Supply chain activity growth remained slow at a global level, according to a new S&P Global Market Intelligence research, while manufacturing new orders are at their highest since March 2022, though growth is inconsistent by region, with Europe lagging and Asia leading.

Retail activity growth is slow, with retailers' revenues forecast to grow by just 4.2% in the fourth quarter of 2024.

As a result, global trade growth is expected to increase slightly to 4.8% in the fourth quarter, led by electronics and capital goods.

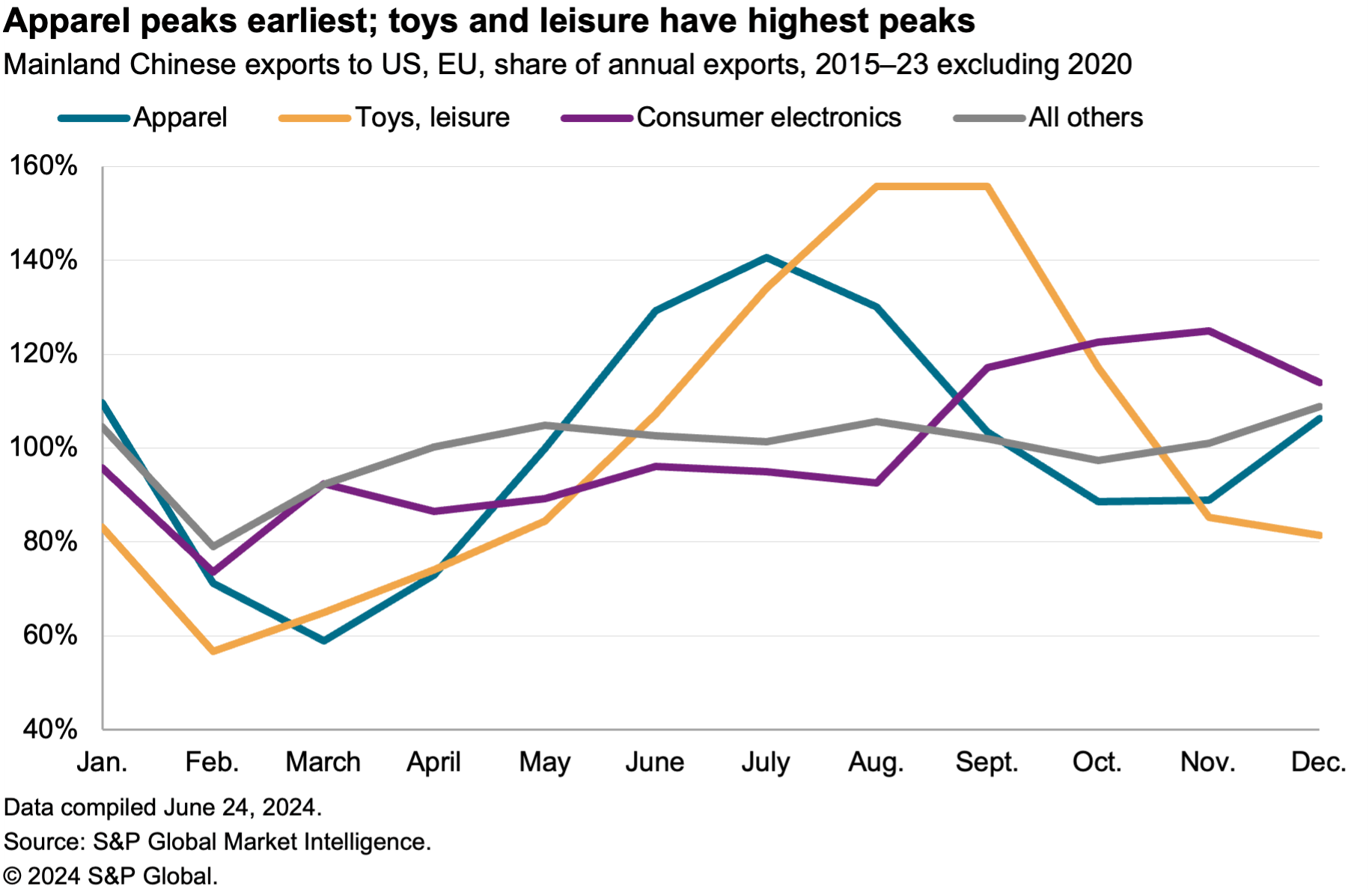

In its latest analysis, S&P said there are significant risks to the smooth running of the peak shipping season, which covers 28.8% of mainland Chinese exports to the US and EU, with a wave of peaks varying by sector from August to November.

It added that there are already "signs of congestion and cargo disruption", with shipping rates surging from a second-quarter slump.

Meanwhile, peak season risks include extreme weather conditions, conflict, trade protectionism and strikes.

Alternative supply chain network designs, such as including airfreight, switching ports and altering upstream sourcing, are options to offset such risks.

The report said, for example, that based on 2023 data, prior US West Coast ports' historical peaks suggest they could handle a combined 15.9% switching from the East Coast.

