Asia Pacific airlines saw cargo volumes decline in 2023 as the industry faced multiple headwinds last year, although freight numbers ticked in December.

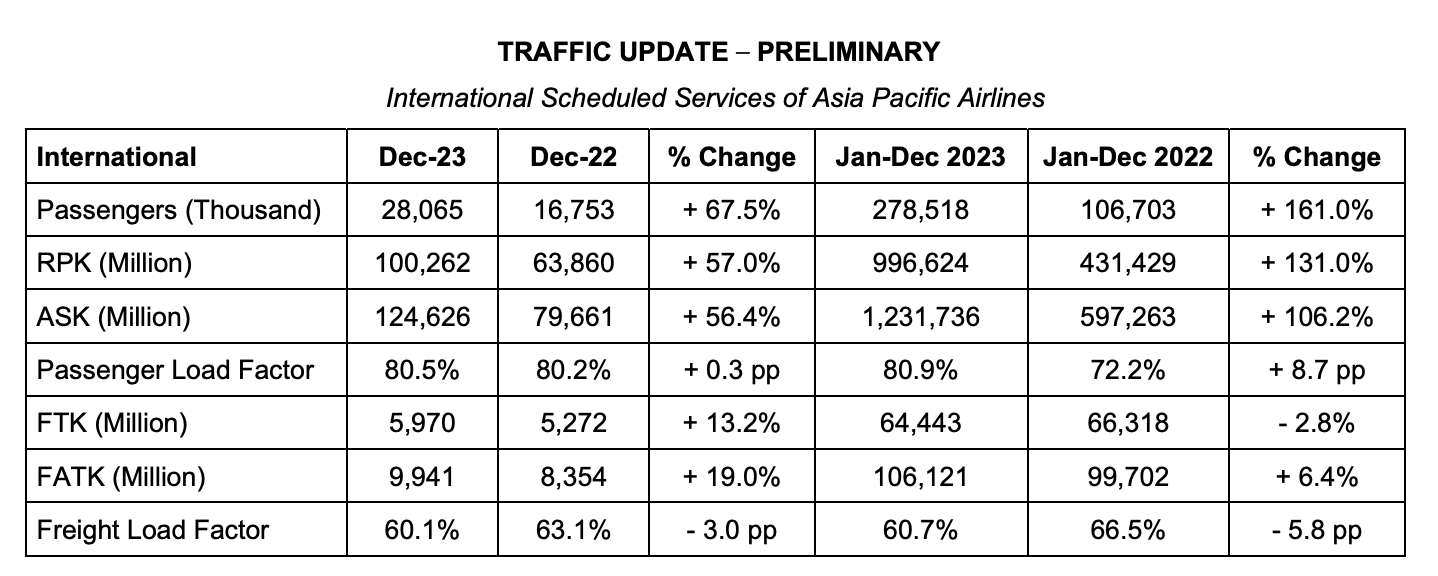

Traffic figures released by the Kuala Lumpur-based Association of Asia Pacific Airlines (AAPA) showed international air cargo demand — measured in freight tonne-kilometres (FTK) — dipped 2.8% year-on-year in 2023.

"Air cargo markets entered 2023, weighed by multiple headwinds, including inflation, a strong US Dollar and government policy dampening trade activity, as well as household spending power," AAPA said.

"Nevertheless, the final months of the year saw demand grow strongly, led by an increase in e-commerce shipments," it added.

In December, international air cargo demand, as measured in FTK, recorded a 13.2% year-on-year growth, further reducing the decline recorded for the full year 2023 to just 2.8%.

Offered freight capacity rose by 6.4%, resulting in a 5.8 percentage point decline in the average international freight load factor to 60.7% for the year.

[Source: AAPA]

"International air cargo demand declined by 2.8% for the full year; the last quarter of 2023 saw an 8.2% increase compared to the previous corresponding period," said Subhas Menon, AAPA Director General.

"Overall, 2023 was a good year for the region's carriers. Passenger demand grew unabated, while air cargo markets ended the year on a high note. The gradual restoration of flight frequencies and city-pair connections over the course of the year provided more options for travellers, further stimulating demand," he added.

"However, as operations were progressively restored, airlines faced capacity constraints in addition to increased cost pressures driven by volatile fuel prices, a strong US Dollar and inflationary impacts on operations," Menon further said.

Looking ahead, Menon signalled optimism for Asian airlines.

"2024 promises to be another good year for Asian airlines. International passenger traffic is poised to return to pre-pandemic levels in the coming months, buoyed by the return of tourism and resilient expansion of the region’s economies," he said.

"However, there remain some uncertainties, including the potential erosion in business and consumer sentiment amid rising geopolitical risks. Against this background, the region’s airlines remain vigilant to market influences while investing for future growth," the AAPA chief added.