Worldwide air cargo average spot rates have continued to rise in the first full week of November, driven by significant week-on-week (WoW) increases from Asia Pacific and other origin regions in an ongoing peak-season strengthening of the market.

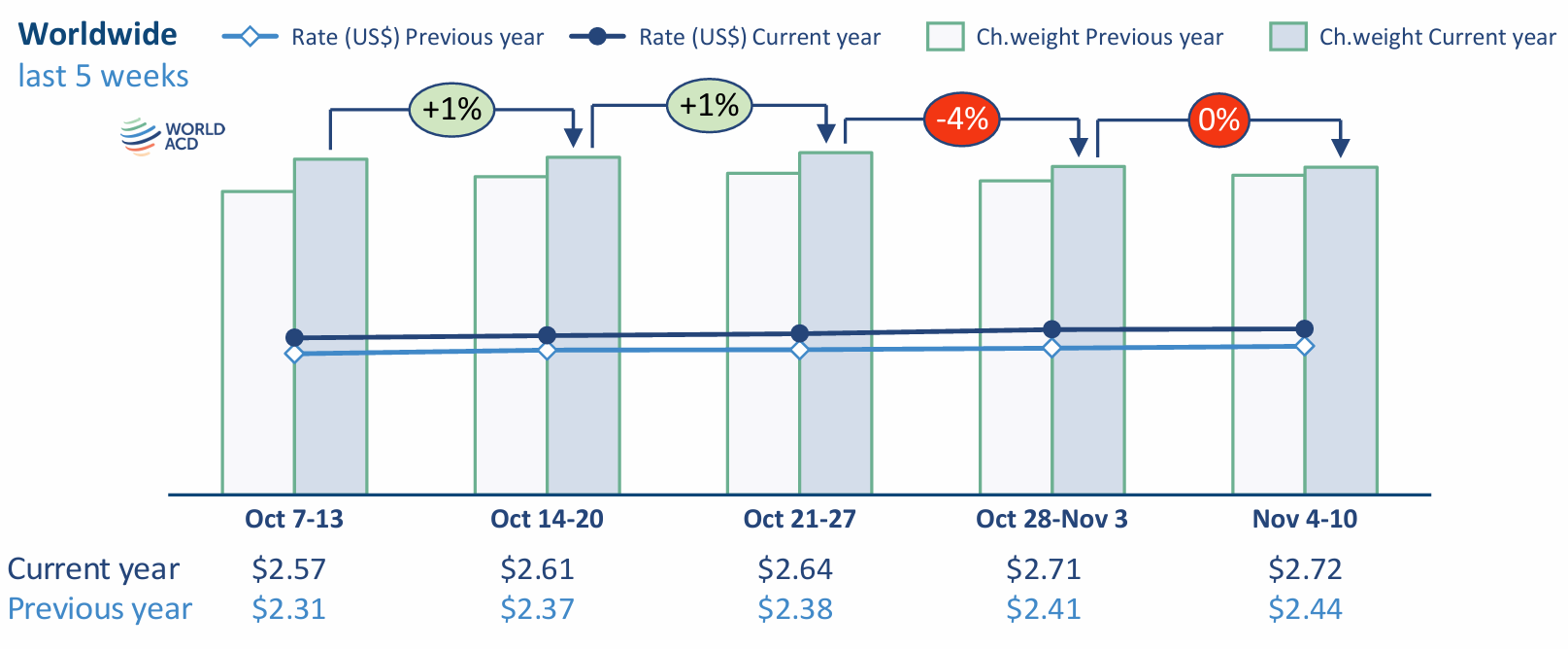

According to the latest weekly figures and analysis from WorldACD Market Data, average global spot rates recorded a further 5% WoW rise in week 45 (November 4 to 10), taking them 24% above their equivalent levels this time last year.

Spot prices from the biggest worldwide origin region, Asia-Pacific, rose by a further 6%, WoW, to US$4.43 per kilo. The second-largest origin region, Europe, also showed a 6% WoW increase to US$2.49 per kilo.

Rates from Central and South America (CSA) rose even more steeply, by 10%, to US$2.04 per kilo, with prices from North America recording a 5% increase, to US$1.83 per kilo. There were WoW falls in spot rates from Africa (down 4%) and the Middle East and South Asia (MESA, 2% drop).

WorldACD noted that compared with the equivalent week last year, when various markets were already experiencing the effects of strong peak-season demand, spot prices this year remain significantly elevated, year on year (YoY), notably from Asia Pacific (up 25%), MESA (up 70%), Europe (up 14%), and CSA (up 14%), with Africa also 10% higher and North America recording a 5% increase, YoY.

[Source: WorldACD]

On the demand side, worldwide chargeable weight flown in week 45 was stable, WoW, with small increases from Europe, Africa, and CSA origins wiped out by decreases from North America and MESA (both down 4%, WoW).

Compared with last year, WorldACD noted that worldwide tonnages were up, YoY, by just 2% in week 45.

"That’s a significantly smaller YoY growth figure compared with most weeks in the last six or seven months, although the comparison period this time last year was a tough one, as volumes were in the midst of a strong fourth-quarter peak season," the analysis said.

Global air cargo capacity in weeks 44 and 45 fell by 3%, on a two-week basis – partly reflecting the start of the winter timetable, although it was also down 2% compared with last year.

"Analysis of the capacity situation in week 45 reveals a WoW drop in passenger capacity of slightly over 1%, despite some recovery from European airports. However, there was also a WoW increase in freighter capacity of around 3%, resulting in overall WoW cargo capacity growth of almost 1%," WorldACD said.

"Some of that reflects a recovery of capacity following typhoon Kong-rey, which particularly impacted Taiwan but also parts of mainland China. But there were new routes and capacity being added to India, particularly to Delhi."

"Last week also saw a significant increase in capacity from the big global integrators, reflecting an ongoing rise in peak-season express traffic, including from the e-commerce sector," the report said.