The quick recovery of July's global IT outage produced no significant ongoing disruption to resurgent air cargo demand, with rates rising for a sixth consecutive month, according to the latest market analysis by Xeneta.

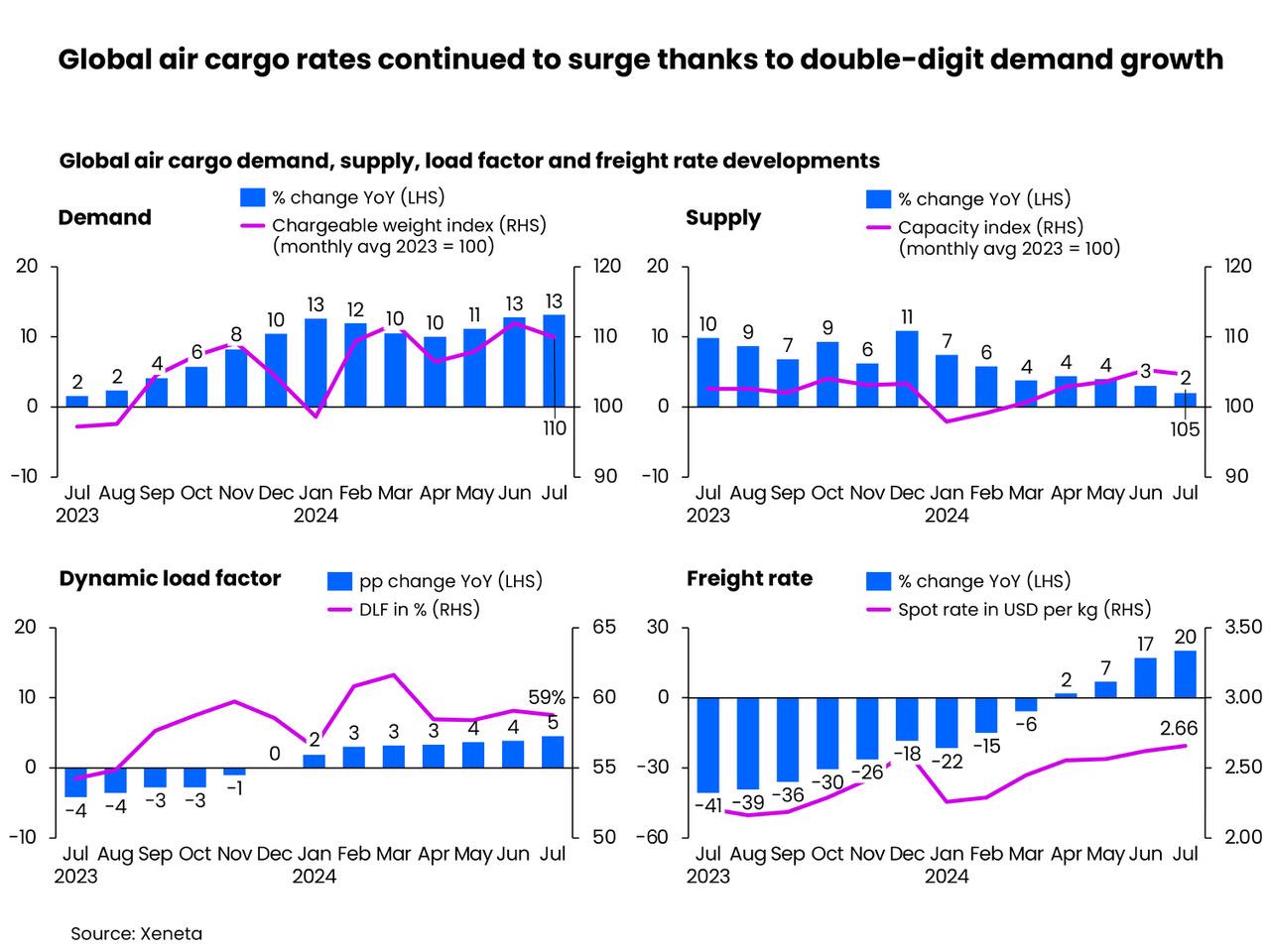

The ocean and air freight rate benchmarking and market intelligence platform said global average air cargo spot rates reached US$2.66 per kg in July, up 20% year over year.

