Recent attacks on commercial vessels in the Red Sea have severely affected shipping through the Suez Canal, adding to existing geopolitical and climate-related challenges facing global trade and supply chains, UNCTAD warned.

In a new report, UNCTAD — the UN agency dealing with trade and development— said that the Red Sea crisis compounds the ongoing disruptions in the Black Sea due to the war in Ukraine, which have resulted in shifts in oil and grain trade routes and altered established patterns.

Additionally, the Panama Canal, a critical artery linking the Atlantic and Pacific oceans, is confronting a separate challenge.

It said that dwindling water levels have raised concerns about the long-term resilience of global supply chains, underscoring the fragility of the world's trade infrastructure.

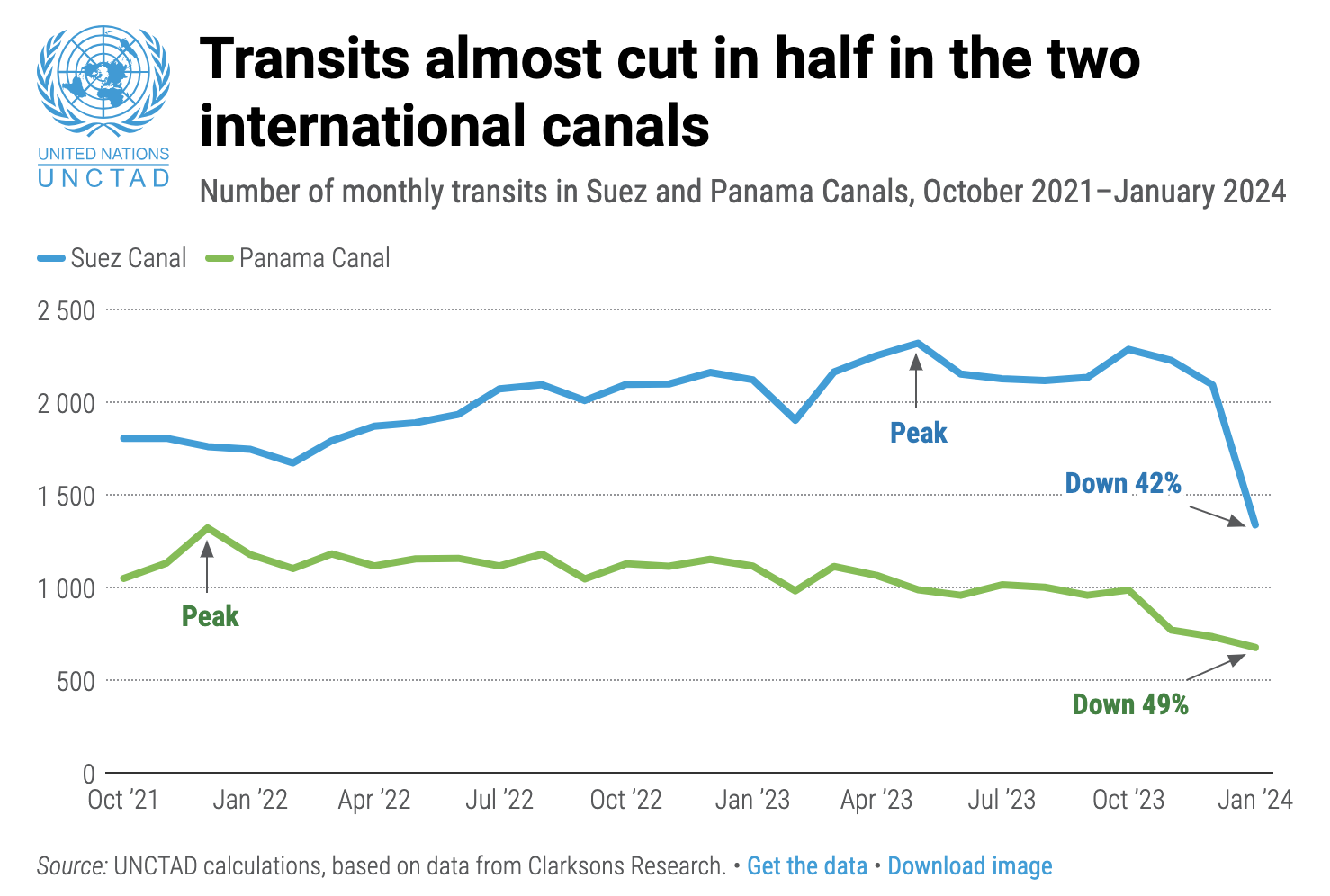

UNCTAD said it estimates that transits passing the Suez Canal decreased by 42% compared to its peak.

"With major players in the shipping industry temporarily suspending Suez transits, weekly container ship transits have fallen by 67%, and container carrying capacity, tanker transits, and gas carriers have experienced significant declines," the report noted.

Meanwhile, it added that total transits through the Panama Canal plummeted by 49% compared to its peak.

Costly uncertainty

UNCTAD said mounting uncertainty and shunning the Suez Canal to reroute around the Cape of Good Hope has both economic and environmental repercussions, particularly for developing economies.

