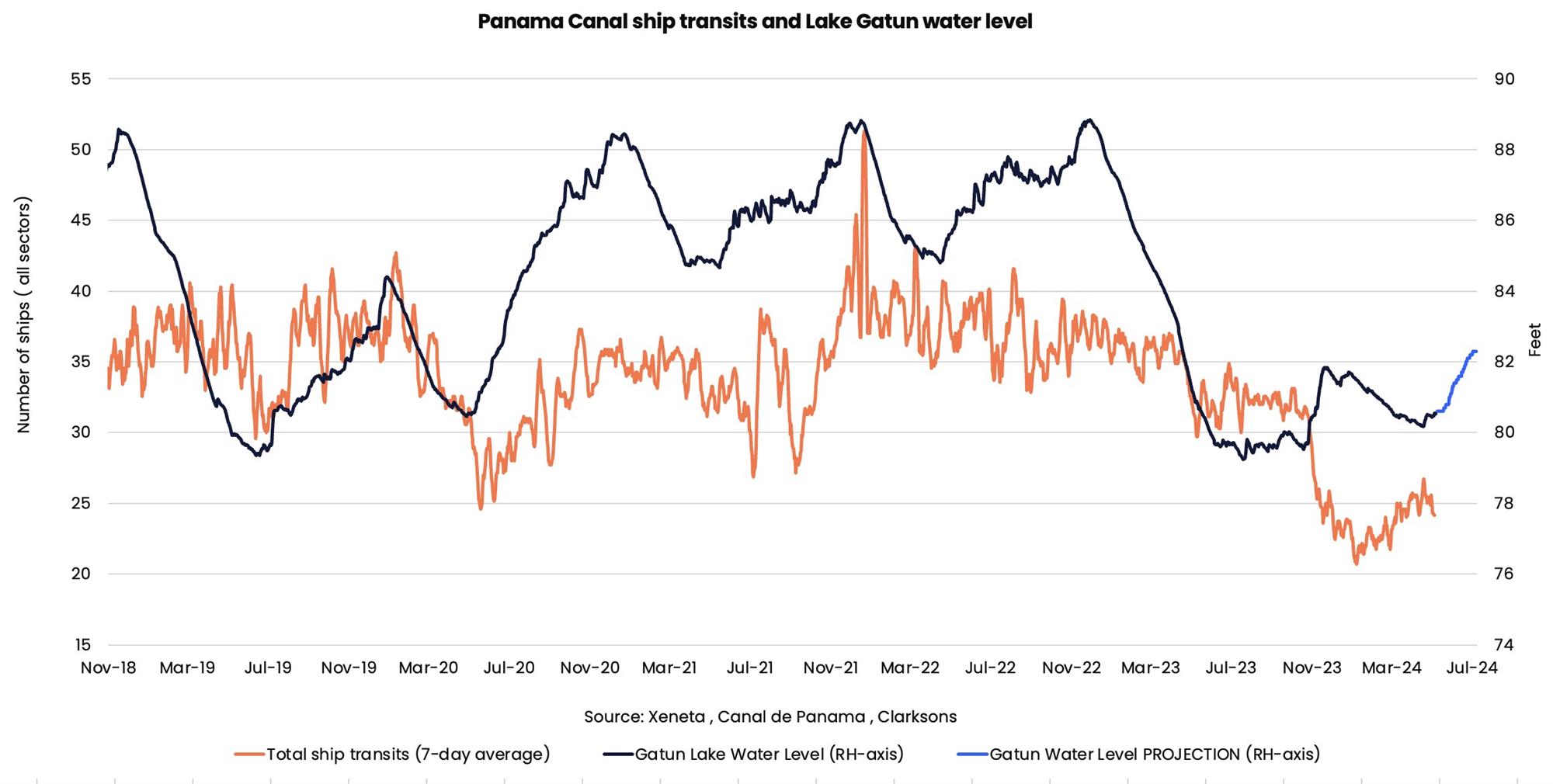

As water levels rise in the Panama Canal, so too do hopes that ocean freight container services can return to business as usual following more than a year of restrictions due to drought.

But Peter Sand, chief analyst at Xeneta, said these hopes "should be accompanied by a dose of realism."

