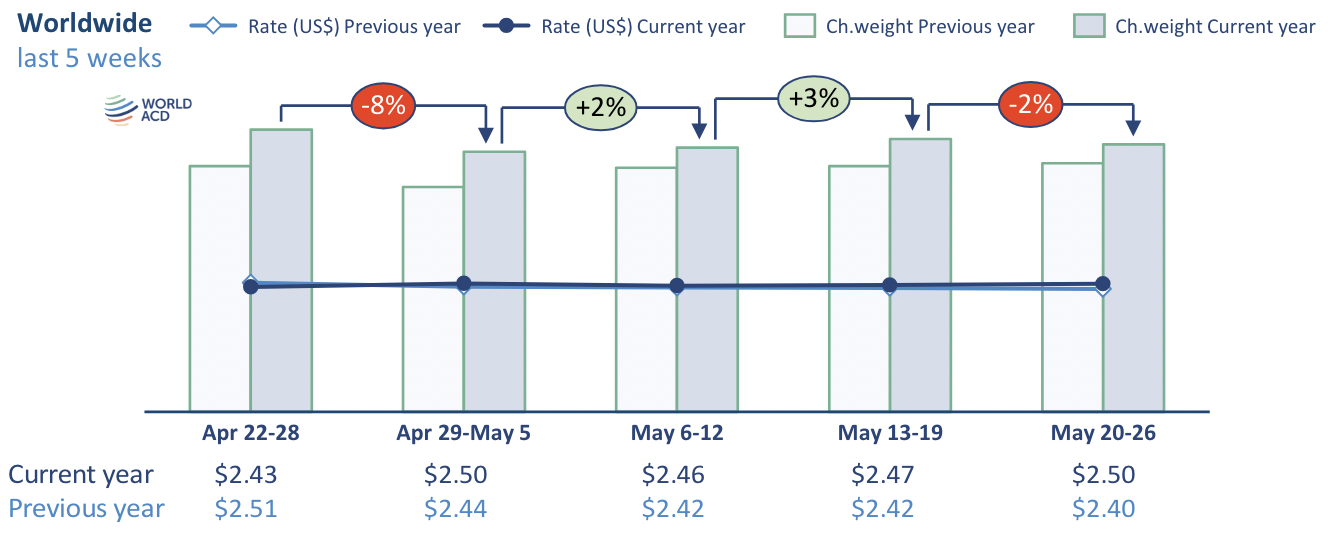

Global air cargo rates have been gradually increasing since the beginning of March 2024, when they were still more than 10% below last year's levels, but a new WorldACD report said at the start of May, average prices exceeded 2023 levels for the first time this year, rising by 2%.

The air cargo market data provider noted that rates have stabilized since then, with a slight further increase in week 21 (May 20 to 26) to 4% higher year over year (YoY).

"More detailed analysis shows that this increase in the worldwide average rate is partly explained by the growing volumes on the long-haul markets from Asia Pacific, where rates are relatively high," WorldACD said.

"If we adjust for volume effects, the average worldwide rate in weeks 20 and 21 is still -2% below the level of last year," it added.

[Source: WorldACD]

According to the latest weekly figures and analysis from WorldACD Market Data, worldwide tonnages decreased slightly by 2% in week 21 compared to the previous week, after a rebound in weeks 19 and 20 (May 6 to 19) of 5% combined.

In turn, that rebound followed a drop of 8% at the start of May around the Labour Day holidays.

Tonnages are up 9% YoY globally for the last two weeks, although that figure is inflated by strong demand from Asia Pacific (up 16%) and Middle East & South Asia (up 14%) origins.

Meanwhile, the report said average global rates remain more or less stable, rising just three cents to US$2.50 per kilo in week 21 — which is up, YoY, by around 4% and significantly above pre-Covid levels (up 41% compared to May 2019).

Also, on a two-week-on-two-week (2Wo2W) basis, average global and regional rates are relatively stable.

But compared with 2023, average rates from the Middle East & South Asia (MESA) are highly elevated (+48%). And to destinations in Europe, average rates from MESA origins remain more than double (up 120%) their level this time last year, as they have for the past two months.

Tonnages from MESA to Europe in the last two weeks (weeks 20 and 21, 13 to May 26) are up, YoY, by 26%, with Dubai at the top of the list in terms of origin growth points (+97%) — although tonnages on Dubai-Europe routes are no longer at the extreme levels (up 228%) seen in the first half of March.

WorldACD noted that those Dubai tonnages to Europe remain inflated by strong sea-air cargo demand caused by the disruptions to container shipping in the Red Sea.

But tonnages from India (up 16%) and Sri Lanka (up 30%) are also significantly up YoY for the last two weeks combined.

The report noted that the double-digit growth in Asia Pacific and MESA continued.

WorldACD said that compared to the previous year, the strongest YoY growth for the last two weeks occurred in ex-Asia Pacific (up 16%) and ex-MESA (up 14%).

"When taking a closer look, all destination regions from Asia Pacific show double-digit growth figures compared to the same two weeks of last year, most notably a 30% increase to MESA, followed by Africa (up 26%), CSA (up 24%), Europe (up 18%), North America (up 16%) and intra-Asia Pacific (up 11%)," he report said.

For origin MESA, it added that the most significant growth is on routes into Europe (up 26%) and into North America (up 16%).