Carbon emissions in ocean container shipping remain high due to ongoing conflict in the Red Sea region and diversions around the Cape of Good Hope – but the picture improved slightly in the second quarter of 2024.

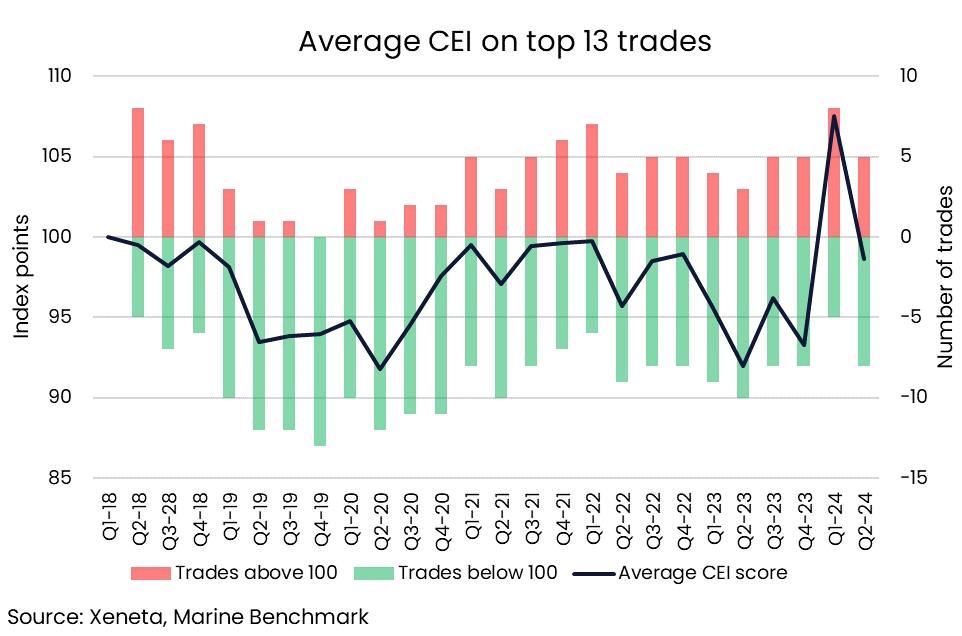

Xeneta said in a new analysis that the Carbon Emission Index (CEI), which measures container shipping emissions across the world's top 13 trades, fell to 98.6 index points in Q2. This is 8.3% lower than in Q1, when it hit 107.5.

"The latest data, released by Xeneta and Marine Benchmark, means the CEI is now back under 100 points, a mark which was breached for the first time in Q1 this year," the ocean and air freight rate benchmarking and market analytics platform said.

"This is a significant milestone because the index is based on CO2 emissions per tonne of cargo carried, with the benchmark of 100 set when the CEI was established in Q1 2018," it added, noting that a score over 100 means carbon emissions per tonne of cargo carried are higher than 2018 levels.

Factors behind CEI improvement

Xeneta noted that the improvement in the average CEI across the top 13 trades is driven by non-Red Sea impacted trades, several of which have achieved their lowest (and therefore best) CEI score to date.

In contrast, the three long-haul trades most impacted by the conflict in the Red Sea – from the Far East to North Europe, the Mediterranean and the US East Coast – have seen emissions increase from Q1.

"It is also important to note that while emissions per tonne of cargo have fallen across Xeneta's top 13 trades, this hides an increase in total emissions across the global container shipping fleet," it said.

"2024 has seen record levels of demand for ocean container shipping globally, meaning more cargo is being transported and higher total CO2 emissions."

Meanwhile, the report noted that four trades hit an all-time low CEI score.

It added that the best-performing trade in Q2 2024 is the backhaul trade from the US West Coast to the Far East at 68.5 points. It is also the first of the top 13 trades to ever pass under this mark.

The lowest score previously was 70.5 points, achieved in Q4 2023 on the fronthaul trade from the Far East to the US West Coast.

Xeneta noted that in Q2 2024, this major Transpacific trade is just 0.1 points off its low score from the end of last year at 70.6 points and compared to Q2 2023, emissions per tonne of cargo carried have fallen by 14.3% between the Far East and the US West Coast.

It added that given more cargo is carried from the Far East to the US West Coast compared to the US West Coast to the Far East (and the CEI is measured in CO2 per tonne of cargo moved), even a small CEI improvement on the fronthaul has a far bigger impact on reducing total emissions.

"A big driver of the improvements in emissions on trips across the Pacific is an increase in the size of ships operating on this trade," Xeneta said, adding that the average size on the fronthaul rose to 10,000 TEU in Q4 2023, though it has since fallen slightly to 9,800 TEU in Q2 this year.

It said that just as larger ships offer economies of scale, lowering the cost per TEU, bigger ships also emit less carbon per tonne of cargo carried — assuming they can maintain a high filling factor.

Emissions on trades directly impacted by Red Sea conflict

The new analysis said that though average speeds have not increased significantly on the Red Sea-impacted trades, new highs have been set for CO2 emissions per tonne of cargo carried, up from the already-high Q1 results.

Xeneta noted that the Far East to the Mediterranean was already the worst-performing trade in Q1, when emissions per tonne of cargo increased by 63% from Q4. The score has declined further in Q2, with the CEI now at 145.6 points, up by 4.9 points from Q1 and 64% higher than in Q2 2023.

"One of the reasons for this worsening score is a slight increase in average sailing distances. In January, some ships were still sailing through the Red Sea, and it was not until later that month and into early February that some other carriers decided to divert. That means the Q1 CEI data includes some ships that were still sailing shorter distances through the Suez Canal," Xeneta said.

In Q2, the average distance ships sail between the Far East and the Mediterranean stood at 15,400 nautical miles.

The report said the increase in emissions is also partly due to a drop in the size of ships deployed to this trade.

As carriers have needed more ships to make up for the longer transit times, Xeneta noted that they have had to accept smaller ships than they would usually deploy here because the availability of larger ships is limited.

"There does not appear to be any prospect of a large-scale return of container ships to the Red Sea any time soon. Therefore, the CEI scores will continue to be impacted by the longer sailing distances," Xeneta said.

It noted, however, that there may be some cause for optimism that CEI scores could start to improve with new ships being delivered into the global fleet, more carbon-efficient, and some of these ships are also ultra-large, which helps to improve CEI scores, as long as a filling factor is maintained.

"The congestion which has plagued ocean supply chains, particularly in Europe and Asia, is now also easing, which should increase available capacity if ships spend less time waiting at port," the new report said.

"This easing of pressure may mean carriers are more likely to reduce sailing speed, especially if spot rates continue to soften as they have started to do in July," Xeneta added.