Air cargo tonnages from most major world regions returned to growth in the final full week of April, according to a new WorldACD report.

During the period, the air cargo market data provider also said that volumes from Central and South America (CSA) continued to surge in the final full week of April as flower growers, retailers and their logistics providers shipped in flowers ahead of upcoming Mother's Day events in May in North America and other parts of the world.

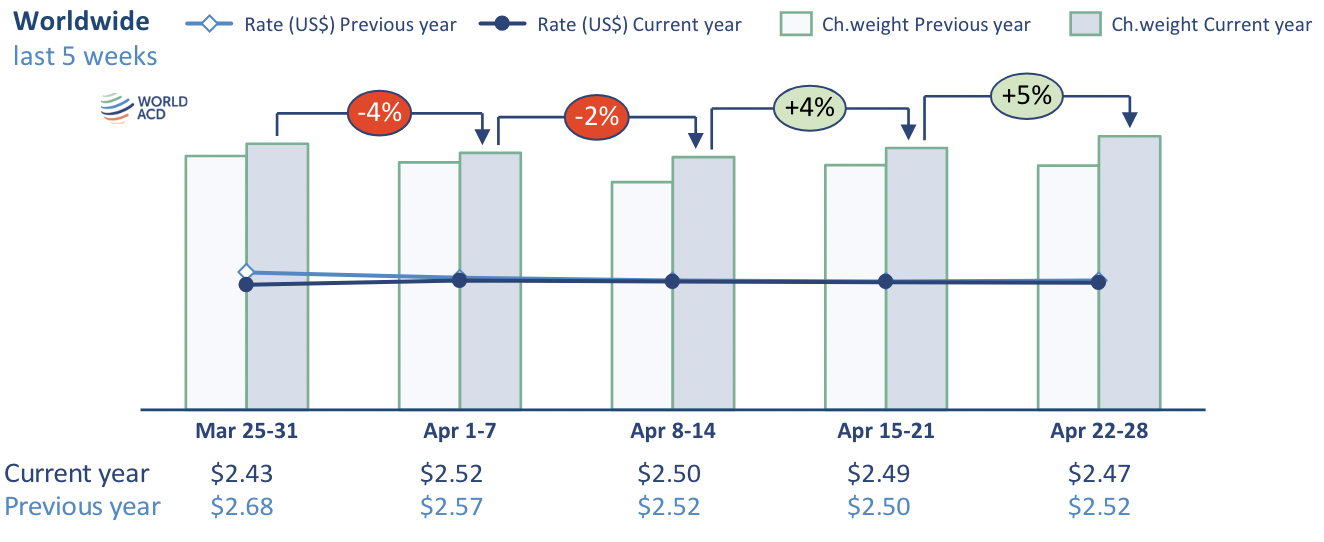

According to the latest weekly figures and analysis from WorldACD Market Data, total worldwide tonnages rose by a further 5% in week 17 (April 22-28) after gaining 4% in week 16, more or less wiping out the week-on-week (WoW) declines of 2%, 4% and 6% in the previous three weeks caused by a combination of the effects of various holiday periods such as Easter and Eid.

It said that average worldwide rates dropped back slightly (1%) to US$2.47 per kilo in week 17, also fractionally below their level in the equivalent week last year (US$2.52).

Despite this dip, WorldACD said the current rates remain significantly above pre-COVID levels or 37% higher than in April 2019.

Volume boost from Mother's Day flowers

WorldACD said that total outbound tonnage from CSA rose by a further 23% week-on-week (WoW) in week 17, following a rise of 14% in week 16. The combined tonnages in weeks 16 and 17 recorded 30% growth compared with the previous two weeks (a 2Wo2W comparison), chiefly to destinations in North America.

It added that CSA to North America tonnages were up by 48%, on a two-week comparison, ahead of Mother's Day in the USA and Canada on May 12.

"As highlighted last week, although around 90 countries or territories around the world celebrate Mother's Day on the second Sunday in May, North America is by far the most important destination market for flowers shipped by air from CSA," WorldACD said in its report.

The report also noted that the surge in export traffic from CSA helped drive total worldwide tonnages back into positive territory (up 5%) on a two-week basis.

WorldACD said the current flower export spike from CSA accounted for around 30% of the worldwide growth recorded in week 17.