"While the situation is improving, there is still a long way to go before transits return to the level seen before the first restrictions were imposed back in February 2023," he said.

As of May 16, the Panama Canal authorities will increase the total number of ships that can transit this vital supply chain chokepoint each day from 24 to 31.

Xeneta said in its new analysis that these additional seven transits would provide limited benefit for container services because they are for ships with a beam not exceeding 107 feet and no bigger than the traditional Panamax ships.

Container services will experience a more meaningful change on June 1. One additional transit will be allowed for Neopanamax ships, rising from seven to eight each day, bringing the overall number of daily transits from 31 to 32.

Carriers make a return to Panama Canal

Sand said while numerical restrictions do matter, what is perhaps of more importance for container services are the draft restrictions (primarily for Neopanamax locks), which restrict the amount of cargo that can be carried on each ship.

"Fortunately, there is good news on this account as well because, on June 15, the draft limitations for ships transiting the Neopanamax locks will increase from 44 feet to 45 feet," he said, adding that carriers and shippers will be looking forward to the day when it reaches 50 feet, which is the normal, undisrupted draft limit.

"The improving picture has tempted some ocean freight container carriers to return to the Panama Canal," Sand said.

For example, the Xeneta chief analyst noted that Yang Ming lines have been avoiding the Panama Canal for its Asia to US East Coast and Gulf Coast services since Q4 2023. However, six months later, it decided to return.

Similarly, Maersk Line has been operating a rail-land bridge on one service as an alternative to transiting the canal but returned to an 'all-water' transport offering on May 10, 2024.

Schedule reliability remains disappointingly low

Sand said this return to a semblance of normality could not come soon enough for shippers, freight forwarders and carriers, who have all paid the price for troubled waters in Panama, particularly in terms of schedule reliability.

He noted that using the Far East to US Gulf Coast trade as an example, schedule reliability hovered around 60% pre-pandemic.

It then plummeted to 20% during the pandemic before recovering to 40% as the impact of Covid-19 began to alleviate.

"It has remained around that level ever since in no small part due to the situation in the Panama Canal, with three out of five ships arriving late at the destination by more than one day. The number of days these ships were late has also increased from three days pre-pandemic to six days currently," Sand added.

Impact of Panama disruption on rates

The Xeneta report said the impact of disruption in the Panama Canal can be seen in the spread of spot rates on the trade from Shanghai to Houston compared to Shanghai to Los Angeles Ports.

Xeneta data shows that in January 2024, when the Panama Canal drought was causing the most severe operational disruption, the spread in the spot rates paid by shippers on these two trades exceeded US$2,000 per FEU (40ft equivalent shipping container).

"This was the highest the spread had been since November 2022 and demonstrates the measurable impact disruption at a vital artery for world trade can have on the cost of ocean freight container shipping," Sand said.

Xenata said the easing of restrictions and return of carriers to the Panama Canal has impacted rates.

On May 13, the spread in average spot rates between the Shanghai to Houston trade compared to Shanghai to Los Angeles Ports had reduced to US$1,319 per FEU. However, this is still higher than the US$873 per FEU seen at the end of October last year.

"Hopes of a return to a 'normal' market very much depend on what is considered normal — and this is certainly a moving target which develops over time as trade flows evolve," Sand said.

Before the COVID-19 pandemic, when the Asia-US Gulf Coast trade lanes were relatively less mature, the average spread in the trades from Shanghai to Houston and Shanghai to Los Angeles stood at US$1,475 per FEU. In 2022, the spread peaked at US$3,860 per FEU.

"Xeneta has long-held the position that the impact of drought in the Panama Canal will be felt for years rather than months," Sand said.

He noted that back in 2023, when drought first hit the headlines, the Xeneta position took some observers by surprise, who expected the situation to resolve itself once the rainy season arrived.

"The situation is clearly improving, and compared to a fortnight ago, the Gatun Lake water level is half a foot higher. But only allowing 31 ships to transit is still impairing businesses with supply chains which transit of the Panama Canal — especially at a time when the Suez Canal is being avoided by the majority of container ships," the Xeneta chief analyst added.

"Hopes will continue to rise that the Panama Canal can return to normal, but it will be a slow process and rely on rainfall, which is a factor people may try to predict but no one can control," Sand further said.