A muted peak season in ocean shipping is prompting a rethink on how the air cargo peak will look this year, according to a new Freightos analysis.

Judah Levine, head of research at Freightos, also noted that optimism from importers of strength in demand toward the late Q4 is a possible sign of a restocking cycle rather than volumes for the holiday season.

"Signs of a muted ocean peak season are leading to pessimism about the strength of air cargo's peak season in the coming months," he said.

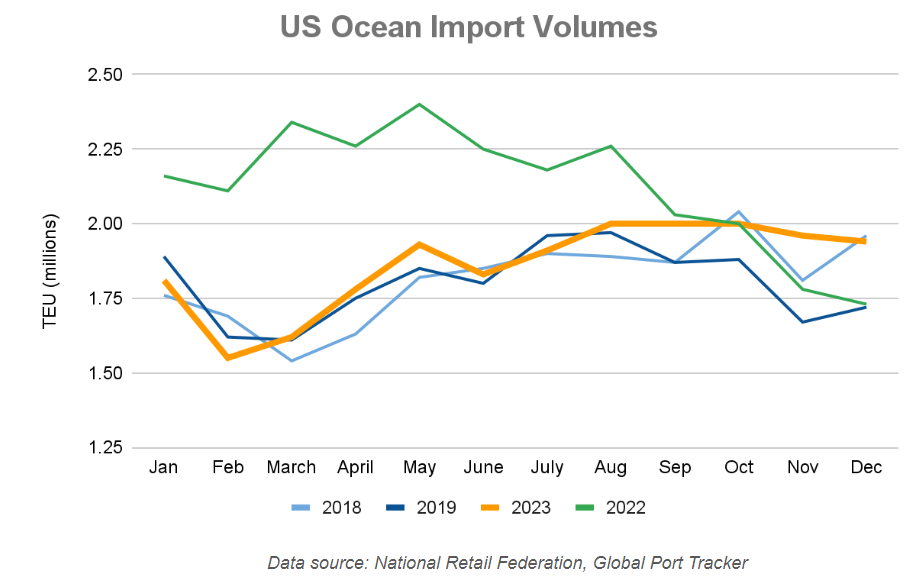

The Freightos analysis cited the latest National Retail Federation US ocean import report projecting that the relative volume strength — about two million TEU — estimated for August will persist through October, reflecting optimism among importers for consumer strength over the holiday season.

It added that these projections have September and October volumes 6-7% higher than in 2019, followed by only a moderate dip in November and December, with volumes about 15% higher than pre-pandemic.

However, Levine commented that this late Q4 strength would be a "possible sign of a general restocking cycle, as these goods would arrive too late for the holidays."

The report said Transpacific rates to the West Coast have come down slightly, about 7%, so far this month, and prices to the East Coast have been about level.

Moderate but sustained peak

"The relative stability in September — though these rates, even with elevated volumes, are still partially facilitated by significant capacity restrictions by carriers — could point to the consistency in volumes projected by the NRF and the possibility of a moderate but sustained peak through October," Levine said.

He noted, however, that the easing rates — even slight declines — in the weeks just before Golden Week, when there's typically upward pressure on prices, together with many anecdotal reports of decreasing ocean bookings, point the other direction.

"In our recent market update webinar, Robert Khachatryan, CEO of freight forwarder Freight Right Logistics, said that many of their customers are reporting 'drops in orders and expectations of a drop in consumer spending in Q4,' and that falling rates ahead of Golden Week only add to the pessimism that this year's peak will persist through September or beyond," the Freightos head of research said.

He added that if demand is easing as capacity continues to increase, carriers will face further challenges in keeping rates elevated.

Levine went on to note that the overcapacity in the market is forcing some to idle new ultra-large vessels even before their maiden voyages from Asia to Europe.

He said rates on this lane fell 8% last week to US$1,608/FEU, though prices remain slightly above 2019 levels. In response, carriers are announcing additional blanked sailings even in the weeks after the Golden Week holiday, suggesting that demand is expected to decrease in the weeks that are typically Asia-North Europe's peak season period.

Though ocean volumes reportedly remain strong for Asia — Mediterranean trade, the Freightos analysis said rates fell 14% last week and are continuing to fall this week to about US$1,800/FEU.

This level is the lowest for this lane since 2019 and is just below the September 2019 mark, the report added.

"This decline is likely driven by carriers adding too much capacity in recent months as demand proved resilient, and carriers are now removing capacity to try and match volumes," Levine commented.

He added that carriers likewise shifted too many vessels to transatlantic trade for much of this year, even as volumes declined, and prices have been falling for much of the past year as a result.

As a result, Levine said rates fell another 7% last week to less than US$1,100/FEU — 45% lower than in 2019 — and carriers have announced a significant increase in blanked sailings to try and push rates back up.

"In the meantime, though, Khachatryan reports seeing 'some uptick in demand for transpacific air bookings in the last few weeks,' which, together with the sluggish rebound of tourism in China not adding as much passenger capacity compared to many other regions, may account for the 37% increase in China - North America Freightos Air Index rates to US$4.78/kg since early August," the Freightos head of research further added.