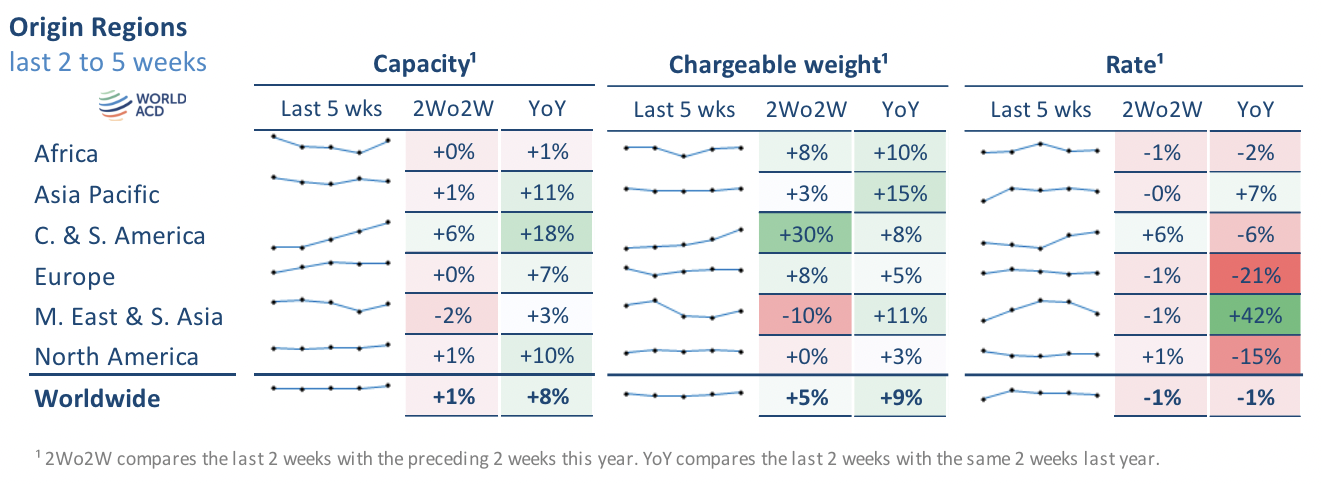

Meanwhile, year-on-year, total worldwide tonnages in weeks 16 and 17 were up by 9%, driven by YoY growth of 15% from Asia Pacific origins, 11% from Middle East & South Asia (MESA) origins, 10% ex-Africa, and 8% from CSA, with more-modest YoY rises from Europe (5%) and North America (3%), as all the main world origin regions recorded YoY growth.

"For the full month of April, total worldwide tonnages were up by +9% compared with last year, preliminary figures show," the report said, adding that this increase is slightly lower than in Q1, when volumes rose 11%.

On the pricing side, WorldACD said the spike in CSA to North American tonnages was also accompanied by a 12% rise in rates in a two-week comparison — the only significant rate rise among any of the main intercontinental lanes measured by WorldACD's data.

For the period, CSA is the only origin region to record an overall rise in average rates.

Dubai-Europe traffic still elevated

"But YoY, the two big pricing stories are the big Asia Pacific outbound market, where average outbound rates are up 7%, and MESA — where, despite a relative slowdown in mid-April due to the Eid holiday period, rates are up by 42%, YoY, linked to strong demand developments combined with supply issues caused by disruptions to container shipping," WorldACD said.

The report noted that, as highlighted in recent months, certain Asia-Europe sea-air hubs such as Dubai, Colombo and Bangkok have experienced exceptionally high air cargo demand to Europe since the start of this year, in large part linked to the disruptions to Asia-Europe container shipping caused by the attacks on vessels in the Red Sea.

Dubai-Europe tonnages have been particularly strong, up by more than 100% YoY, since week 7.

WorldACD said although Dubai-Europe tonnages softened slightly in weeks 15 and 16 due to the Eid holidays and flood-related impacts on air services in Dubai, demand bounced back extremely strongly in week 17, with tonnages up by a staggering 255%, YoY — albeit against a slightly soft comparison week last year.

"Nevertheless, although there are some suggestions that shippers are adapting to longer container shipping transit times from Asia to Europe, and average container vessel reliability is returning towards pre-crisis levels, there are no signs yet of the current highly elevated Dubai-Europe air cargo traffic levels waning," the report said.