Air cargo spot rates from the Asia Pacific continue to rise despite a drop in demand from China to the US in the last two full weeks.

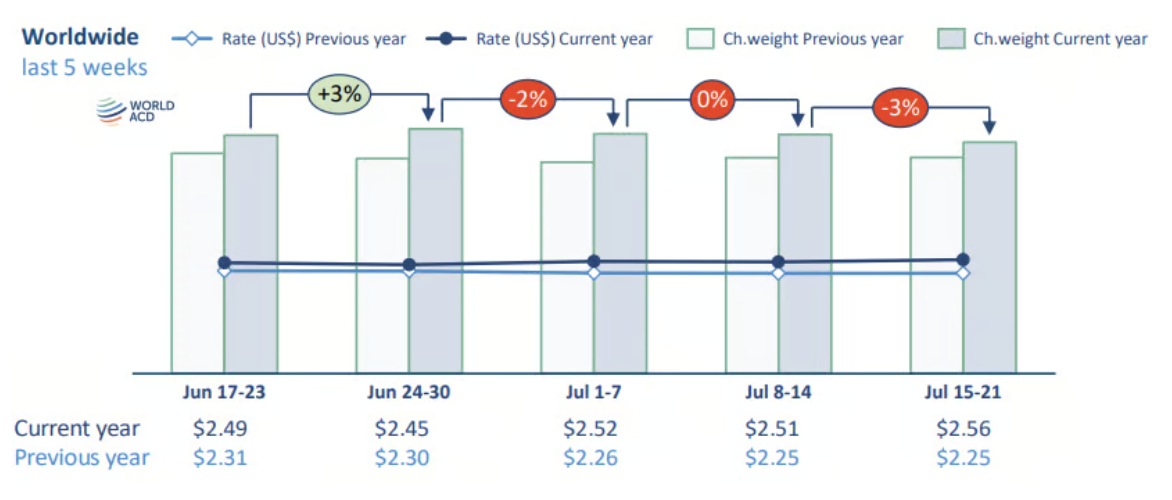

Weekly figures and analysis from WorldACD Market Data showed that the average global air cargo rate rose by a further 2% in the third full week of July to US$2.56 a kilo due to increases from Asia Pacific and Middle East & South Asia (MESA) origins. This was despite total worldwide tonnages declining for the third consecutive week.

That average worldwide of US$2.56 a kilo is 14% above the equivalent week last year and remains significantly higher than the equivalent period prior to COVID-19 (up 47% compared to July 2019).

Based on a full-market average of spot rates and contract rates, average prices from Asia Pacific origins rose by a further 2% in week 29 (July 15 to 21) to US$3.34 per kilo, up by 25% compared with the equivalent week last year.

[Source: WorldACD]

Meanwhile, average rates from MESA origins went up by 1% to US$2.78 per kilo and stand 56% higher than this time last year as disruptions continue to container shipping in that region.

WorldACD noted that African origins also saw a 2% increase to US$1.93 per kilo, around 6% up on last year.

These pricing increases come despite falling demand from all of the main regions in week 29, including a 7% week-on-week (WoW) decrease from MESA and Africa and a 4% drop from Central & South America and Europe compared with the previous week.

Meanwhile, worldwide chargeable weight in week 29 was up 7% YoY, although that compares with a rise of around 10% or more YoY throughout most of this year.

Asia Pacific to US rates soar

After dropping by 2% and 3% in the previous two weeks, WorldACD said chargeable weight from Asia Pacific to the US bounced back with a 2% increase compared with the previous week.

This was accompanied by a 5% rise in spot rates, taking average spot prices from Asia Pacific to the USA above US$6 per kilo in week 29 (US$6.01).

"That's their highest level for several months and up 67% compared with this time last year," the air cargo market data provider said.

The report noted that demand from China to the US declined.

Chargeable weight from Asia Pacific to the US was also up by 8% year over year in week 29, although tonnages from China to the US were down by 8% year over year.

WorldACD said that decline is particularly noticeable in the China to Los Angeles (LAX) market, where tonnages were down 23% YoY, limiting total YoY tonnage growth from Asia Pacific to LAX to just 4%.

"China to LAX tonnages began declining around three months ago, around the time when US authorities tightened certain customs inspection policies for inbound shipments from China, especially at LAX," the report said.

"Nevertheless, average China to the US and China to LAX spot rates of US$5.25 and US$5.02 in week 29 remained significantly higher than their level the same week last year," WorldACD added, noting that this is up 40% and 44%, YoY, respectively.

Demand from MESA origins to Europe—which has been at elevated levels much of this year—has dropped back somewhat in the last few weeks.

WorldACD said although tonnages in the last two full weeks are still around 15% higher than in the equivalent period last year, that's well below the levels of +30% to +50% recorded in February, March and April.