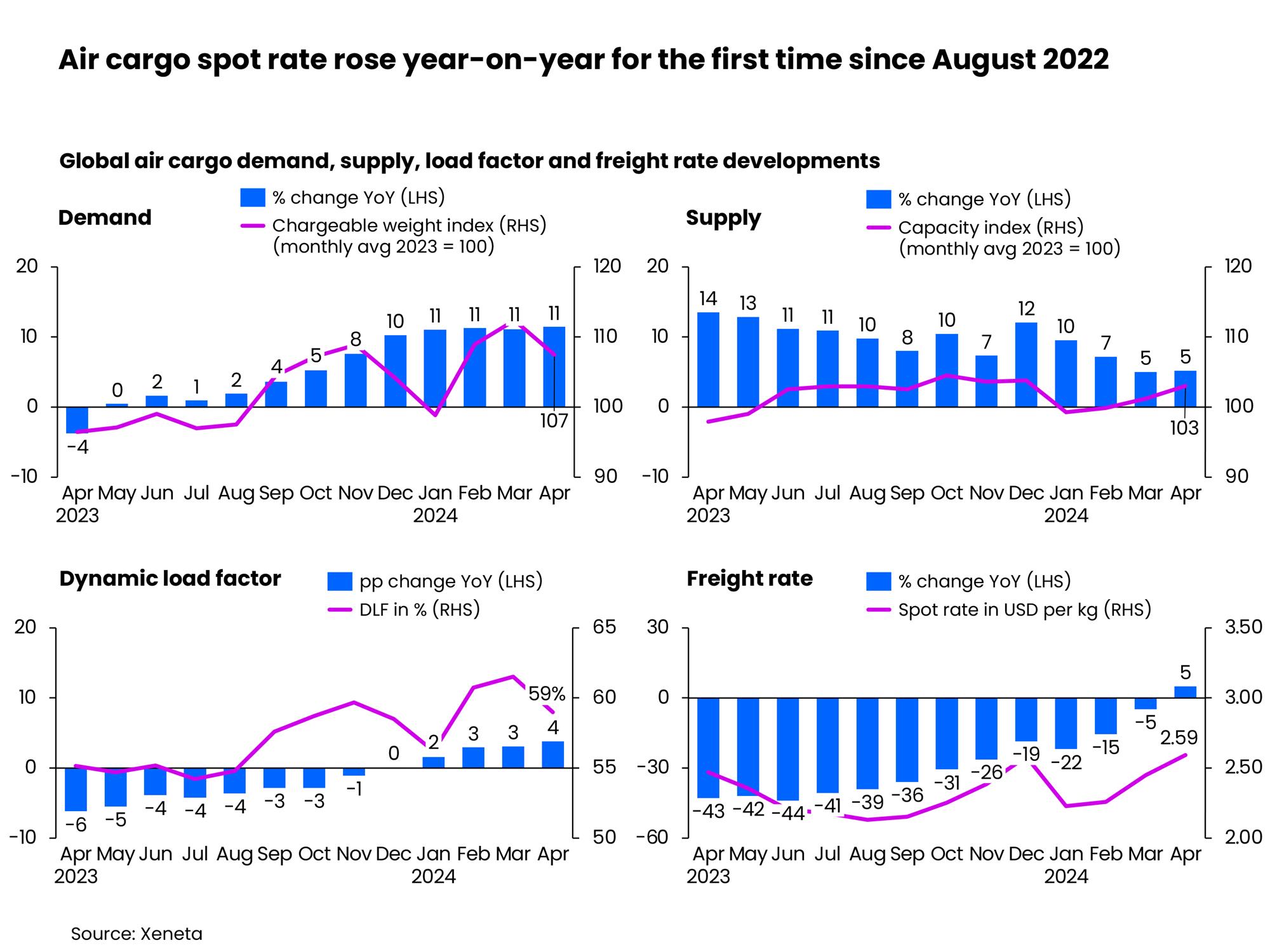

The impact of air cargo's 'black swan' event—the conflict in the Red Sea disrupting ocean freight services—showed signs of easing in April, according to the latest weekly data analysis by Xeneta. However, volume growth still registered the fourth straight month of 11% increases in global air freight demand.

