Air cargo tonnages worldwide have continued to decline in the first week of 2024, following the usual drop in the second half of December, according to the latest figures from WorldACD. However, the air cargo market data provider noted that this decline is most likely due to the inclusion of January 1 in the week 1 figures.

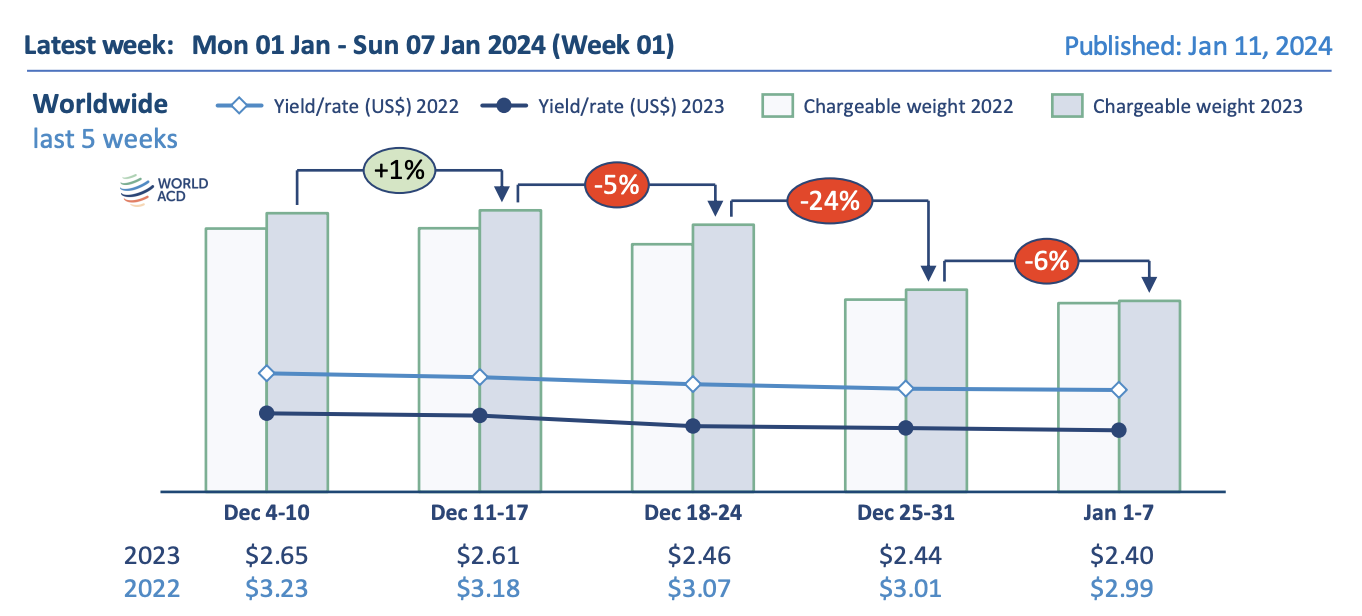

Preliminary figures for week 1 (January 1 to 7) indicate that global air cargo tonnages fell 6% compared with the previous week (WoW), after falling by around 30% in the second half of last month, while average worldwide rates dropped by around 2% in the first week of 2024 after falling by around 7% in the second half of December.

WorldACD noted that the main lanes that contributed to the WoW decline in tonnages of 6% were ex-Asia Pacific to, respectively, North America and Middle East & South Asia (both 17% decline), and intra-Asia Pacific (13% decline).

[Source: WorldACD]

"The global WoW patterns are broadly similar to those of previous years, although tonnages in the first week of 2023 remained stable compared with those of the previous week, whereas this year they continued falling," the report said.

It noted, however, that it is worth pointing out that week 1 last year (January 2-8) was a 'normal' working week as it excluded January 1 — a holiday in many parts of the world — whereas this year's week 1 (January 1-7) included January 1, potentially explaining this year's week 1 tonnage decline.

