Global air cargo tonnages stabilized in October close to their levels this time last year, with preliminary full-month tonnage figures for October down just -1% compared to those in October 2022, according to the latest figures from WorldACD Market Data.

The air cargo market data provider noted that the difference of -1% in October is the smallest full-month year-on-year drop recorded so far this year, narrowing from a year-on-year decline of -10% in the first quarter, -6% in the second quarter and -3% in the third quarter of the year.

"But this narrowing of the gap compared with last year's demand levels should be seen more as a stabilization than a recovery, with tonnages in October 2022 having already experienced a double-digit percentage decline (-13%) compared with those of the previous year, heralding a non-existent peak season last winter," WorldACD said.

It noted that tonnages for the full year in 2022 were around -6% below the (near-record) full-year figures for 2021, and just slightly above (+2%) those in 2016, with full-year figures for 2023 set to be significantly below last year’s levels (around -5%).

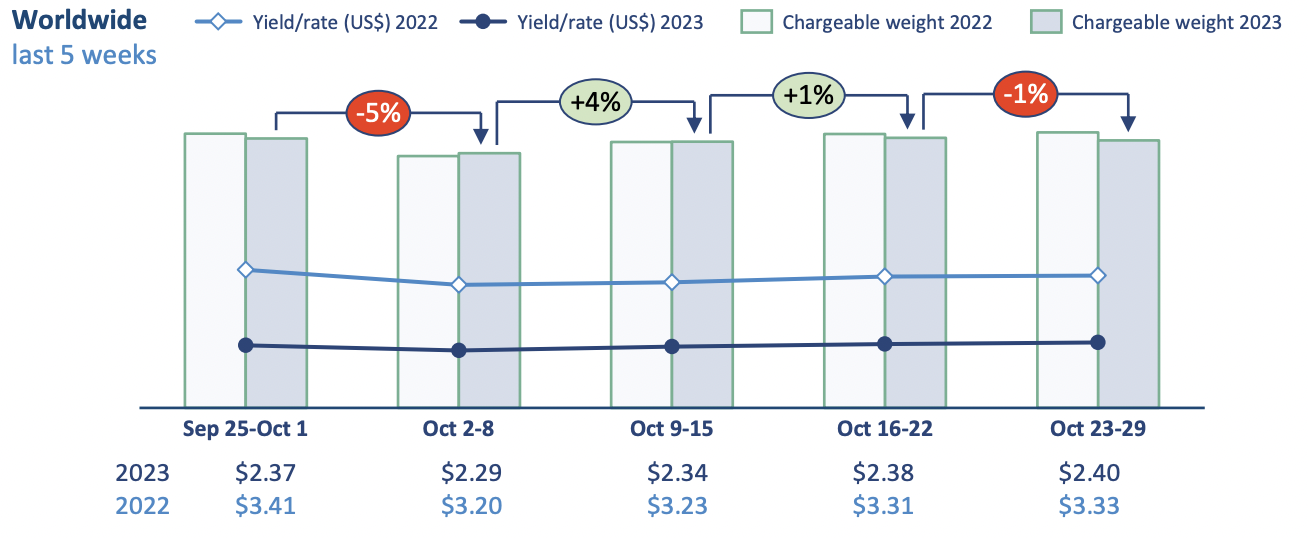

Preliminary figures for week 43 (October 23 to 29) show a -1% decrease in tonnages and a +1% increase in global average rates, compared with the previous week, based on the more than 400,000 weekly transactions covered by WorldACD's data.

WorldACD said the slight tonnage decrease in the last full week of October follows the same pattern as the previous year, characterised by a mid-month recovery in tonnages following a sharp drop during the first full week of October (-5% in 2023; -8% in 2022), corresponding with China's Golden Week holiday break.

