A recent study commissioned by DP World has found that businesses in the Asia Pacific that are leveraging technology and reconfiguring their supply chains are optimistic despite geopolitical and economic uncertainty.

The latest Trade in Transition research — led by Economist Impact — found that the primary driver of optimism in the Asia Pacific (APAC) is a growing belief that technology will transform the efficiency and resilience of supply chains.

The report added that in the face of political instability, high inflation and interest rates as well as economic downturn in key markets, businesses are also implementing friendshoring and dual supply chain strategies to manage risk across their operations.

"Asia Pacific's imports and exports are projected to grow over 5% in 2024 — the fastest, globally. The report makes clear that intra-Asian trade is critical to ensuring that businesses continue to develop and prosper in the region, and technology will play a critical role," said Glen Hilton, chief executive officer and managing director for DP World in Asia Pacific.

He added that the company will accelerate its investment and forge strategic partnerships to strengthen and expand its offerings to help businesses achieve their growth ambitions in the region.

Technology spurs optimism in APAC supply chains

When asked to assess the future of global trade, the report found that 32% of APAC business leaders cited the ability of technology to improve supply chain efficacy and resilience as their main reason for optimism.

It added that 27% also expect technological upgrades to serve as primary growth drivers for their companies' imports.

"At the core of these positive sentiments is the increasing adoption of Artificial Intelligence (AI)," the report said, noting that 99% of APAC businesses are using AI to revolutionise at least one aspect of their supply chain management.

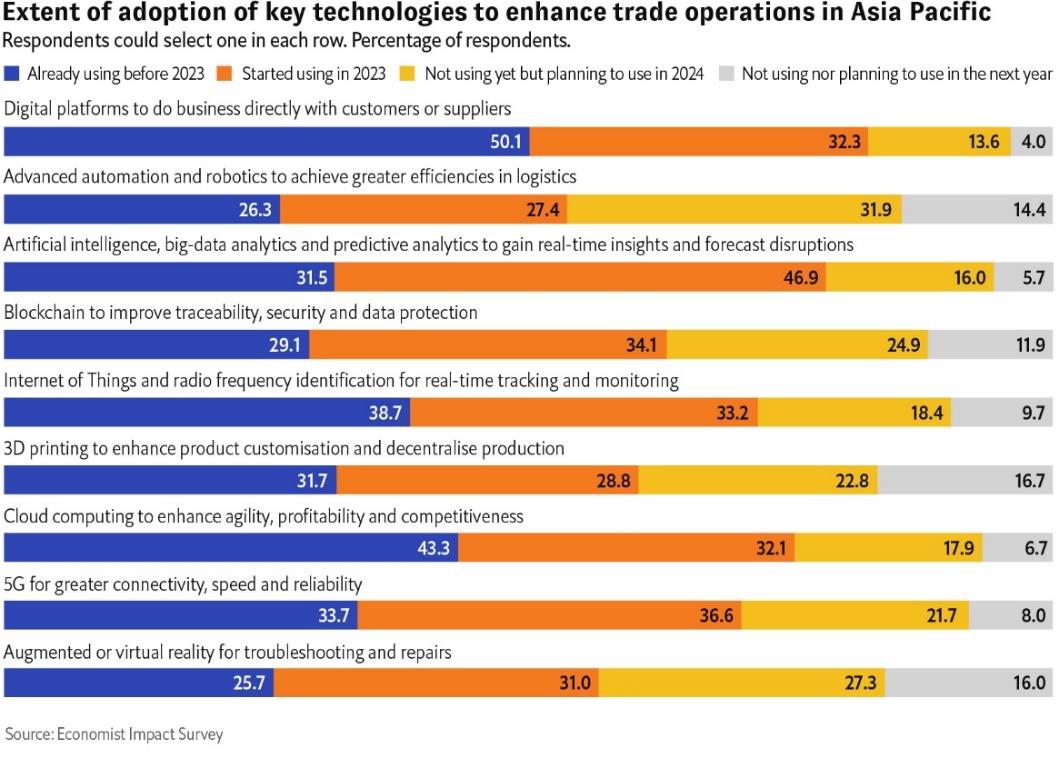

Businesses are also set to proactively ramp up their technological adoption in 2024, underscoring a commitment to innovate in the face of an ever-changing operating environment.

The report said 39% are prioritising increasing research and development efforts to enhance products, services and supply chain operations.

Of those surveyed in the APAC, 32% are poised to incorporate advanced automation and robotics to amplify logistical efficiencies; 27% intend to embrace augmented or virtual reality for troubleshooting and repairs, and 25% will integrate blockchain technology to enhance traceability, security, and data protection.

Among APAC executives surveyed, the report also found that the enduring threat of inflation was cited by 28% as their main concern over the next two years.

Additionally, 26% express fears of economic downturn in key markets where they operate.

"In response to economic headwinds, an increasing number of APAC businesses are restructuring their supply chains, with 24% opting for fewer suppliers — a 13 percentage point increase from the previous year. Many more are also looking within Asia for trade opportunities, with 30% of APAC executives stating that Southeast Asia is one of their primary export markets," it added.

Beyond economic fears, geopolitical tensions also weigh heavily on executives' minds.

Rise of friend-shoring, multi-sourcing

In APAC, nearly a quarter of businesses express concerns about political instability in sourcing markets.

The report said almost a fifth cite worries about heightened geopolitical uncertainty, with ongoing events such as the war in Ukraine and tensions between the US and China.

To mitigate risk, a third are utilising friend-shoring, while a similar proportion says that they are establishing parallel supply chains or employing dual sourcing.

"Supply chain diversification is particularly evident in APAC with more and more businesses adopting a 'China+1' strategy," DP World said in a statement.

It added that countries like Malaysia, Thailand and Vietnam, which firms see as "lower-risk production destinations," are benefitting from this trend.

However, despite many businesses indicating that they are diversifying supply chains away from China, manufacturing levels in the world's second-largest economy remain robust, demonstrating the nuanced nature of supply chain dynamics in the region.