The International Air Transport Association (IATA) has revised its 2024 airline profitability projections, which are now stronger compared to its forecasts in June and December 2023.

It noted, however, that an aggregate return above the cost of capital continues to elude the global airline industry.

The trade association of the world's airlines said airlines' net profits are now expected to reach US$30.5 billion in 2024 (3.1% net profit margin) — an improvement on 2023 net profits, which are estimated to be US$27.4 billion (3.0% net profit margin).

"It is also an improvement on the US$25.7 billion (2.7% net profit margin) forecast for 2024 profits that IATA released in December 2023," IATA added.

Return on invested capital in 2024 is expected to be 5.7%, which is about 3.4 percentage points (ppt) below the average cost of capital.

Operating profits are expected to reach US$59.9 billion in 2024, up from an estimated US$52.2 billion in 2023.

For 2024, total air cargo volumes are expected to reach 62 million tonnes.

"In a world of many and growing uncertainties, airlines continue to shore up their profitability. The expected aggregate net profit of US$30.5 billion in 2024 is a great achievement, considering the recent deep pandemic losses," said Willie Walsh, director-general at IATA, noting that a record five billion air travellers are expected in 2024.

"Moreover, the global economy counts on air cargo to deliver the US$8.3 trillion of trade that gets to customers by air. Without a doubt, aviation is vital to the ambitions and prosperity of individuals and economies. Strengthening airline profitability and growing financial resilience is important," Walsh added.

He noted that profitability enables investments in products that meet customers' needs and in sustainability solutions that will need to achieve net zero carbon emissions by 2050.

"The airline industry is on the path to sustainable profits, but there is a big gap still to cover. A 5.7% return on invested capital is well below the cost of capital, which is over 9%. And earning just US$6.14 per passenger is an indication of just how thin our profits are, barely enough for a coffee in many parts of the world," Walsh added.

"To improve profitability, resolving supply chain issues is of critical importance so we can deploy fleets efficiently to meet demand. And relief from the parade of onerous regulations and ever-increasing tax proposals would also help," he further said.

"An emphasis on public policy measures that drive business competitiveness would be a win for the economy, for jobs, and for connectivity. It would also place us in a strong position to accelerate investments in sustainability," the IATA director general added.

Airline profitability is expected to strengthen in 2024 as revenues grow slightly faster than expenses (up 9.7% vs. 9.4%, respectively).

IATA noted that operating profits are expected to reach US$59.9 billion (up 14.7% from US$52.2 billion estimated for 2023).

Net profits are expected to grow slightly slower, by 11.3%, from an estimated US$27.4 billion in 2023 to an estimated US$30.5 billion in 2024.

Cargo revenues seen to fall in 2024

Meanwhile, cargo revenues are expected to fall to US$120 billion in 2024 (from US$138 billion in 2023).

"Both are down sharply from the extraordinary peak of US$210 billion in 2021, but it is above 2019 revenues, which were US$101 billion and an improvement on the previous forecast of US$111 billion (announced in December 2023)," IATA said.

Despite the strength of demand, cargo yields are expected to fall 17.5% in 2024 while remaining slightly above 2019 levels.

IATA said this is a normalization after extraordinary pandemic highs after a significant belly capacity that entered the market in 2023 in tandem with the recovery of passenger travel.

"In general, air cargo is in a period of correction following an exceptional year in 2021. Yields, capacity growth, the belly-dedicated freighter split, and other key metrics are moving from the extraordinary mid-pandemic situation towards a continuation of pre-pandemic trends and levels," IATA said.

Despite bullish profitability expectations in 2024, IATA noted risks that could impact this rosy outlook, including global economic developments, ongoing wars, supply chain and regulatory issues, and risks involved with elections in many parts of the world this year.

"Industry profitability is fragile and could be affected positively or negatively by many factors," IATA said.

In terms of economic developments, it noted that issues in China should be "closely watched" as slowing growth, youth unemployment, and the relative strength of the service sector over manufacturing are all indications that China's economy is in transition — and could have broad impacts beyond its borders.

IATA said the operational impact of the Russia-Ukraine war and the Israel-Hamas war has been largely limited to the immediate vicinity of these conflicts. However, an escalation of either conflict has the potential to negatively shift the economic outlook.

"Supply chain issues continue to affect global trade and business. Airlines have been directly impacted by unforeseen maintenance issues on some aircraft/engine types, as well as delays in the delivery of aircraft parts and aircraft, limiting capacity expansion and fleet renewal," IATA added.

[Source: IATA]

[Source: IATA]

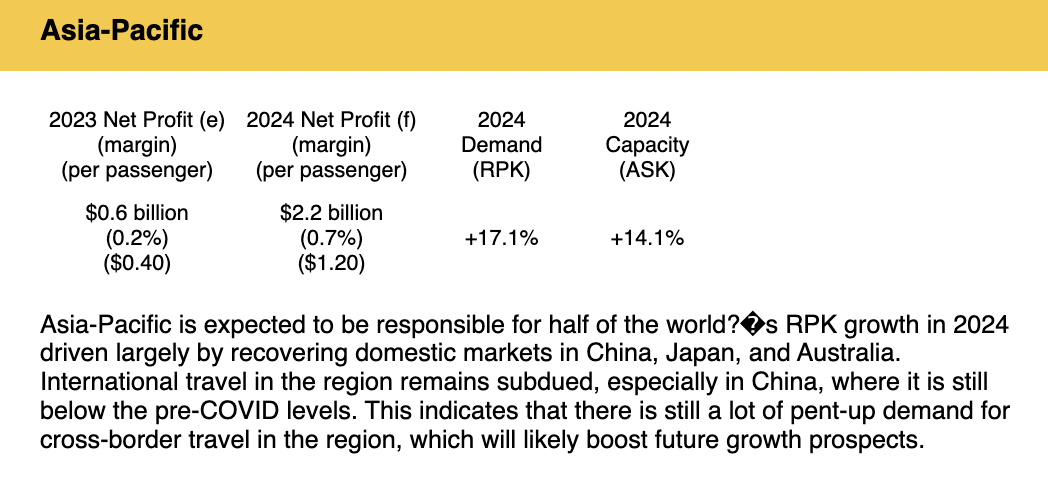

The report noted that in 2024, all regions are expected to generate profits for a second year in a row, with the most significant increase being for Asia-Pacific carriers.