Alongside easing in global air freight demand, the injection of extra cargo capacity as airlines launched their summer schedules boosted supply growth by 5% year-on-year in April.

Xeneta said this placed expected downward pressure on the dynamic load factor, dropping from 62% in March to 59% in April.

Dynamic load factor is Xeneta's measurement of cargo capacity utilisation based on the volume and weight of cargo flown alongside the capacity available.

In April, the global air cargo spot rate's year-on-year growth turned positive for the first time since August 2022, rising 5% due to a combination of Middle East conflicts and strong e-commerce demand.

Xeneta noted that as a result, the average global spot rate rose to US$2.59 per kg, its highest level this year.

"In absolute terms, the levels of demand and supply growth are what we expect to see in April after what was a typically strong month of March at the end of Q1. April may well represent an interlude to a quieter period for the air freight market," said Niall van de Wouw, chief airfreight officer at Xeneta.

"The growth in the spot rate was very much driven by regional developments as well as a case of market sentiment tending to follow market fundamentals," he added.

The Xeneta chief airfreight officer further said, "This is what happens in jumpy market conditions. The freight rate in April was a reaction to high first quarter volumes, but we expect rates to ease."

Shippers and forwarders coming to terms with delays in ocean freight services due to diversions in the Red Sea will also have an impact on air cargo demand.

"We have clearly seen a push for airfreight capacity around the Indian subcontinent because of the Red Sea disruption, but this impact is easing as businesses which depend on ocean freight are now planning in longer lead times. So, we expect the recent surge in demand for airfreight in this region to lessen," van de Wouw said.

In the third week of April, Xeneta began to see a downward trend in air freight spot rates from this region, with China to the US market jumping 20% month-on-month to US$4.87 per kg, followed by outbound freight from the Middle East and Central Asia region.

In April, average spot rates in Europe and the US grew at a similar rate of 18% month-on-month, reaching US$3.29 per kg and US$4.79 per kg, respectively. The Southeast Asia to Europe spot rate rose by 14% month-on-month to US$3.06 per kg, while the rate to the US increased 12% to US$4.66 per kg.

Xeneta said conversely, the only major region to see a significant decline in freight rate was the Europe to US market.

"This reflects the market expectation of milder freight rate adjustments for the transatlantic market thanks to adequate cargo capacity and freight rate levels getting closer to their pre-pandemic levels," van de Wouw said.

The Xeneta report added that April typically marks the beginning of the traditional slack season for the global air cargo market — a slowdown in global cargo demand growth became apparent in the air freight rate trend in the final weeks of April.

