Asia Pacific airlines finally saw cargo volumes in an uptrend — marking the first month of growth this year — driven by the traditional peak season demand.

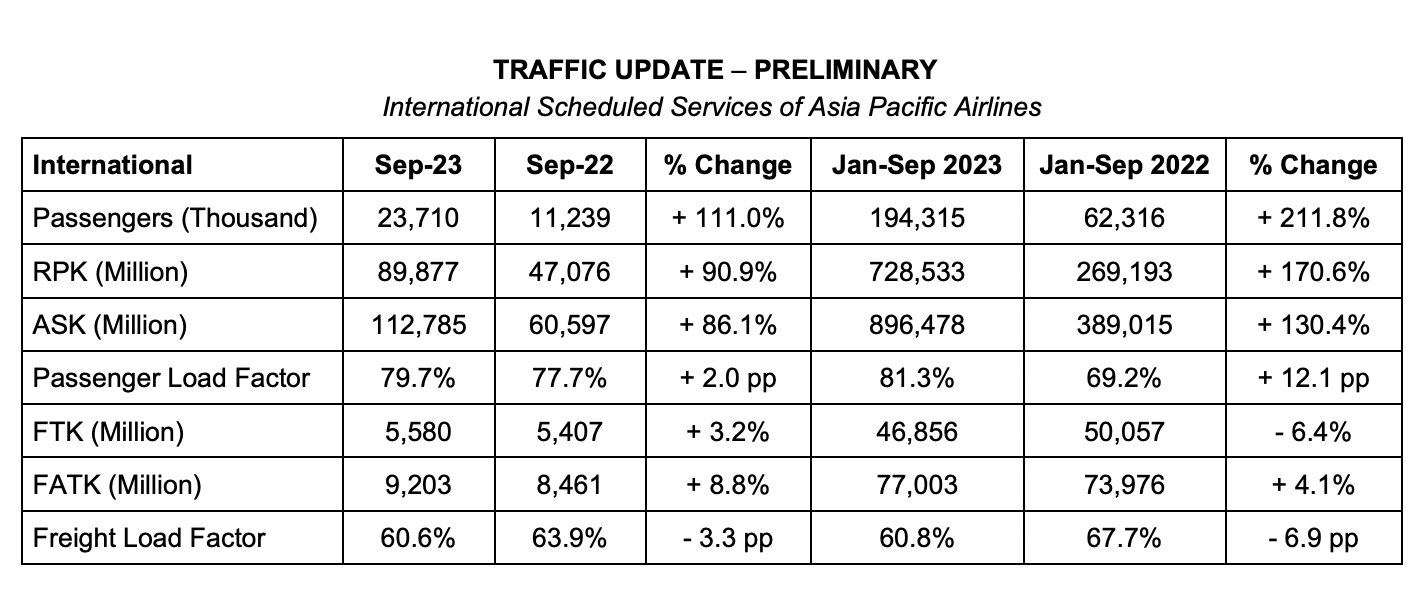

Traffic figures released by the Kuala Lumpur-based Association of Asia Pacific Airlines (AAPA) showed international air cargo demand — measured in freight tonne-kilometres (FTK) — showed a 3.2% year-on-year growth in cargo as measured in freight tonne kilometres (FTK).

This comes after a 1.8% year-on-year fall in August and a 0.6% year-on-year decline in July. In June, volumes dropped 8.1% after a 7% decline recorded in May 2023.

Asia Pacific airlines also recorded a 5.5% decline in April, 10.9% year-on-year in March, a 9.8% decline in February, and a steeper 20.5% year-on-year decline recorded in January this year.

For the full year 2022, Asia Pacific airlines saw air cargo demand also drop by 8.2%.

“Following 18 consecutive months in decline since March 2022, the region’s carriers recorded an upswing in international air cargo demand in September,” AAPA said in its report.

It added that while the increase was in part attributable to comparisons with depressed levels recorded last year, the start of the high-demand season leading to the year-end festive period also contributed to growth.

For the period, AAPA noted that the international freight load factor fell by 3.3 percentage points to average 60.6% for the month, after accounting for an 8.8% year-on-year expansion in offered freight capacity.

[Source: AAPA]

Subhas Menon, director general of AAPA, said air cargo demand turned positive for the first time in 2023 in September, which helped to moderate the decline for the year to date to 6.4%.

“It is a welcome relief to have both passenger and cargo demand on a positive footing, although the fall in export orders seen across major economies still signals challenging market conditions,” he said.

Looking ahead, Menon noted that the outlook for the region’s markets is “broadly positive” going into the final quarter of this year, with continued expansion in air passenger demand supported by resilient growth in the Asian economies.

“Airlines are facing increasing headwinds, marked by sharply higher fuel costs in recent months. Nevertheless, the region’s carriers are buoyed by the strong recovery of air travel in the region and are looking forward to the growth continuing into 2024,” Menon said.