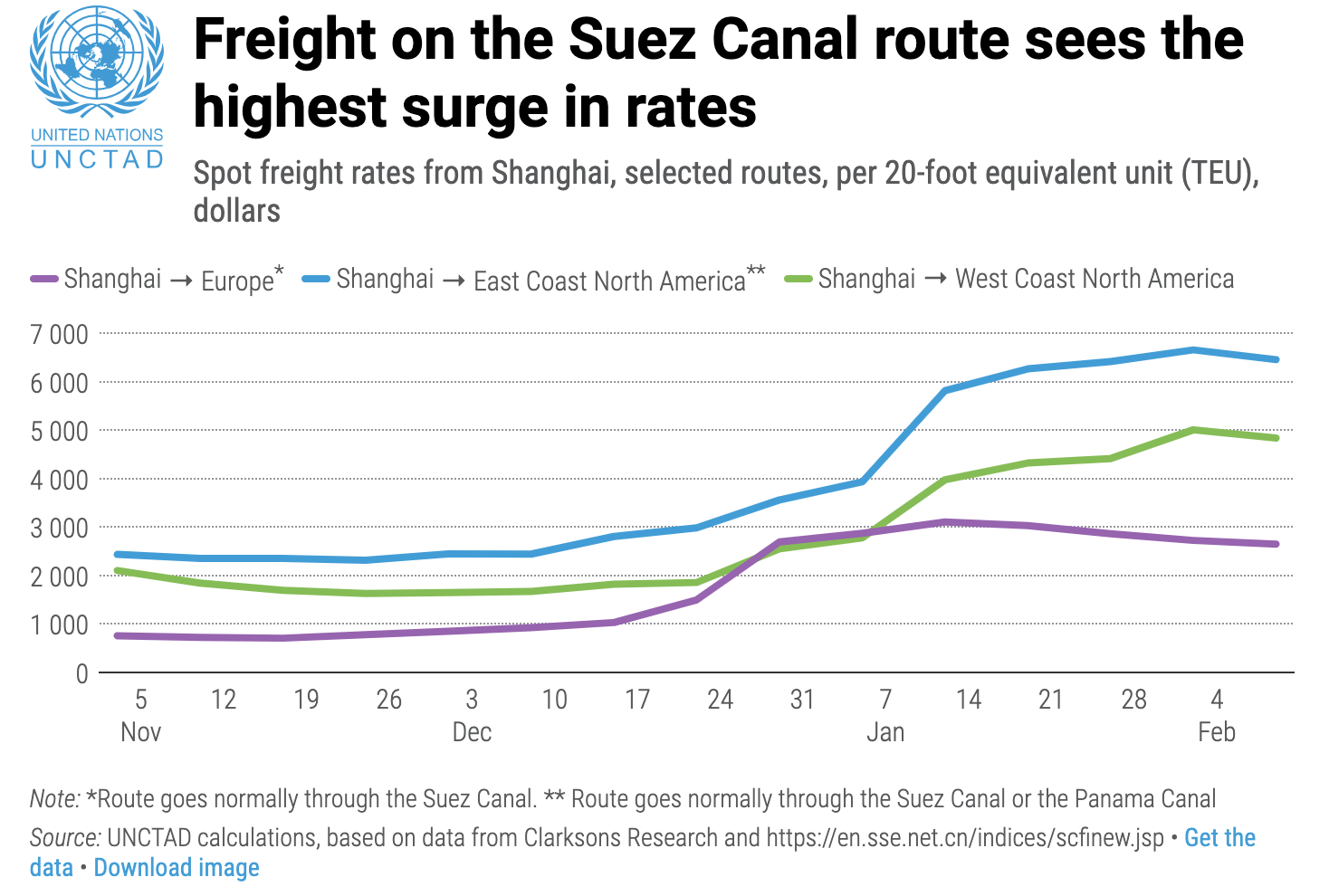

Growing significantly since November 2023, the surge in the average container spot freight rates registered the highest-ever weekly increase of US$500 in the last week of December.

It said that this trend has continued.

The report noted that average container shipping spot rates from Shanghai more than doubled since early December (+122%), growing more than threefold to Europe (+256%) and even above average (+162%) to the United States West Coast, despite not going through Suez.

UNCTAD said the Panama Canal is particularly important for the foreign trade of countries on the West Coast of South America — with approximately 26% of Ecuador’s trade volumes crossing the canal. The share is around 22% for both Chile and Peru.

Foreign trade for several East African countries is highly dependent on the Suez Canal.

Soaring prices

UNCTAD also underscored the far-reaching economic implications of prolonged disruptions in container shipping, threatening global supply chains and potentially delaying deliveries, causing higher costs and inflation.

It said that the full impact of higher freight rates will be felt by consumers within a year.

"In addition, practically no liquified natural gas carrying vessels are using the Suez Canal at present. This is directly impacting energy supplies and prices, especially in Europe," the report added.

The crisis could also impact global food prices, with longer distances and higher freight rates potentially cascading into increased costs.

UNCTAD said disruptions to grain shipments pose risks to global food security, affecting consumers and lowering prices paid to producers.