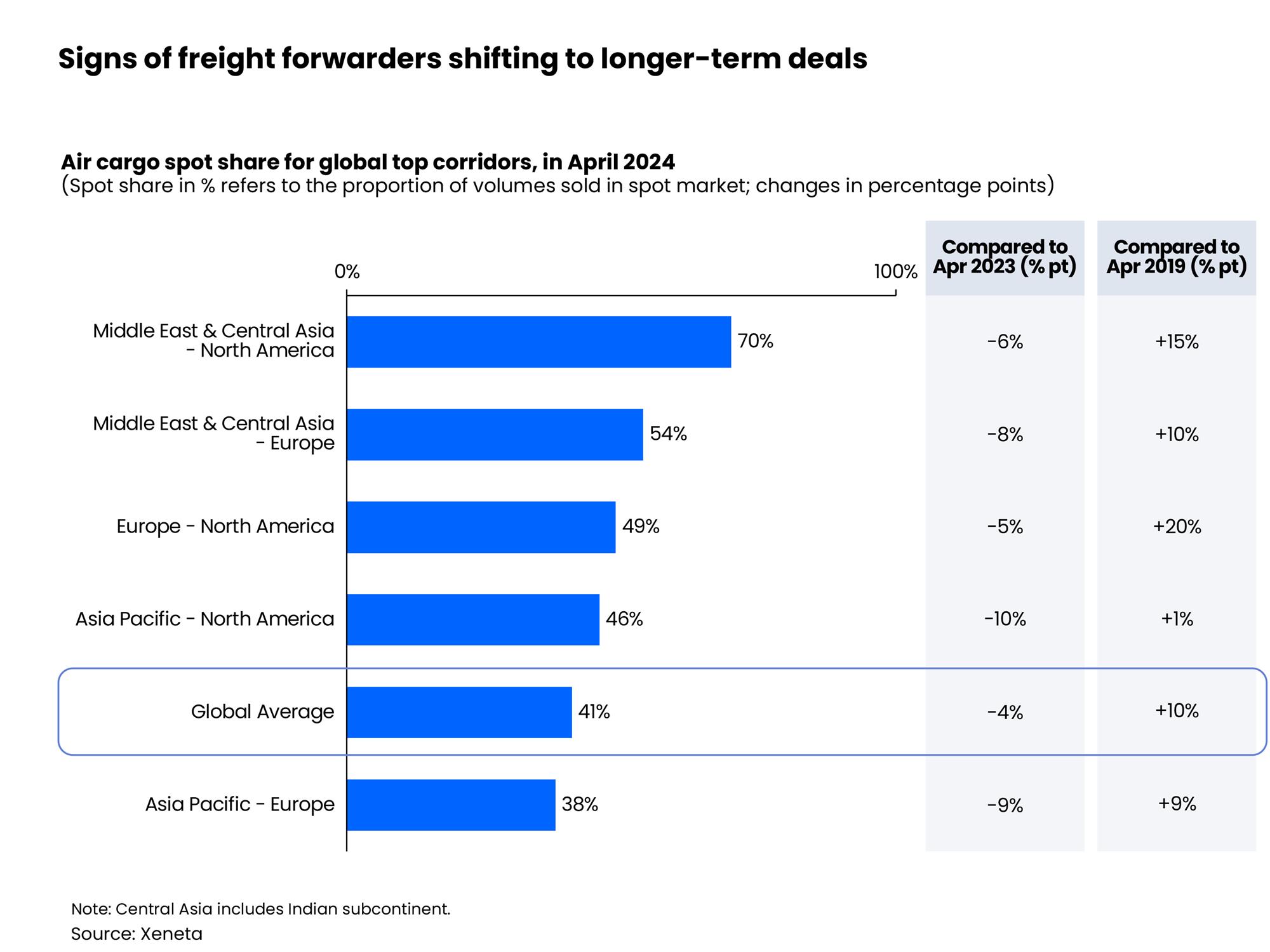

Meanwhile, Xeneta said it also saw more freight buyers shifting volumes off the spot market (with freight rates valid for up to one month).

In April, the global spot share averaged 41%, down 4% pts from a year earlier. However, it remained 10% pts above the pre-pandemic level for the same period.

Attention is now turning to Q4 as shippers and forwarders make an early start to their peak season planning after the market experience of 2023.

"There's the reality of now, where you will see load factor decline on markets because of the increase in capacity, sitting alongside the preparations already underway for Q4. That's top of mind for shippers, forwarders and, to a lesser extent, airlines, and they are jockeying for position after a 'strong' peak season last year," van de Wouw said.

"Before then, there was no prior experience of the order of magnitude of the e-commerce behemoths and their impact on air cargo's traditional peak season market. This year, the traditional market is looking to derisk and will plan to be better prepared."

The Xeneta chief airfreight officer added, "Q4 is just around the corner in planning terms, and freight forwarders are already looking beyond the summer to secure market share because they are concerned about what e-commerce is going to do out of southern China and Hong Kong later in the year."

van de Wouw noted that while forwarders are looking to buy more longer-term capacity, airlines face 'a balancing act'.

"If airlines think Q4 is going to be busy again, they're not going to sell all their capacity now. They must decide how much they want to commit now, knowing they can possibly get up to 50% more revenue for that same capacity on the short-term market in Q4," he said.