Regulatory risks from recent elections should prove manageable, with indications in India and Mexico so far leading to policy continuity.

"The European Parliament election results raise uncertainties over the implementation of carbon border rules, deforestation regulations and tariffs on mainland Chinese electric vehicles. On the latter, mainland China may react with tariffs on products ranging from food to autos, copper and solar panels," S&P added.

It further noted that the US election in November brings further uncertainty regarding tariff policy, shipments of high-tech goods and trade on the Mexico–US border.

There is also a list of hybrid operational-geopolitical risks ranging from conflict in Ukraine to shipping in the South China Sea.

Concerns about supply chain risks dwindling

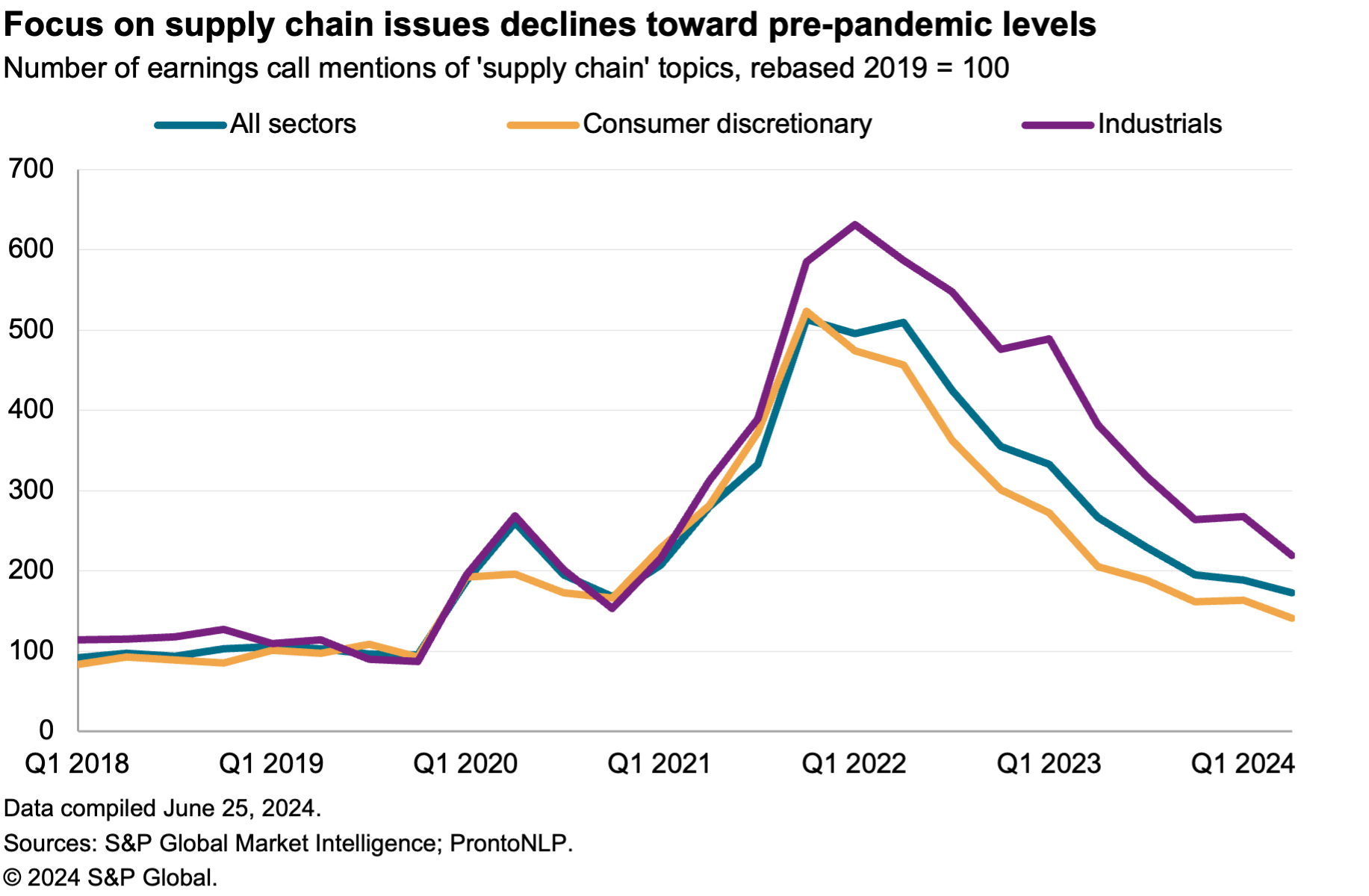

S&P noted that corporate concerns about supply chain risk are falling, with mentions of supply chain topics on earnings calls dropping to the lowest since the third quarter of 2020.

Inventory destocking is continuing, as shown by the manufacturing Purchasing Managers' Index (PMI) for finished goods stocks, which had fallen from April 2023 through May 2024.

The evidence from commodity prices and sector-specific issues, including in aerospace, show that vigilance is still needed.