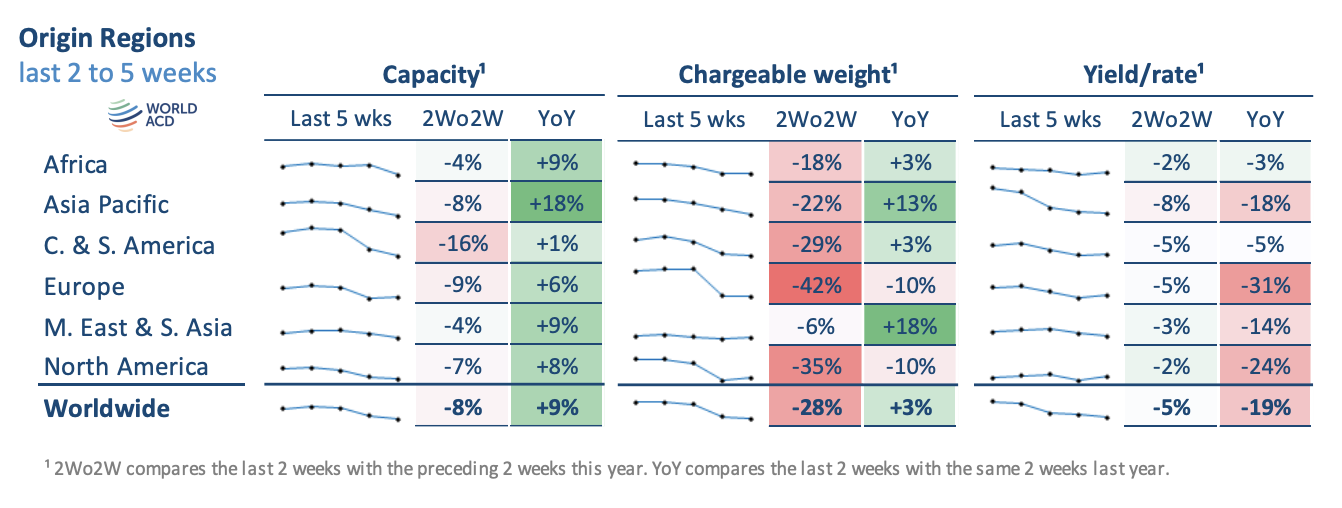

Expanding the comparison period to two weeks, WorldACD said total combined tonnages for week 52 of 2023 and week 1 this year were down by 28% compared with the preceding two weeks (2Wo2W), and average rates fell by 5%, with capacity down 8%.

While volumes went down significantly across all regions, on a 2Wo2W basis, there were particularly big tonnage declines ex-Europe (decline of 42%) and North America (decline of 35%), followed by ex-Central & South America ( decline of 29%), ex-Asia Pacific (decline of 22%) and ex-Africa (decline of 18%), and a more-modest fall ex-Middle East & South Asia (decline of 6%).

"There were also double-digit percentage declines on almost all the major intercontinental lanes, with drops of 40% or more on all the main corridors ex-Europe, including on the North Atlantic (down 43% westbound, decline of 35% eastbound), to Asia Pacific (drop of 42% eastbound, decline of 13% westbound), to Africa (drop of 41% southbound, drop of 19% northbound, and to Central & South America (decline of 40% southbound, decline of 28% northbound).

Tonnages between Asia Pacific and Middle East & South Asia were also less affected by the end-of-year declines but were still down 16% in both directions, while intra-Asia Pacific volumes fell by almost one-third (32%) on a 2Wo2W basis.

On the pricing side, WorldACD said the 5% global average decline in the last two weeks was mainly driven by falling rates on the big lanes, ex-Asia Pacific to North America (-16%) and Europe (-14%).

Other markets recorded single-digit average percentage declines, with the exception of Central & South America to Europe (up 6%), intra-Asia Pacific (up 2%), Africa to Europe (up 1%) and Middle East & South Asia to Asia Pacific (up 1%), on a 2Wo2W basis.

Tonnages, capacity up year-on-year

[Source: WorldACD]

WorldACD said that compared to the equivalent period a year ago, total global tonnages for week 52 of 2023 and week 1 this year were around 3% higher, year on year (YoY), led by double-digit percentage growth ex-Middle East & South Asia (18%) and ex-Asia Pacific (13%).

It added that worldwide average rates are currently 19% below their levels this time last year, at an average of US$2.40 per kilo in week 1, although they remain significantly above pre-Covid levels (30% higher compared to January 2019).

Meanwhile, overall available capacity has increased by 9% compared to the equivalent period a year ago, with capacity ex-Asia Pacific up by a noteworthy 18%.