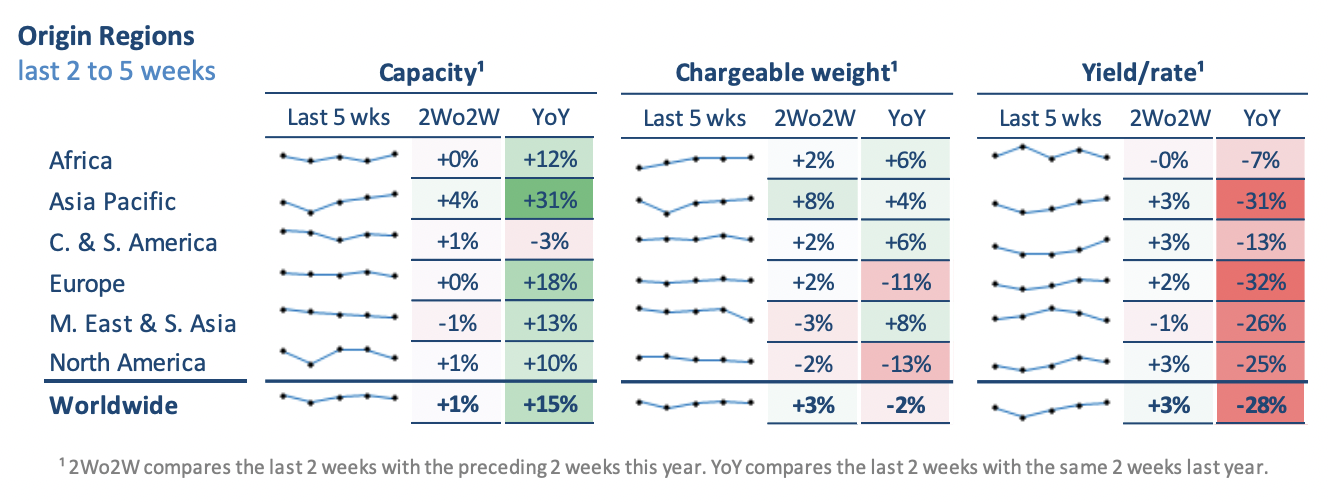

Comparing weeks 42 and 43 this year with the preceding two weeks (2Wo2W), overall tonnages and worldwide rates jumped +3%, while capacity increased by +1% versus the combined total in weeks 40 and 41.

At a regional level, increases in tonnages for the period were recorded most strongly on flows outbound from Africa to Europe (+14%) and from the Asia Pacific to, respectively, North America (+9%), Middle East & South Asia (+8%), Europe (+7%) and intra-Asia Pacific (+7%).

Also, notable increases were recorded outbound from Europe to Asia Pacific (+7%), from North America to Central & South America (+5%), and from Central & South America to Europe (+5%).

Meanwhile, on the negative side, the biggest percentage decreases were recorded on flows outbound from Europe to the Middle East & South Asia (-6%) and from North America to, respectively, Europe (-5%) and Asia Pacific (-4%).

The WorldACD report said on the pricing side, there were small to modest increases in rates, on a 2Wo2W basis, on the majority of regional flows, most notably ex-Europe to North America (+6%) and ex-Asia Pacific to, respectively, North America (+4%) and Middle East & South Asia (+4%), as well as on flows between Middle East & South Asia and Asia Pacific (+4%) and ex-Central & South America to Europe (+4%).

Tonnages, rates track lower year-on-year

Comparing the overall global market with this time last year, chargeable weight in weeks 42 and 43 was down -2% compared with the equivalent period last year, with the most notable changes on an origin region level being a +8% rise ex-Middle East & South Asia and a +6% increase ex-Central & South America and ex-Africa. Tonnages were also up ex-Asia Pacific (+4%).

But, similar to previous reports, there were significant decreases in tonnages ex-North America (-13%) and ex-Europe (-11%).

Overall capacity has increased by +15% compared with last year, as passenger air services continue to return to the market, with capacity ex-Asia Pacific up by a noteworthy +31%.

WorldACD said worldwide average rates are currently -28% below their levels this time last year, at an average of US$2.40 per kilo in week 43, although they remain significantly above pre-Covid levels (+36% compared to October 2019).