight on Intra-Asia, Asia-US, and Asia-Europe routes, while Apple's introduction of new products in September is expected to surge demand for air freight capacity, especially from China, Vietnam, and India to the United States and Europe.

However, capacity remains tight for some lanes as passenger flights in the Asia Pacific region have resumed 65.3% of their 2019 capacity, according to the International Air Transport Association (IATA), but flights between the US and China are still operating at only 6% of pre-pandemic levels.

[Source: Dimerco]

[Source: Dimerco]

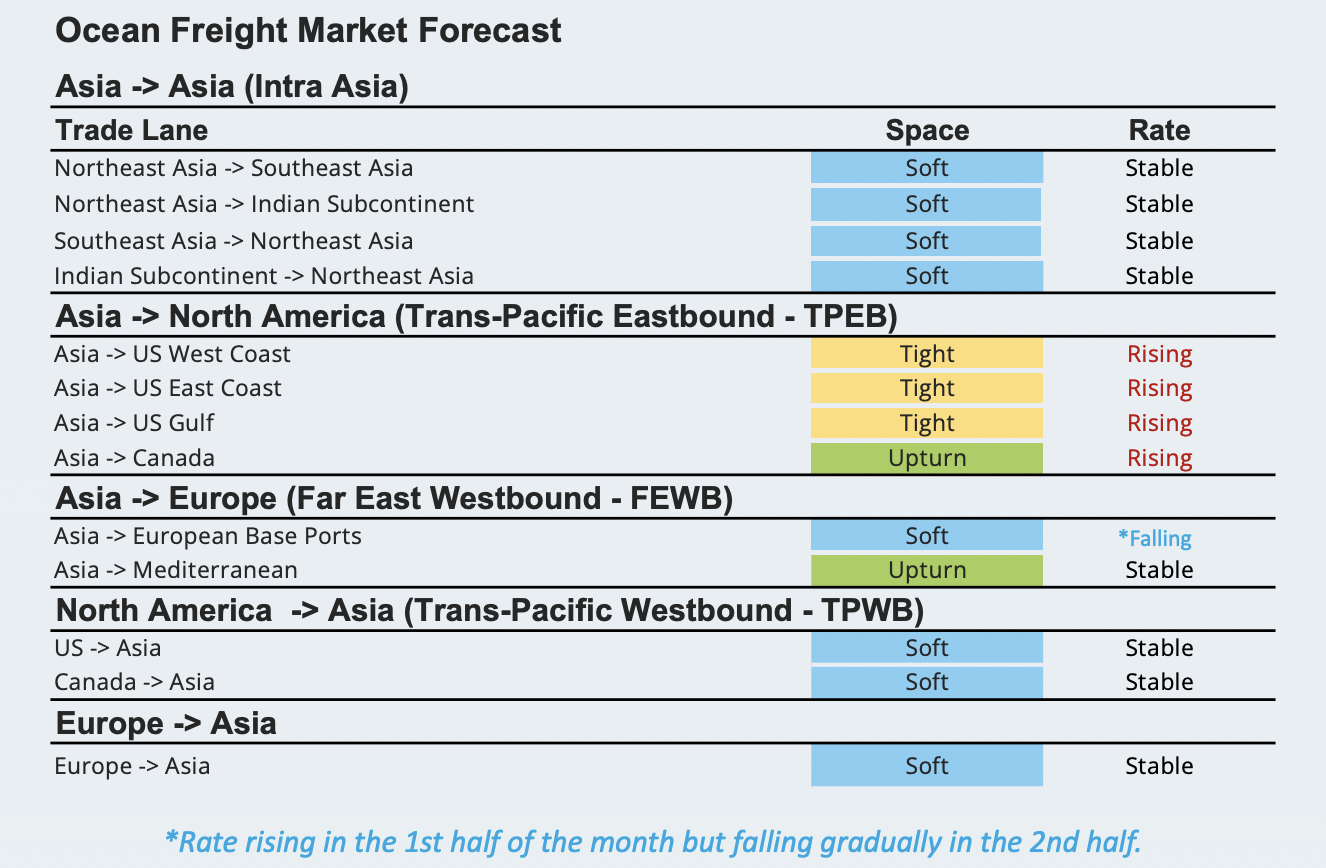

In terms of ocean freight, the global 3PL company said rates for most long-haul trades have been rising in August as carriers operate blank sailings to balance capacity and demand in the market.

Citing a Sea-Intelligence report, Dimerco noted that 21.7% of capacity on the trans-Pacific to USWC was blanked in July, up from 14.7% in June.

"Despite all the frustrating factors pointing to a global market downturn, ocean freight rates for most long-haul lanes have been trending upwards in August," the global 3PL firm said.

"One of the major catalysts behind the rate increases is said to be the capacity cuts deployed by the carriers," it added.

[Source: Dimerco]

Dimerco noted that as we approach the end of August, ocean carriers have been reducing the number of scheduled sailings by around 9%.

This is a response to the seasonal uptick in volumes during this period.

"While no obvious cargo surge has been observed during this year's peak season, we strongly suspect that ocean rates for key lanes, such as the trans-Pacific Eastbound (EB) and Europe/Mediterranean Westbound (WB), will revert to the surprisingly low level seen in Q2 2023," Dimerco further said.

It went on to note that rather than just focusing on cheaper rates, the attention should be on the issues of blank sailings and the numerous general rate increases (GRIs) that carriers are likely to implement in the coming months.