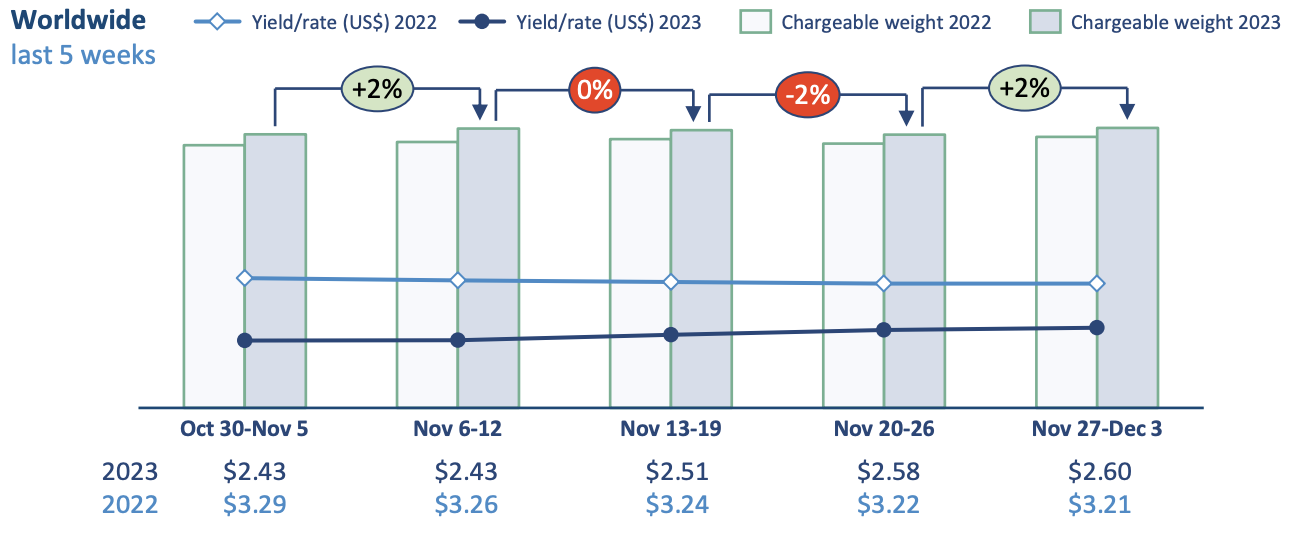

Global air cargo tonnages have rebounded more quickly than last year following the annual Thanksgiving holiday in the US, regaining the 2% lost last week, while prices ex-Asia Pacific continue to rise strongly, particularly on the big head-haul lanes to North America and Europe, according to the latest weekly figures from WorldACD Market Data.

The air cargo market data provider said preliminary figures for week 48 (November 27 to December 3) show a +2% increase in tonnages and a +1% increase in global average rates compared with the previous week.

WorldACD said tonnages have followed a similar pattern as they did this time last year, although this year, demand has already recovered from the seasonal post-Thanksgiving dip, while in the equivalent week last year, global tonnages fell further following a steeper decline the previous week.

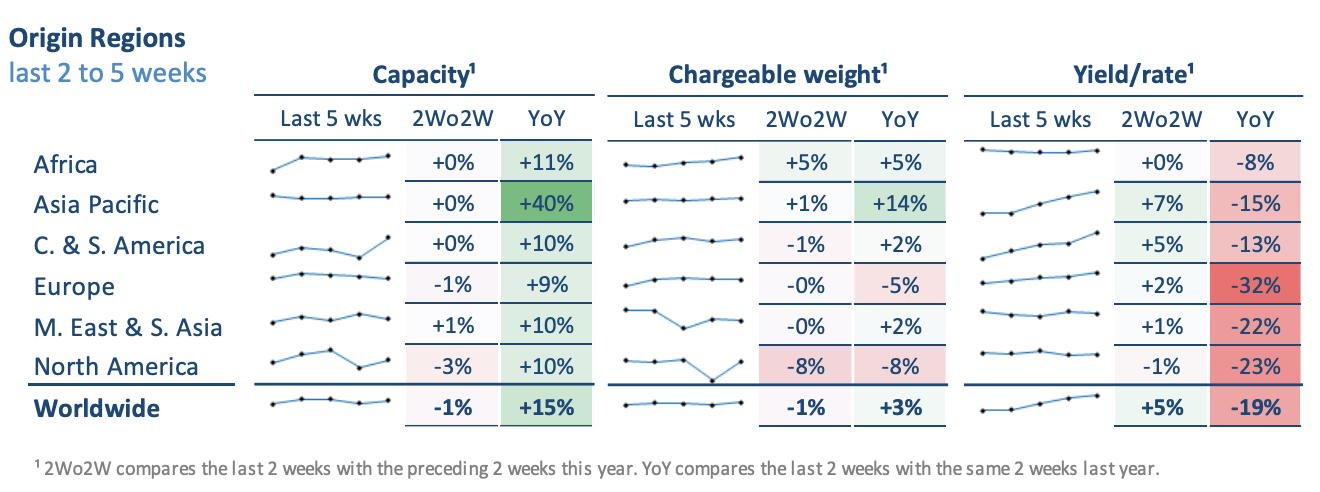

It said that comparing weeks 47 and 48 this year with the preceding two weeks (2Wo2W), overall tonnages fell -1%, while overall global average rates continued to rise with a +5% increase, at a slight capacity decrease (-1%).

The minor decrease in tonnages, on a 2Wo2W basis, was mainly due to the Thanksgiving holiday in the US, which caused tonnages ex-North America to slow down by -8% (2Wo2W), compared with -14% this time last year.

Looking at the regional developments, on a 2Wo2W basis, the impact of Thanksgiving is clearly visible ex-North America to Asia Pacific (-10%) and to Europe (-9%), with inbound tonnages ex-Europe and ex-Central & South America to North America both also down -5%.

WorldACD noted that other significant demand changes include a 7% drop from ex-Central & South America to Europe, whereas volumes from ex-Africa to Europe grew by +5%.

There was also strong growth between the Middle East & South Asia and Asia Pacific (+7% eastbound, +5% westbound).

On the pricing side, the strong increases noted last week ex-Asia Pacific have continued (+7%), on a 2Wo2W basis, with a further big jump to North America and Europe (both +8%), as tonnages ex-China continue their strong rebound since the second quarter of this year and especially since September, which has led to double-digit month-on-month percentage rises in prices in recent weeks to North America and Europe.

Volumes, capacity up YoY, rates down 19%

On a global basis, volumes in weeks 47 and 48 remain above their levels this time last year, now standing +3% higher year-on-year, driven mostly by a +14% increase ex-Asia Pacific, with more modest rises ex-Africa (+5%), ex-Middle East & South Asia (+2%) and ex-Central & South America (+2%).

WorldACD said there remain significant decreases in tonnages ex-North America (-8%) and ex-Europe (-5%), although these are far less severe than the deficits reported in previous weeks, most notably ex-North America.

Meanwhile, overall available capacity has increased by +15% compared with last year, with capacity ex-Asia Pacific up by a noteworthy +40%.

Meanwhile, WorldACD said worldwide average rates are currently -19% below their levels this time last year, at an average of US$2.60 per kilo in week 48, although they remain significantly above pre-Covid levels (+43% compared to November 2019).