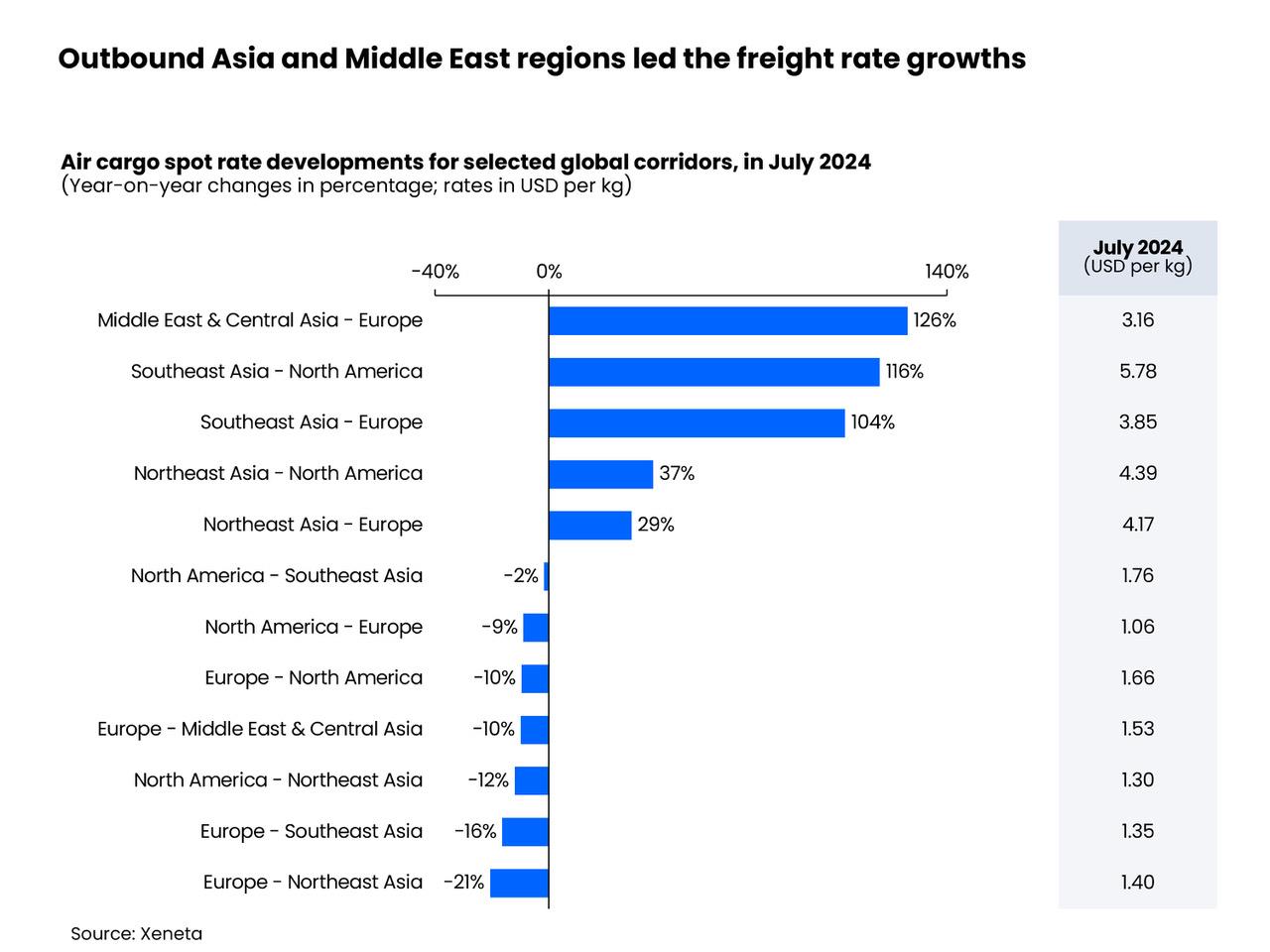

"This was again driven by strong global cargo demand growth," Xeneta said, adding that July volumes rose 13% year-on-year, thanks to buoyant e-commerce demand from Asia as well as the comparatively low demand base in the corresponding month in 2023.

In contrast, global air cargo supply grew at a much slower pace of 2% year-on-year this July.

Xeneta noted that demand growth alongside only a modest increase in capacity supply produced an expected boost to the global dynamic load factor — exceeding last year's level by five percentage points, reaching 59% in July.

"With the peak summer holiday season starting in July, global air cargo demand slowed month-on-month. This was echoed by the ocean container shipping market, where container spaces in recent weeks became easier to book, and spot rates on the major fronthaul trades from the Far East to Europe and the US either declined or flattened," the latest analysis said.

Meanwhile, it added that the global IT outage affecting Microsoft systems on July 19 caused widespread disruption, with flight delays and cancellations lasting more than a week.

The resulting cargo backlogs saw cargo load factors on some impacted airlines increase up to 4 percentage points compared to the previous week. But load factors had mostly recovered to pre-outage levels by July 28.

During this time, Xeneta said, as is often the case, short-term panic among shippers and forwarders pushed up the price of capacity, which rose to its highest level of the year in the last week of July to a global average air cargo spot rate of US$2.70 per kg.

Looking ahead to the remainder of 2024

"Strong year-on-year growth in air cargo demand is expected to extend into August and September, in part due to the low base set last year," the ocean and air freight rate benchmarking and market intelligence platform said.

"Heading to the second half of the year, disruptions in the Red Sea will likely continue to pose risks to supply chains due to container vessels' longer sailing times and reduced schedule reliability," it added.

Despite the container market's early peak season, Xeneta said the current situation may last until China's Golden Week in October.

On top of this, potential sea port strikes in Hamburg and the US East and Gulf Coasts could coincide with the much-anticipated peak season for airfreight and apply further upward pressure on air cargo rates.

"For the air cargo market, it's now all eyes on late August for the first signs of a proper peak season, which would be the cherry on top of the cake for airlines after such unexpected volumes and demand growth in the first seven months of the year," said Niall van de Wouw, chief airfreight officer at Xeneta.

"In July, had the IT outage taken longer to fix, we might have seen a slightly different outcome. However, once again, air cargo showed resilience after seeming to have dodged another major disruption. Going into the peak time of the year, airlines might just be starting to think their tailwinds will hold out," he added.