Logistics article(s)

Rating

ASIA-PACIFIC LOGISTICS RENTS CONTINUED TO RISE IN THE SECOND HALF OF 2023 LED BY MANILA

February 14, 2024

Logistics rents in the region continued to grow, according to Knight Frank, powered by an acceleration in rental growth in Manila.

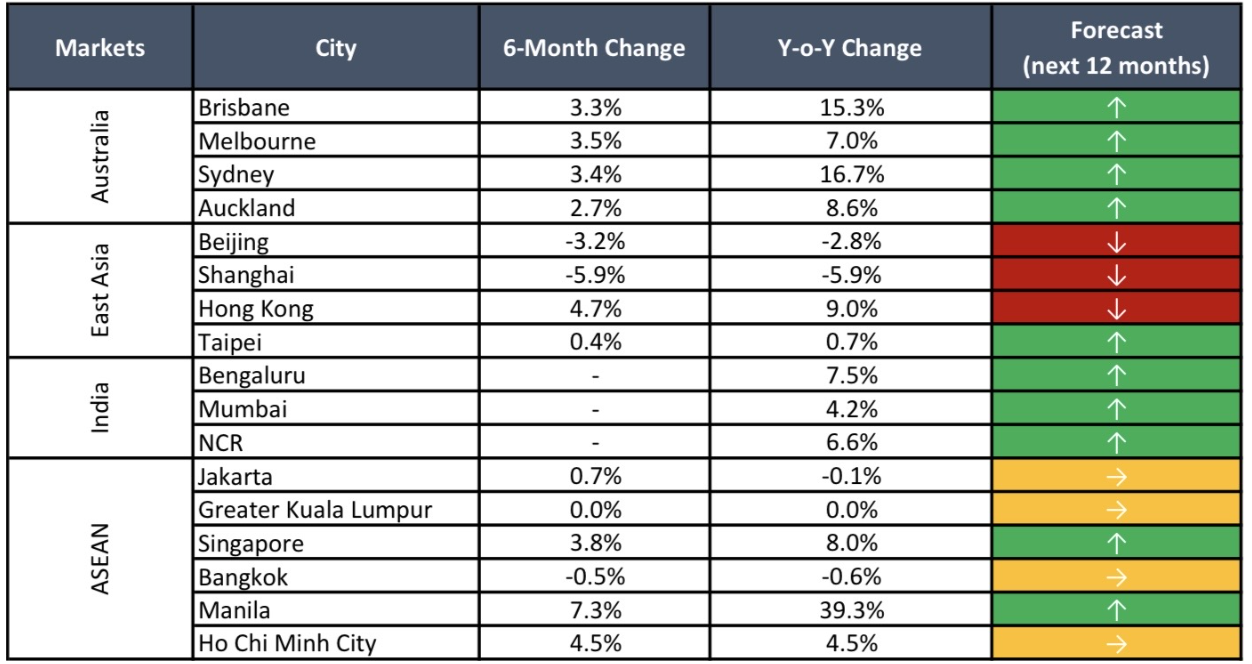

In its latest research, Asia-Pacific Logistics Markets report for H2 2023, the independent global property consultancy firm — which tracks prime logistics rents across 17 key cities said Asia-Pacific's (APAC) logistics industry — said overall prime logistics rents in the region continued their upward trajectory to grow 6.2% year-on-year in H2 2023.

However, the report shows a slowdown in short-term momentum, with a 1.5% increase in rental growth, compared with 4.6% for H1 2023.

Knight Frank said of the 17 cities tracked by the index, 13 cities recorded stable or increased rents in H2 2023, compared with 16 in the prior six months.

[Source: Knight-Frank]

Meanwhile, rental growth was led by Manila, which rose to 39.3% annually and 7.3% from 6 months ago amid the rapid expansion of the e-commerce sector fueled the rise.

For the period, Beijing and Shanghai registered notable rental declines as a sluggish economy weighed on demand amid the substantial supply pipeline.

"In H2 2023, leasing activity in the Chinese Mainland's logistics sector faced challenges due to a weakened economy and substantial new developments in key markets such as Beijing and Shanghai," Knight-Frank said in the report.

It added that the significant slowdown in total trade in 2023 reduced the demand for logistics warehousing space.

"In response, landlords opted to implement significant rent reductions to facilitate the leasing process and adapt to changing market dynamics," the global property consultancy firm said.

The report added that while rents have continued to rise, the structural shortage of quality spaces is expected to constrain growth, resulting in a sharp moderation of rental increases to between 1 to 3% in 2024, compared with the over 6% rise observed in 2023.

"As logistics occupiers continue to dial back on expansionary ambitions, it is becoming apparent that the supply-demand imbalance that had fueled the region's steep rental growth is waning," commented Tim Armstrong, global head of occupier strategy and solutions at Knight Frank. "However, the Red Sea conflict is a reminder that global supply chains remain vulnerable to disruptions."

"The region's ample development pipeline is an opportunity for occupiers to review their logistics footprint," he added, noting that leasing activity is expected to turn more selective with take-up from occupiers seeking strategically located prime logistics spaces that are automated and compliant with sustainability standards.

Christine Li, head of research Asia-Pacific, added that the supply of logistics space will remain "considerable" in 2024 due to an ample development pipeline and growing sublease availabilities.

"However, its impact will be uneven across the region. Strong pre-commitments in Pacific markets are keeping vacancies tight while Southeast Asia and India will continue to benefit from supply chain diversification," Li said.

"In contrast, Chinese mainland markets will likely require some time to absorb a substantial pipeline, given the sluggish economy. While the appetite for expansion among logistics occupiers has cooled, demand fundamentals in the region remain robust," she added, noting that global trade and production converge in the region while the need for supply chain resilience will continue to underpin demand.